After a disappointing result on Saturday and an incredible game against Italy, we reflect on the exciting second week of Euro 2016 in the Livewire Euros Insider. Results for Wednesday’s game against Italy had not come in at the time of writing. This week, we are looking at younger versus older fans* interest levels; what trends have been identified and how will they impact brand and sponsor activity in particular.

After a disappointing result on Saturday and an incredible game against Italy, we reflect on the exciting second week of Euro 2016 in the Livewire Euros Insider. Results for Wednesday’s game against Italy had not come in at the time of writing. This week, we are looking at younger versus older fans* interest levels; what trends have been identified and how will they impact brand and sponsor activity in particular.

TV Impact

This week we have seen a 15% decrease in viewership of the Ireland v Belgium match when compared with Ireland’s opener against Sweden. Interestingly, viewership peaked at 1.02m right at the start of the second half but only declined slightly as the Belgian goals went in. A massive 81% of all people watching TV at the time were watching the match, at its peak. It is worth noting that this does not count people who watched in pubs that would have seen likely seen higher numbers on a Saturday, compared with the Sweden game, on a Monday – publicans please confirm! In addition, Livewire’s research showed that 36% of all fans said they would be watching in pubs, with younger fans, under 35, considerably more likely than over 35’s to head to down to the local. Nearly half of all under 35’s planned to watch matches in the pub when compared to 32% of over 35’s.

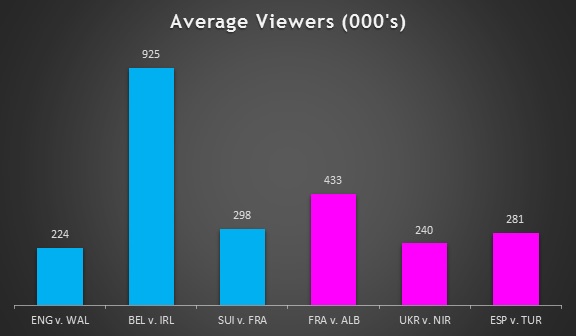

Looking at matches across RTE2 and TV3, the below graph takes a selection of three matches from both RTE and TV3 and compares them in terms of average viewers. As with last week, RTE2 matches are illustrated in blue with the TV3 matches in pink:

Republic of Ireland’s clash with Belgium on Saturday tops the pile with 925,000 tuning in to watch the disappointing loss on RTE2. There was very little drop off of viewing during the game only 6% tuned out between the beginning of the second half and the end of the game. This reflects our research pre-tournament, which indicated 87% of those supporting the boys in green would support the team even when they weren’t winning. In a shift from last week’s data, viewership figures for the Northern Ireland game surpassed Wales and England’s showdown in Lens. This is promising for TV3 in the context of the split rights deal.

Republic of Ireland’s clash with Belgium on Saturday tops the pile with 925,000 tuning in to watch the disappointing loss on RTE2. There was very little drop off of viewing during the game only 6% tuned out between the beginning of the second half and the end of the game. This reflects our research pre-tournament, which indicated 87% of those supporting the boys in green would support the team even when they weren’t winning. In a shift from last week’s data, viewership figures for the Northern Ireland game surpassed Wales and England’s showdown in Lens. This is promising for TV3 in the context of the split rights deal.

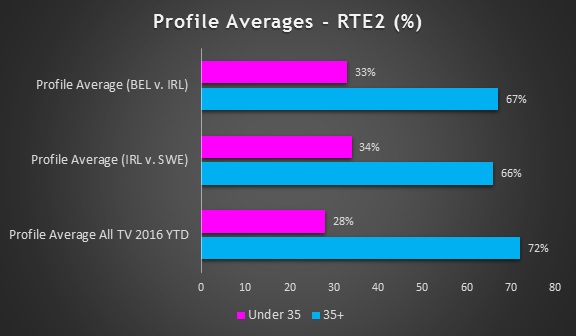

Looking at the below graph, it is clear that live sport is drawing the younger audience in as the profile base is higher during live match time in comparison with the total RTE2 base. In addition to this, all of the Ireland Euro games are streamed live on the RTE player and there has been jump in live streaming from 2012 v 2016, in some cases a double digit jump, with RTE forecasting 1.2million streams for the Euros matches on the Player along with TV performance which is up from 2012.

The pre-tournament research, conducted by Ignite, highlighted that 11% of fans overall would watch Euro matches online and again the split is heavily skewed towards younger audiences, 20% of whom claim the will watch online and only 7% of over 35’s saying the same. With over 92,000 streams of last Saturday’s game on RTE player, we can assume that these figures also skew younger.

The pre-tournament research, conducted by Ignite, highlighted that 11% of fans overall would watch Euro matches online and again the split is heavily skewed towards younger audiences, 20% of whom claim the will watch online and only 7% of over 35’s saying the same. With over 92,000 streams of last Saturday’s game on RTE player, we can assume that these figures also skew younger.

A third of younger fans said they would try to watch all of the Euro matches when compared with just a fifth of older fans. This means there are TV opportunities beyond the Ireland games to reach the elusive younger audience, who are often using other devices rather than TV. It also proves that TV is still king when it comes to live matches for younger football fans.

Social impact

Opportunity to target youth through social

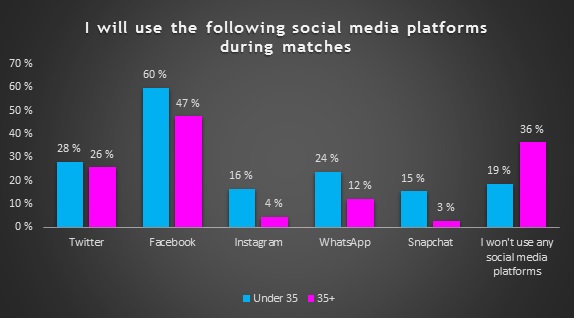

While almost half of fans* said they would watch the Euro matches without a device, it is still interesting to look at second screening in terms of young versus older fans, as well as the use of social media platforms.

Livewire’s research highlighted that almost double the number of younger fans (under 35) would use their smartphone during matches, either to access messaging apps like Whatsapp or to use sports/news apps, when compared with older fans (35+).

The most popular social media site among fans is Facebook, as half said they would be using this platform, while a quarter claimed they would use Twitter. Whatsapp is clearly popular with the younger fans as almost 25% use the messaging app during matches, which is double the number of older fans. Looking at Snapchat, the contrast between young and older fans is stark as over 5 times more fans under 35 are using the platform compared to older fans (35+). Almost double the number of older fans said they would not be using social media compared with younger fans.

The most popular social media site among fans is Facebook, as half said they would be using this platform, while a quarter claimed they would use Twitter. Whatsapp is clearly popular with the younger fans as almost 25% use the messaging app during matches, which is double the number of older fans. Looking at Snapchat, the contrast between young and older fans is stark as over 5 times more fans under 35 are using the platform compared to older fans (35+). Almost double the number of older fans said they would not be using social media compared with younger fans.

It is clear from results like this that there is significant opportunity to speak to the younger fan through social media platforms during the Euros for brands and sponsors alike.

Sponsors activating through social

Carlsberg was highlighted last week as a sponsor who is using social media heavily in its activation. Republic of Ireland team sponsors such as SPAR, Umbro and SSE Airtricity are also utilising social media in their activations.

SPAR once again topped the Ireland match day SOV on Facebook with 48% as the brand ran another competition, this time a man of the match competition involving Gary Breen. A small incentive (€50 voucher) and good timing creates strong social performance. They also showcased plenty of activity from their Team of Gary Breen’s who collectively headed to the game against Belgium, accompanied by the great man himself.

Umbro has created a free overlay people can add to their profile pictures on either Facebook or Twitter to show support for the Irish team. The banner holds the popular hashtag #COYBIG, the Umbro logo, and the national team’s crest. The brand has also been posting exclusive footage from within the stadiums during Ireland matches. Umbro performed well on Twitter in the week preceding match day with a 12% share of voice and on Ireland match day itself with 15% SOV. Livewire’s research also showed that a quarter of people claimed that sponsors providing access to exclusive content is appealing to them. Thus, the brand’s engaging and exclusive activity is clearly appealing to consumers.

Umbro has created a free overlay people can add to their profile pictures on either Facebook or Twitter to show support for the Irish team. The banner holds the popular hashtag #COYBIG, the Umbro logo, and the national team’s crest. The brand has also been posting exclusive footage from within the stadiums during Ireland matches. Umbro performed well on Twitter in the week preceding match day with a 12% share of voice and on Ireland match day itself with 15% SOV. Livewire’s research also showed that a quarter of people claimed that sponsors providing access to exclusive content is appealing to them. Thus, the brand’s engaging and exclusive activity is clearly appealing to consumers.

Finally, SSE Airtricity has been running a series of giveaways as part of its #PowerOfGreen campaign. Posts on the brand’s social media page give fans the opportunity to enter to win exclusive items such as a signed Irish jersey by answering trivia questions. Interestingly, Livewire’s research also showed that the top sponsor activity that appeals to fans is giving them free merchandise (50% of people) and running competitions for them to enter (45%).

Finally, SSE Airtricity has been running a series of giveaways as part of its #PowerOfGreen campaign. Posts on the brand’s social media page give fans the opportunity to enter to win exclusive items such as a signed Irish jersey by answering trivia questions. Interestingly, Livewire’s research also showed that the top sponsor activity that appeals to fans is giving them free merchandise (50% of people) and running competitions for them to enter (45%).

The opportunity with social media during the Euros has already been outlined above, and it is clear that some sponsor brands are utilising it to their advantage. Livewire’s research also showed that, across the board, the younger fans had higher sentiment and purchase intent toward sponsors as a result of the sponsorship. Sponsors should be capitalising on this sentiment and intent from younger fans by targeting them through social where the opportunity lies.

The opportunity with social media during the Euros has already been outlined above, and it is clear that some sponsor brands are utilising it to their advantage. Livewire’s research also showed that, across the board, the younger fans had higher sentiment and purchase intent toward sponsors as a result of the sponsorship. Sponsors should be capitalising on this sentiment and intent from younger fans by targeting them through social where the opportunity lies.

Arguably a brand winning at the moment more than most is the online sports news & content site, Pundit Arena. Playing in a very competitive space, it has produced and uploaded some great content. Their song, Takin Over France, in aid of Special Olympics Ireland with RedFM, has amassed over 6m views and is number 1 in the download charts. Another video posted by the young, innovative team featuring Irish fans trying to fix a dent in a car roof, was trending No. 1 on Reddit worldwide. Expect a lot of brands to start looking at the young entrepreneur’s site for reaching engaged sporting audiences. http://www.punditarena.com/football/european-football/euro-2016/thepateam/irish-fans-dent-car-donate-fix-dent/

For brands and sponsors alike, social media does represent a significant opportunity to connect and engage with younger audiences. However, ignore the power of live TV for this audience at your peril.

*A fan is someone who has said they will be watching the Euros which represents 52% of total the respondents.

The Livewire Euros Insider is brought to you by Livewire, Ignite Research and Radical – all members of Core Media Group