The latest instalment of Empathy’s Covid-19 Tracking Research highlights that 34% of all online grocery shoppers since restrictions have come into place are first-timers, with the majority having a positive first experience writes Robert Clarke.

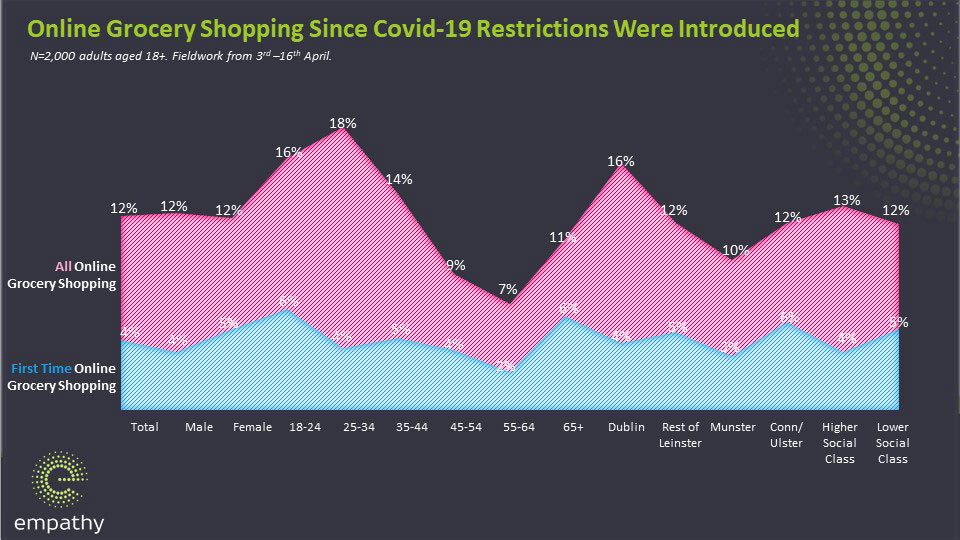

The penetration of online grocery shopping in Ireland has always been in the single digits and has broadly oscillated between 5% and 7% over the years. Then Covid-19 happened and now some 12% of grocery shoppers claim to have conducted an online grocery shop since restrictions came into force in March.

Certain retailers will undoubtedly welcome this growth, having struggled to convince reluctant Irish shoppers to buy their groceries online, but ultimately they will be asking themselves ‘will this stick’ in a post Covid-19 world?

To answer this, and as part of our continuous tracking into how Covid-19 restrictions are impacting on our daily lives, we surveyed and analysed over 2,000 consumers to understand how their general grocery shopping behaviour has changed since restrictions were introduced, what their experience of online grocery shopping has been and what their preferred future channel will be when it comes to doing the grocery shop.

First-Timers

Amongst the 12% of grocery shoppers who claim to have conducted an online grocery shop since Covid-19 restrictions have come into place, 4% claim that this was their first time conducting their grocery shop online.

Interestingly, this sub-group of new online grocery shoppers’ over-indexes amongst those aged 65+ (24%), with many in this age group cocooning and unable to access groceries through any other means, they have begun to shop online.

SuperValu have performed very strongly in this channel, with 48% of all those who have carried out an online grocery shop since restrictions were introduced doing so with SuperValu, with 43% conducting their online grocery shopping with Tesco and 9% doing so with Lidl. Amongst the first-timers, Tesco are marginally ahead, accounting for 47% of shoppers, with SuperValu attracting 43% and Lidl attracting 10%.

How has this initial foray into online grocery shopping affected likely future behaviour?

The experience of online grocery shopping amongst first-timers has been generally positive, with the majority having a good experience. Almost 3 in 10 (28%) claim that the experience was better than they expected and 44% claim that the experience was as they expected.

That said, there appears some work to do for retailers to maintain traction in this channel, particularly amongst those who have shopped online for the first time since restrictions have been introduced. 1 in 2 (55%) of this cohort claim that they will conduct their next main grocery shop online. This is driven by a reluctance to visit physical supermarkets, with the speed of the online process and a pleasant delivery experience over-indexing for this group, compared to all those who have shopped for groceries online since restrictions have been introduced.

However, there are 45% of these first-time online grocery shoppers who claim they will shop in-store when conducting their next main grocery shop. Key drivers of this behaviour include a desire to get out of the house, with a lack of delivery times/slots available, the time spent “queuing” online and receiving items which weren’t selected also adding to the return to physical stores.

What is the long-term future of the online grocery channel?

As more shoppers begin to realise and experience the benefits of doing a grocery shop online, either for themselves, or for their loved ones, they are beginning to overcome previous pre-determined barriers to using this channel. This new behaviour will become the norm for many, especially as the experience of searching, product selection and delivery begins to match or surpass in-store and other online experiences.

However in a week which saw Primark/Penneys reveal that their sales have evaporated from approximately €744 million (£650m) a month to zero as a result of the Covid-19 shutdown and having no online store to fall back on, the bigger question is will the business model add-up for retailers, suppliers and service providers to meet the expectations of a growing base of online grocery shoppers into the future?

It will remain a challenge until this channel benefits from scale, and a business model that works but one would expect other retailers, suppliers, collaborators, and innovators to enter this medium as online grocery shopping in a post-Covid world becomes an essential consideration for future growth strategies and a channel that most can no longer afford to ignore.

Robert Clarke is Research Director with Empathy