For the duration of the UEFA Euro 2016 tournament, sponsorship specialists Livewire, together with Radical and Ignite Research will be supplying Adworld.ie with an overview of the key marketing and media trends surrounding the tournament.

For the duration of the UEFA Euro 2016 tournament, sponsorship specialists Livewire, together with Radical and Ignite Research will be supplying Adworld.ie with an overview of the key marketing and media trends surrounding the tournament.

As the tournament unfolds, the Livewire Euros Insider will assess the impact of the tournament on fans, sponsors and brands alike.

Half of the country will watch Euro 2016 and a third believe that the Rep. of Ireland will progress beyond the group stages. This interest and optimism, coupled with an improving economy, means there is a golden opportunity for brands to capitalise on and to channel the national excitement towards various business objectives. The challenge for sponsors and advertisers is to leverage this excitement with strategic activations that do not interrupt the fan experience, but add real and measureable value to it.

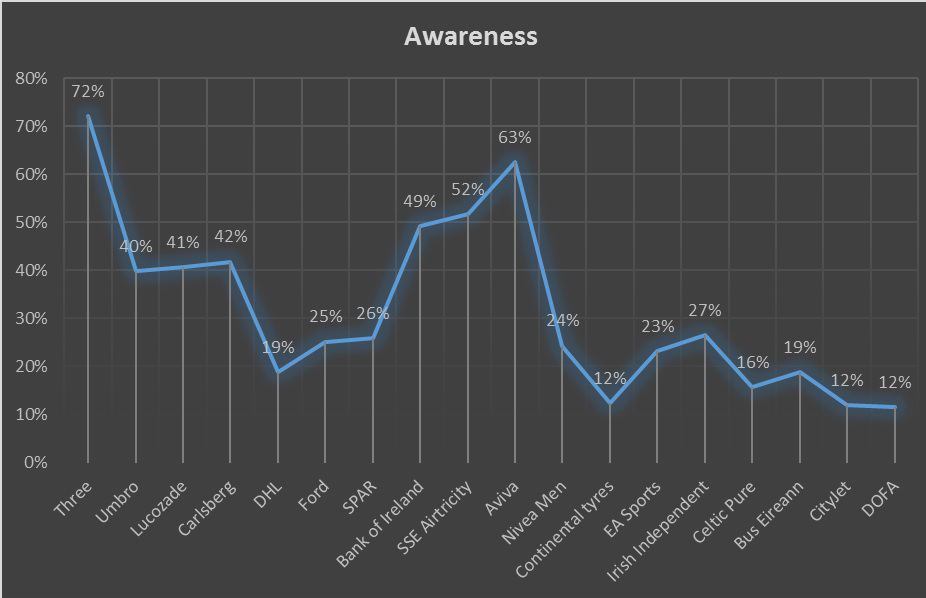

Awareness of FAI sponsors

In a year that has seen Leicester City and Connacht Rugby win their respective leagues, it is perhaps understandable that 8% of people believe that the Rep. of Ireland can go all the way and win the Euro 2016. Perhaps more realistically a third of people believe that that the Rep. of Ireland will progress beyond the group stages of Euro 2016. 18% believe Ireland will make the quarter finals. Whatever the outcome, every sporting event starts with the same ingredients: anticipation and excitement.

The vast majority of people (91%) believe the country gets a lift when the Irish soccer team performs well. Already, ahead of Euro 2016, 60% of people believe the team has a connection with fans, with a similar number of people stating that they like this current crop of players. Tapping into this lift is the key opportunity for sponsors.

A brand who has already capitalised on and contributed to the high spirits of the nation is National Team sponsor Three, which recently extended its sponsorship with the FAI to 2020. Three launched its Euro 2016 #MakeHistory campaign in April, the centre piece is undoubtedly their TV ad which is backed by a large outdoor advertising presence. With millions of views on TV and online, the ad, created by ad agency Boys & Girls, has been shared and received extensive positive commentary in social media. After six years of sponsoring the team, almost 70% of people are aware that the brand sponsors the Rep. of Ireland soccer team. This long-term association also gives the brand legitimacy to tap into the emotion and heritage associated with Irish teams and big tournaments, something it has absolutely nailed with the current campaign. Livewire’s research shows that over a third of people feel more positively about the brand as a result of its team sponsorship – demonstrating the power of sponsorship, when you get it right.

Despite the optimism and return to growth for advertising spend, it is surprising to hear that there is still availability for advertisers on TV3 and RTE. That said, RTE has closed its books to car advertisers, meaning they cannot get a car brand into any more breaks. They also say that the availability is very limited and only for certain categories. Other sectors which are spending include betting, telco and super market categories. According to Nick Fletcher, broadcast director of Core Media, some advertisers are leaving it late to commit to spend, preferring to see how the team performs before making a move. Perhaps the legacy of 2012 explains this cautious approach. Viewing figures for Irish matches at Euro 2012 dropped from a high of 1.2m for the opening game against Croatia to 900k when Ireland was beaten 2-0 by Italy. Having said that, 900k is still a phenomenal viewing figure for a dead-rubber match. Have the broadcasters got the pricing strategy right? Both claim they have exceeded targets, and are happy with their position. Interestingly, once you set your price for advertiser packages, UEFA rules stipulate that you cannot discount this package without discounting for all spenders. Hence the rigidity of broadcasters on pricing.

Team performance is not the only unknown factor heading into the tournament. While it unlikely that the prospect of terrorism is playing a role towards advertiser caution, it is important to note that 65% of people have concerns over fan safety at the tournament.

Engaging fans

The Ignite consumer impact survey for Livewire Euros Insider shows fans expect to increase spending on a variety of goods and services during the tournament. Over 40% of people list food and drink as the main reason for spending more money while over third expect to spend more on alcohol alone. In fact, those surveyed stated that they would spend c. €185 on alcohol over the course of the tournament. The grocery sector will look to capitalise on these intentions, as well as tapping into the collective home viewing experience.

In addition, 35% of people list the pub as a destination for watching some of the tournament. As official partner of both the FAI and Euro 2016, Carlsberg will expect to capitalise on these trends. The good news for Carlsberg is that 59% of people are aware that the brand is a sponsor of the tournament. However, the bad news for Carlsberg is that 62% list Heineken as a tournament sponsor. Heineken is a sponsor of the UEFA Champions League, but not of the Euro 2016. In fact, Heineken comes out on top of the research, alongside tournament sponsors Adidas. The significant sums invested by the brand to build association with football fans during the UEFA Champions League seems to be paying off. Equally it demonstrates that activation of sponsorship is important in all markets, time was when Carlsberg would have had Three’s approach and really capitalised on the excitement of the nation pre-tournament. While still a strong sponsor, they have missed the opportunity to ‘own’ the build-up.

17% of people expect to spend more money on gambling during Euro 2016. Those who take a punt expect to spend approx. €85 during the tournament. With increasing amounts of gambling now taking place online, it is not surprising that the gambling sector will be highly visible across sites including The42.ie and MailOnline. The betting sector will likely contribute more than 20% of spend on television advertising during the tournament with the aim of encouraging people to go online to place a bet. For this reason they are likely to be heavy in the earlier and mid breaks with no little or no presence once the results are known.

Almost 10% of people are looking to purchase TV and audio equipment in the build-up to Euro 2016. Those that do, expect to spend close to €300 euros which is good news for companies such as Dixons (Curry’s PC World), which have already been very active in the build-up to the tournament. The brand has chosen press including the Irish Daily Star and Irish Daily Mail, to establish a connection with the Euros and also to drive sales of TV’s. On radio the brand is running a pre-Euros weeklong promotion on 2fm’s Breakfast Republic as well as sponsoring 2fm Time Checks. Across digital the aim has been to target key footballing times in the lead up to the Euros to encourage the football fan to purchase or upgrade their TV. The brand is running in match targeting, networks and HPTOs on highly relevant sports sites. Their competitors too, are very active.

The role of social media and digital

While sponsors can generate awareness via sponsorship, the best sponsorships focus on an engaged strategy that adds value to the fan experience with relevant activations and, in turn, generates awareness. Almost without exception, brands are choosing social media to assist with this form of engagement. Attempting to tap into the passion of fans for as long as possible. A good example of this is Adidas, which created a Twitter account for Brazuca, the official match ball of the 2014 World Cup. At its peak, @brazuca was the fastest-growing Twitter account of the World Cup – boasting 3.5 million followers.

The sharing of football related branded content is rich territory for sponsors. The fact that 90% of people say they will watch some matches at home is good news for digital advertisers. As with other recent sports events, the explosion in second screening and digital activity during matches is expected to continue over the next month. While this is just one form of fan engagement, opportunities will exist for brands with real-time content strategies wishing to capitalise on big game moments.

Interestingly 46% people claim they will only watch the matches on TV, preferring not to use smartphones, tablets or lap tops during matches. However we do expect an explosion in social media use immediately prior to and especially after matches, if the team is successful. This offers brands a great platform for agility marketing. Being ready in advance for these moments, is the key to success. Think Oreo’s and the blackout during the Super Bowl in 2013.

Recent UK studies highlighted that 60% Euro 2016 fans will share Euro 2016 related content online. Match scores being the most popular content. Our own Irish research shows that almost half of Irish fans watching matches at home will also use their smartphone (46%); by far the most used second device, ahead of lap tops (32%) and tablets (17%). Of those using smartphones 17% will be using social sharing apps such as whatsapp.

Over half of fans online during matches will be using Facebook. This is double the amount who plan to use Twitter, which is often considered the perfect platform for engaging fans during live sport. Regardless, Twitter continues to be an interesting platform for gauging fan sentiment and interests. Already, a week out from the tournament, #COYBIG has been trending in Ireland while SSE Airtricity’s #PowerofGreen is the most widely used sponsor related hash-tag.

Notably 16% of people will use whatsapp to follow matches or look at content related to the tournament. This provides a good indication to the volume of activity that can be expected to take place on ‘dark social media.’

Our research highlights more women than men will use second devices while watching matches. In fact over a third of men say they will use no device compared with just 20% of women. This stat suggests digital and social media could provide brands with access to female fans during the tournament. An important consideration then is to have content which appeals to both sexes.

The Role of TV

Television will continue to play an important role for sponsors, advertisers and fans alike. It is 26 years since ‘a nation held its breath’ yet television remains the central medium for watching live sport. 8.1 billion viewers were reported to have tuned into a Euro 2012 match. In Ireland, the Euro 2012 final had a share of 50% of the TV audience, peaking at 740,000 viewers on RTE 2.

Unlike certain FIFA World Cups, the kick-off times of the European Championships are favourable for Irish television audiences. We expect viewing figures to be as strong, if not stronger over the next four weeks. Our research highlights that only 10% of people will watch Euro 2016 live matches online, the rest choosing television, the vast majority (90%) at home. This statistic cements the role that television advertising will play over the course of the next four weeks.

UEFA operates a similar sponsorship structure for the Euros as it does for the Champions League – only the top tier tournament sponsors have access to television sponsor stings. This means that Irish team sponsors and other advertisers (if not also a tournament sponsor) cannot benefit from programme sponsorship.

For the first time in Ireland, the television coverage will be split between RTE and TV3 giving brands greater choice and access. While RTE is showing all Rep. of Ireland matches, TV3 will air other key matches with teams such as England and Germany. Interestingly, should the Rep. of Ireland be knocked-out, almost 20% of people will be supporting England and over 10% supporting Germany as their second team. Group games featuring these teams will play an important role for TV3’s commercial sales.

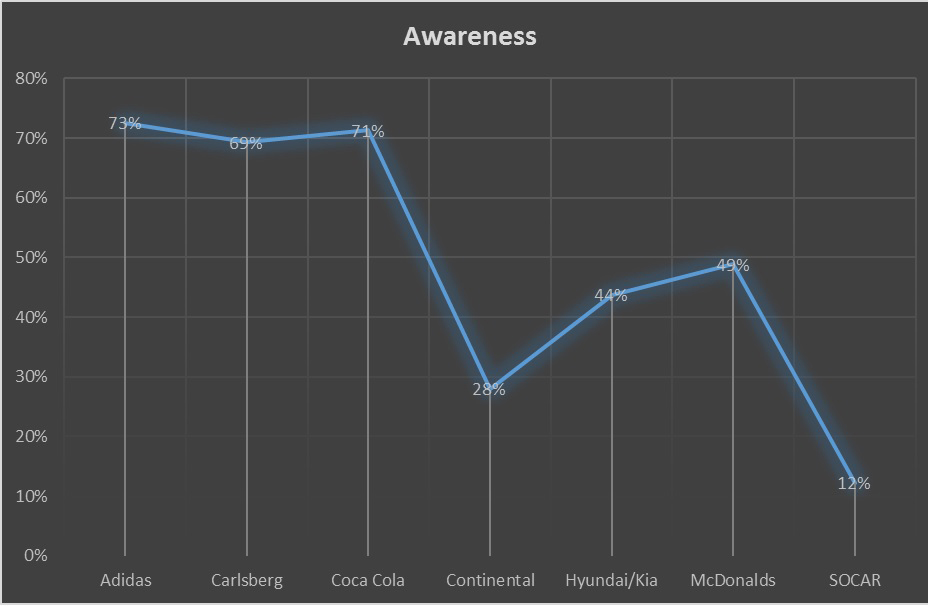

Awareness of Euro 2016 sponsors

While the excitement around Euro 2016 provides brands with an opportunity to engage football fans, only tournament sponsors are entitled to associate with the tournament itself. In particular this creates a challenge for FAI sponsors looking to leverage their association with the team playing in the competition.

The money invested by sponsors for the right to associate with either the Irish team or Euro 2016 serves to create an opportunity to engage football fans. The trick is maximising this opportunity with an activation strategy that connects. Despite the increasing amount of content being created by sponsors, especially on digital platforms, our research shows that it is tangible benefits such as free merchandise and opportunities to enter competitions that is most appealing to fans. In fact, over half of people identify free merchandise as the most appealing sponsor activity.

For example SPAR’s recent promotion to send a Team of Gary Breens to France to support the boys in green, along with the former Irish international himself seems to have had a positive impact. Our research shows that 23% of people state they are more likely to shop at SPAR as a result of its sponsorship. The activation ran in-store, alongside a broadcast partnership with Off The Ball on Newstalk. The campaign was activated both on-air and online through display, native content and a number of giveaways (incl. a signed team jersey), culminating in an outside broadcast event in J.T. Pim’s in Dublin city centre.

Another example of a brand using simple and tangible benefits to its advantage is SSE Airtricity. Over a third of people feel positively towards the energy brand as a result of its sponsorship of the Irish team. It’s #PowerOfGreen campaign rewards customers who switch to SSE Airtricity with a new official Ireland football jersey free, as well as 15% off their home energy (customers can also opt for a €50 Welcome Credit instead of the Ireland jersey).

Every sponsor wants to ‘cut through’ the noise and access football fans. Our research highlights that certain sponsors have work to do to keep ahead of competitors. For example Nike, a non-Euro 2016 sponsor, came sixth on a list of Euro 2016 sponsors and non-sponsors, enjoying 55% attribution compared to 62% for Adidas, an official sponsor. In addition, Barclays Bank (35%) and Mastercard (58%) enjoy considerable tournament attribution. Combined with Heineken 62%, it is clear that a number of non-sponsors are achieving a significant ‘halo’ effect from other sponsorships, such the Champions League and Premier League. This serves to re-enforce the role and impact that sponsorship can have when activated properly.

Predictions?

Germany are the overwhelming favourites to win the tournament. Over 40% of people believe the team can follow-on from its 2014 World Cup triumph and lift the Cup in July. This is in line with the bookmakers; Betway currently has Germany at 4/1.

But which sponsors do we predict will come out on top? Based on current activity, it appears Ford, SPAR and Three have been quickest off the blocks. Consumer sentiment towards the brands is currently high with Ford on top with almost 45% of fans feeling more positive towards the brand as a result of its sponsorship of the Irish team. This contrasts with a lower level of awareness, Ford ranks 10th on a list of brands most associated with the Irish team. The motor brand (24%) is a long way behind Three (68%). However, we expect this to improve as a result of its engaging activations which are evidently driving affinity towards the brand. Ford’s Euro 2016 campaign centres on the nostalgia of Euro ’88 and includes two videos, ‘Journey to Stuttgart’ a ‘Taxi with Packie.’ The brand is also running a sponsored content partnership with the Irish Independent, with articles such as ‘Tips for travelling to France for the Euros’ and ‘8 differences between travelling to Euro ’88 and France 2016.’

While there is a long way still to go, it would appear that Three, SPAR and Ford are in pole position to come out on top on July 10th.