Niamh Manning, marketing executive PML Group, with this week’s view from Out of Home.

Monday marked the first day of an accelerated and revised phase 2 of the government’s roadmap to reopening. Thousands of businesses and retailers across the country opened their doors for the first time in months, travel limits and social gatherings extended and more amenities are now available.

These factors attribute to OOH’s buoyancy as people begin to move and travel further afield, strengthening and increasing audience levels. With a desire to spend more time outdoors and an eagerness for instore experiences, OOH is well placed to communicate to audiences in the moment.

As we begin to venture outside more, the advertising options in the public space has expanded significantly with more audiences exposed to the OOH medium. Context and relevancy are key for advertisers to create effective advertising to create cut through and memorability. As the situation continually evolves and the original roadmap will be continually revised, flexibility and adaptability in brand messaging will be another integral part of navigating the phases to recovery.

Retail

100,000 visited Dublin on first day of stores reopening

This week saw the welcomed move to accelerate store re-openings as we entered a fast-tracked phase 2 of the roadmap. Thousands of businesses reopened for the first time in weeks with people flocking to retail hubs as travel limits were extended.

Scenes of the reopening soon emerged with long queues and big crowds gathering at retail outlets across the country. DublinTown estimate around 50% of shops and cafes in the city centre are now open. Major retailers that reopened include IKEA, Smyths Toys, Lifestyle Sports and Harvey Norman.

Figures suggest that over 100,000 people visited Dublin on the first day of phase 2 of the roadmap. Footfall in the city centre was up again on Wednesday, as 160,000 flocked to Dublin city on the day Brown Thomas and Arnotts opened.

With the long-awaited return of Penneys today and shopping centres such as Dundrum Town Centre due to resume trading next week, we can expect retail environments will be even busier in the coming week. These multi-purpose centres offer strong audience targeting due to the high volume of people and a large mix of demographics.

Grafton Street on the 1st day of reopening. Photo cred: Will Goodbody

Grafton Street on the 1st day of reopening. Photo cred: Will Goodbody

Research conducted by Core revealed 29% have visited a DIY store and 26% have visited Garden Centre since the retailers reopening in May. Woodie’s announced sales in its DIY, Home and Garden business soared in the last two weeks of May- above levels for the same period in 2019, as pent-up demand for paint and plants was unleashed by the initial easing of lockdown.

Additional sales figures by Nielsen released this week further cements our choice to support local produce during the pandemic. Shoppers in Ireland spent €178 million on Irish sourced products in the four weeks ending May 17, an extra €35 million when compared to the same period last year. Irish alcohol brands have contributed in large to the sale of Irish owned products at 47%.

With stories of long queues and large volumes of people arriving at retail hubs this week, it seems people have been longing for an instore experience. The reopening of larger retailers and high street stores is welcomed from an OOH point of view, expanding the viewability of OOH touchpoints in different environments. Ensuring brands are top of mind will be the key to success as we begin the journey to our new normal. OOH can be a powerful tool for retailers to reach audiences as we begin to return to the pleasures of shopping.

With the reopening of Dublin city and public heath protocols in place, DCC and key stakeholders in the capital, together with Legacy Communications and PML has launched a new OOH communication campaign to help guide visitors around the city. The campaign ‘Easing Like Sunday Mornings’ aims to ensure the city reopens in a safe manner.

Mobility

Locomizer

This week we’ve compared app data from Tuesday 9th June with the 27th April to visually represent the growth in auto and pedestrian volumes in Dublin over the space of 43 days. The timeline maps below represent autos within the M50 and pedestrians within the canals.

In both instances increased density is apparent across a larger area, particularly auto movement on arterial routes, and pedestrian activity spreading out from the Liffey quays to the wider city centre.

TII

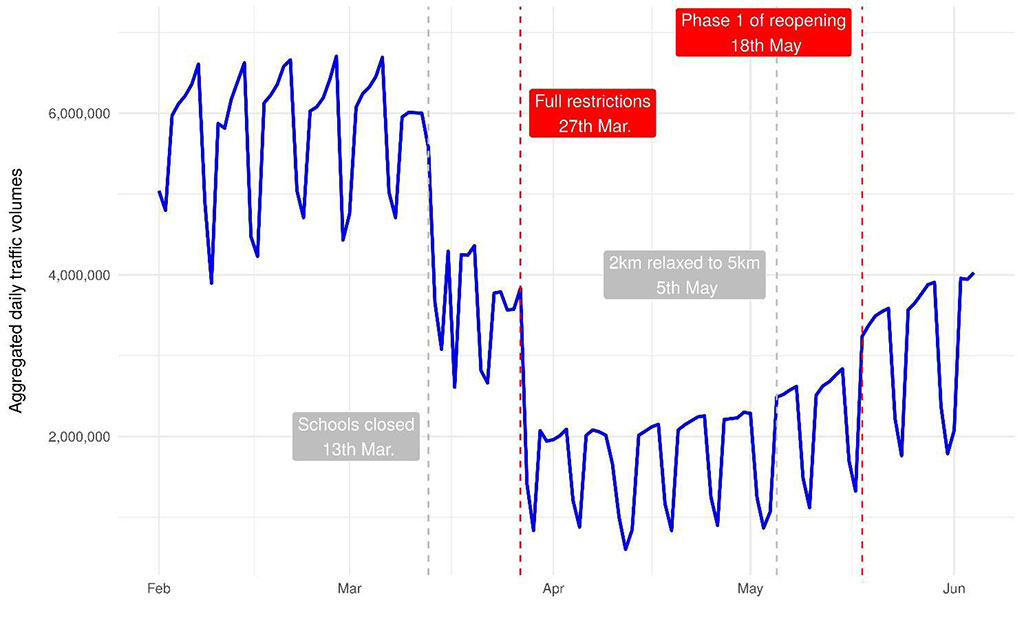

Daily traffic data from Transport Infrastructure Ireland this week indicates a continued increase in road users with the latest data on Thursday 11th showing a weekly increase of 8% across the ten traffic counters. Traffic levels nationally are now at 57% of that for the same week last year. This represents a strong rebound from two months ago when overall traffic volumes were typically down approximately 65-70% across the national road network.

Aggregated traffic volumes on national roads since February 1st 2020

Apple Mobility Trends

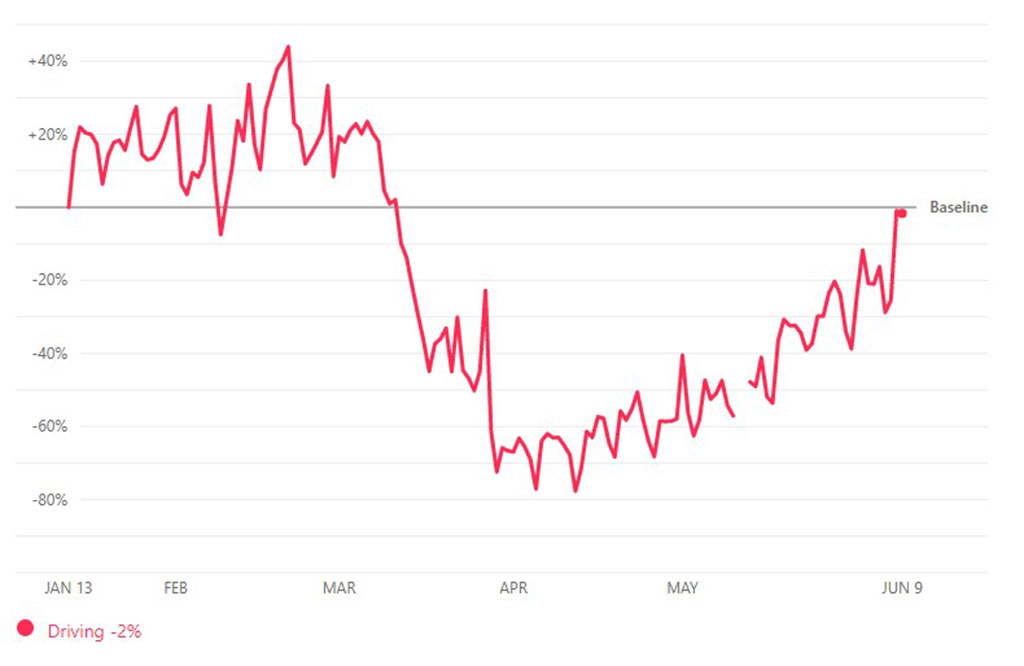

Apple’s routing requests reveal daily trends in mobility. The latest data to June 9th, shows that nationally driving mobility is up 5% this week compared to last and now stands at 78% of the baseline figure from 13th January.

The figures are even healthier in Cork, Ireland’s largest county, with driving data approaching parity with baseline at just -2%. This compares to a same day low point on 31st March when it stood a just a third of pre-Covid levels.

Change in routing requests since January 13, 2020

Public Transport

Travel demand during Phase One easing of restrictions has been higher than expected, the National Transport Authority (NTA) has reported. An increase in passenger numbers had been apparent, increasing from 500,000 weekly passengers in mid-April to approximately 700,000 in mid-May prior to the easing of restrictions. On 8 June, normal Monday-Friday timetables for commuters on bus and DART commenced. The use of public transport will continue to be discouraged at peak times except for essential travel and businesses will be encouraged to have staggered start times and operate longer opening hours to spread demand out of peak times.

Travel & Tourism

Travel

Fáilte Ireland reports that intention to take a short break in the next six months has increased significantly. In response to the Government’s Roadmap providing clarity and clear timelines, short break intentions have climbed to levels not seen since March. Hotels remain important when it comes to where visitors will stay in light of early data indicating that self-catering holiday homes have already been booked out.

Consumers have become more discerning in planning trips. Price and visitor segment differences will be key success factors. Visitors are moving out of the ‘Dreaming Phase’ and are now actively booking holidays. While this is reflective of all visitors, there are differences in the data for different groups. This highlights the opportunity for targeted marketing activities in the trade, particularly when it comes to families. City breaks are an opportunity, but only if key safety concerns are met. Crowds, adherence to health/social distancing protocols and public transport are just some of the challenges which face city destinations. However if these are addressed, visitors are positive about city breaks, with reconnection and rediscovery the strong emotional drivers. Dublin in particular has an opportunity with rediscovery and outdoor experiences.

Intentions for short breaks in Ireland have increased significantly following the announcement of the Governments Roadmap for reopening the country. Intentions for all other trip types remain unchanged.

Increases in intention were most evident among the 18-24 and 45–64 age cohorts. Those from Dublin also reported a significant increase (to 57%).

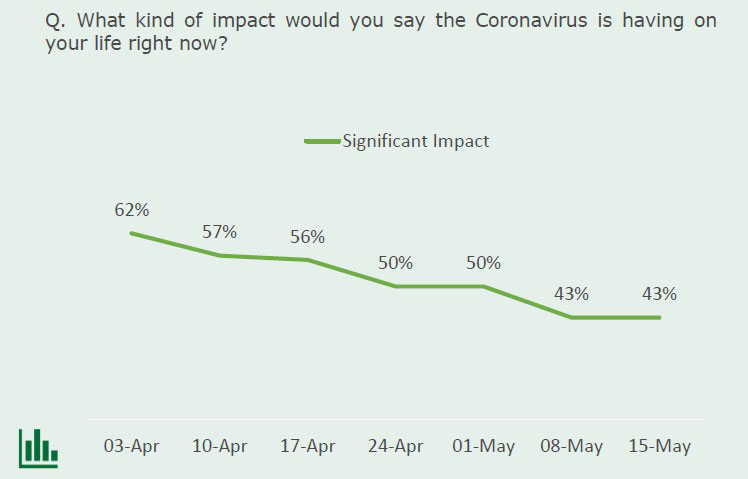

As the crisis extends and the public acclimatise to restrictions, those ‘significantly impacted’ by Covid has fallen considerably.

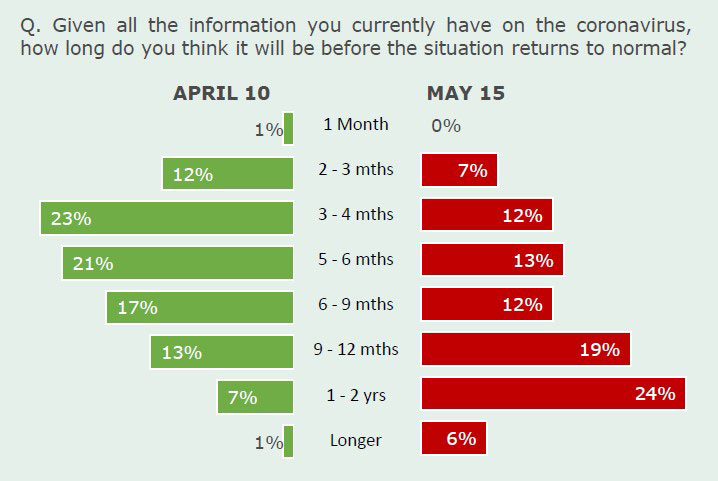

Timeframes of when life will return to normal have also shifted as more is known and accepted

about the nature of Covid impacts.

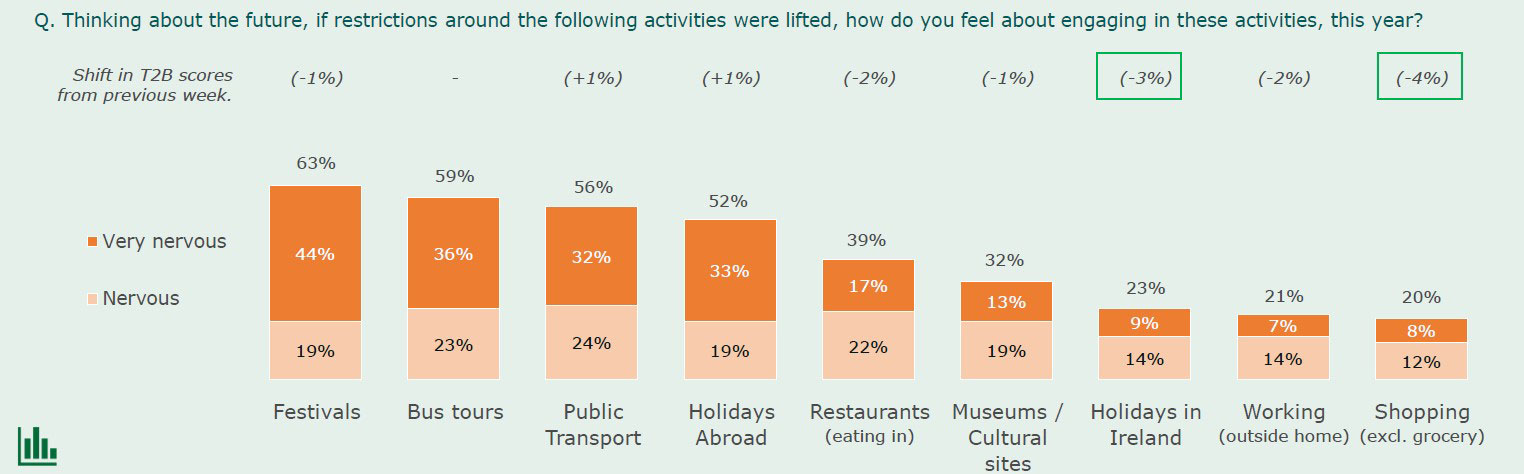

Although indicative only, there is evidence of public concern over specific activities is easing, including shopping and domestic holidays.

Activities such as festivals which involve high volumes of people and/or proximity continue to create nervousness.

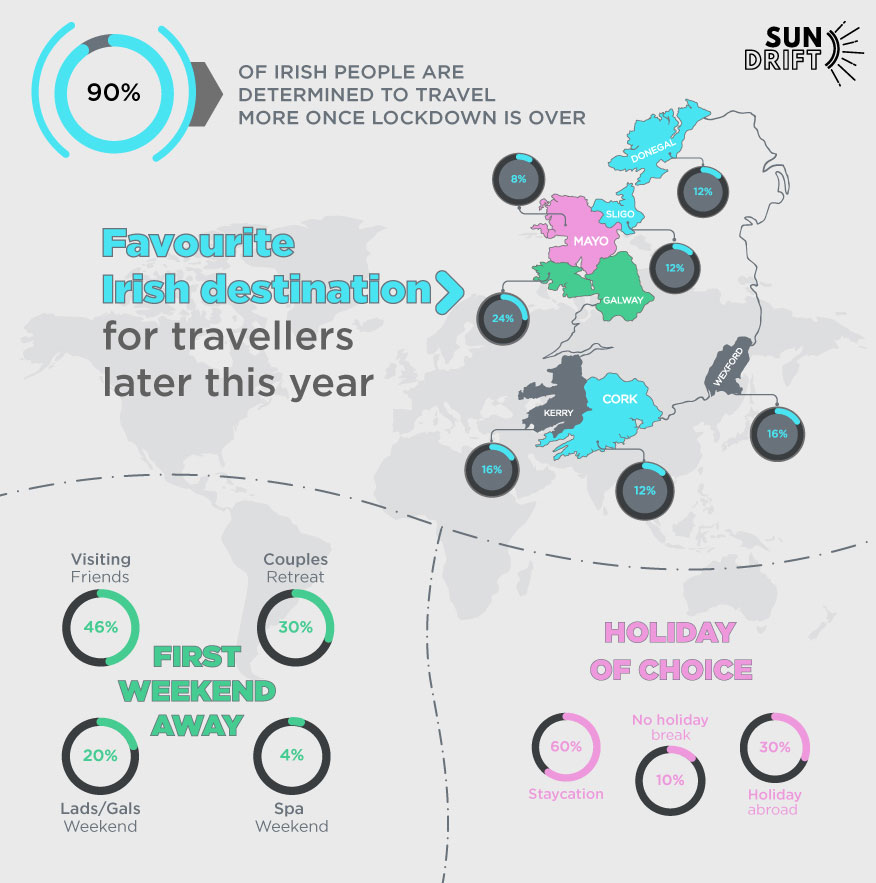

With lockdown putting paid to travellers’ plans for summer 2020, Irish sustainable backpack company SunDrift, has commissioned a survey of 500 people to unveil how the Irish public intend to travel once life returns to normal. According to the survey, the vast majority of Irish people expect to be bitten by the travel bug when post lockdown with an extraordinary 90% of those surveyed revealing that they intend to travel more following the outbreak.

Having been confined to their immediate surroundings for a number of months it will come as no surprise that 65% plan on leaving their home county more often once restrictions are lifted. Elsewhere, Irish tourist destinations may be set for a much-needed boost in visitors with 60% of those asked suggesting that a staycation will be their holiday of choice in 2020 while 30% opted for a holiday abroad and only 10% intend on not taking a break this year.

With 24% of the vote Galway edged out the Kingdom (16%) and Wexford (16%) as the favoured Irish destination for travellers later this year while Cork, Donegal and Sligo also proved popular with 12% of the vote apiece. Finally, Visiting Friends (46%) was the most popular choice of activity for the first weekend away beating out Couples Retreat which polled 30% and Lads/Gals Weekend and Spa Weekend which received 20% and 4% of the vote respectively.

Speaking of the survey, SunDrift founder Fiona Parfrey, comments; “Having been confined for the past couple of months it’s clear from our survey that the Irish public has every intention of getting outdoors, exploring and making new memories as soon as the opportunity arises. We may have been grounded this summer but it seems Irish travellers have every intention of taking flight once things return to normal!”

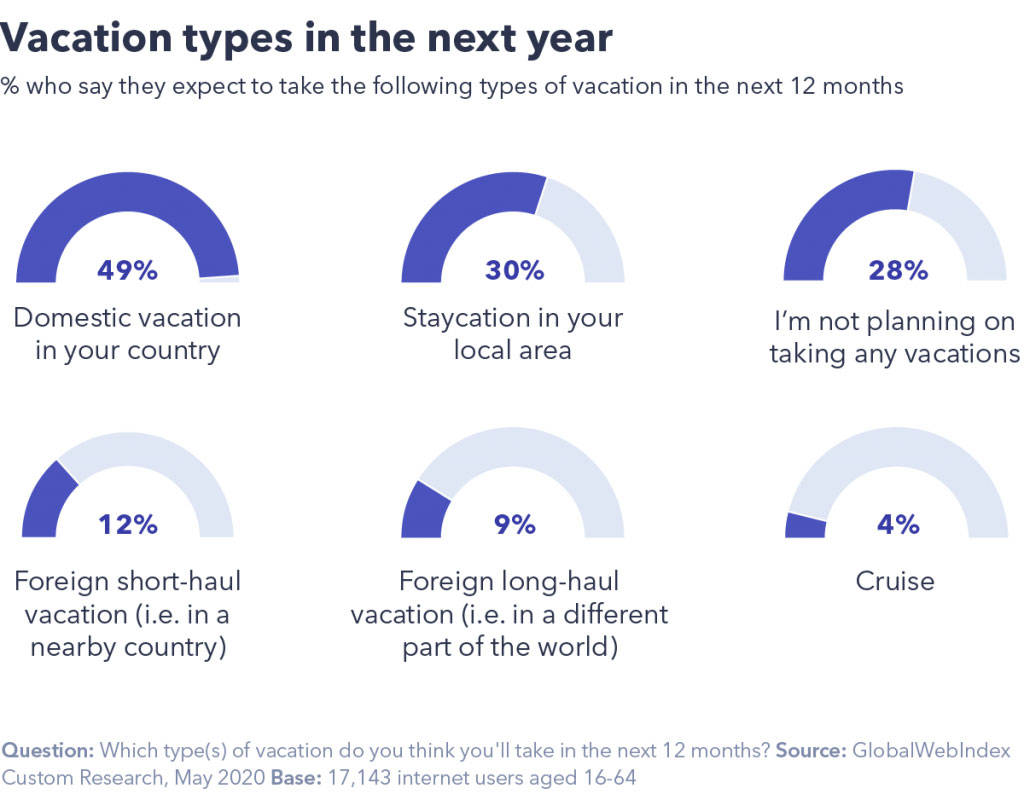

GlobalWebIndex has conducted dedicated research into the impact of the coronavirus pandemic on the global consumer landscape. Their fourth wave of research, fielded in 20 countries between May 19 – 26, paints a picture of societies moving closer to the ‘new normal’.

Updating insights it discovered travel seems set to change for the medium term, with domestic vacations and staycations top of the agenda and safety the biggest purchase influencer.

As seen in previous waves, staycations and domestic vacations are most favoured by those who express less concern about coronavirus in their own country – which is what we’ve seen happen in countries which have moved furthest along the recovery route.

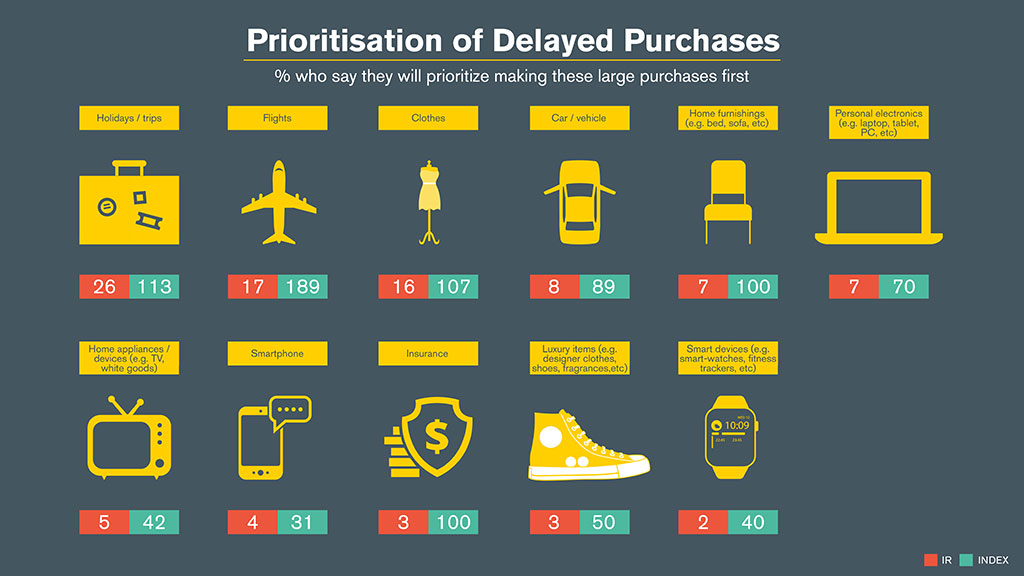

For the 532 Irish respondents’ foreign holidays are more of a priority both in terms of short-haul (25%, index 208) and long-haul (15%, index 167). As is the case globally, feeling safe is the most important holiday factor for the Irish consumer with 61% listing it. Proportionally we place greater importance on price (35%, index 113) and booking flexibility (19%, index 112) than global norms. We also prioritise experiences over possessions in terms of first large purchase with our top two being holidays / trips (26%, index 113) and flights (17%, index 189).

Sentiment

Optimism during outbreak at an all-time high

As we begin the journey to recovery, the Irish population is optimistic about Ireland’s Covid-19 pandemic.

The latest wave of Core Research states 74% of people are optimistic that Ireland can overcome the COVID-19 outbreak – an increase from 61% in May.

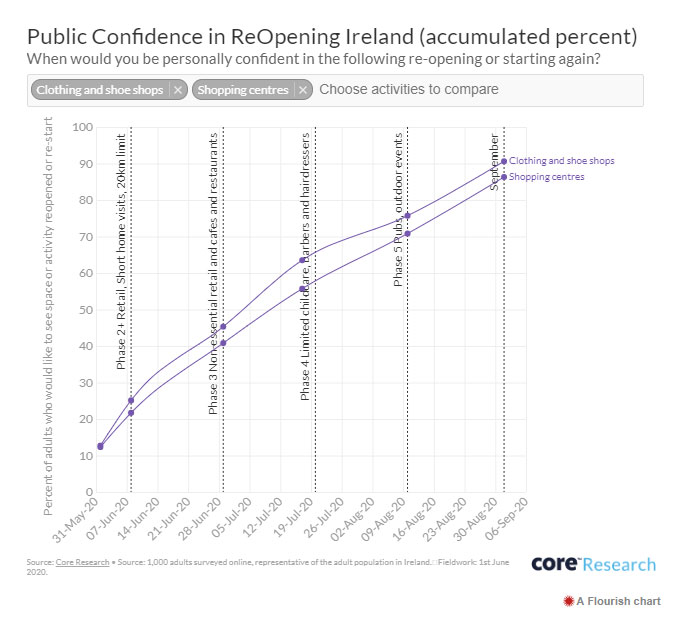

Delving into specific aspects of the reopening, Core research also measured the public confidence in a return to our outdoor activities. The research found 1 in 4 are confident to return to a clothing shop this week, this increases to 45% by June 29th.

43% would confidently return to a coffee shops by early July, while 27% would confidently return to restaurants on or before phase 3.

By September, 70% of people would be confident about cinemas reopening. Half the population (48%) have met up with a small group outside during phase 1. Local shops and business have maintained high levels of consumer confidence with 86% saying they have handled the situation well.

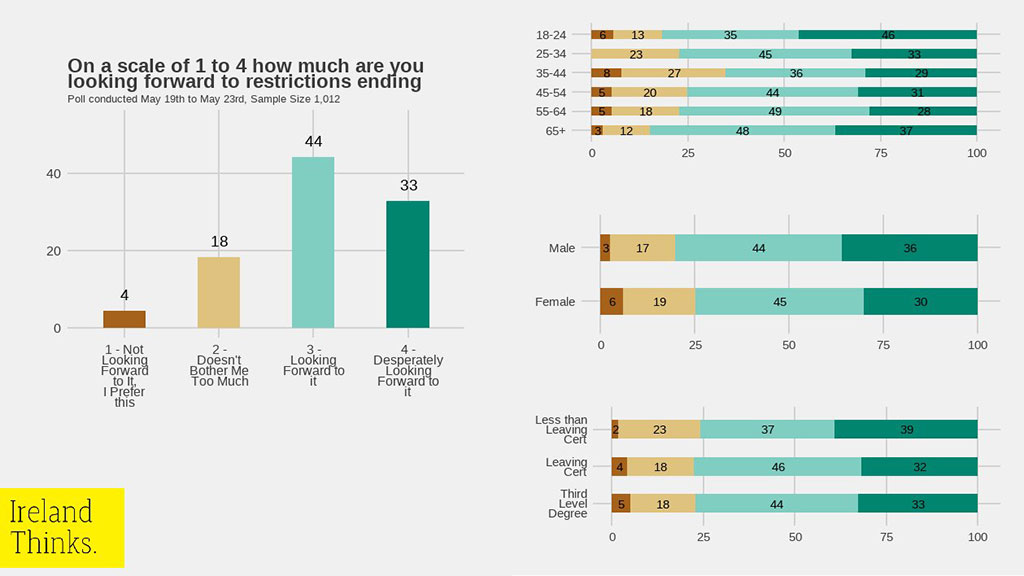

Research and strategy company, Ireland thinks, published details on the public mood and their anticipation of restrictions ending with 44% looking forward to restrictions being lifted. 33% stated they are desperately looking forward to restrictions ending.

The latest public opinion tracker conducted by Amárach on behalf of the government reveals 60% of the respondents think Ireland is returning to normal at just the right pace.

The same study also suggests an uplift in positive emotions with 50% stating they experienced a lot of enjoyment, up 10% compared to 3 weeks previous. 39% also stated they experienced a lot of happiness. Negative emotions such as anxiety, frustration and sadness have dropped to their lowest level since the research began at the beginning of the outbreak.

Strategy

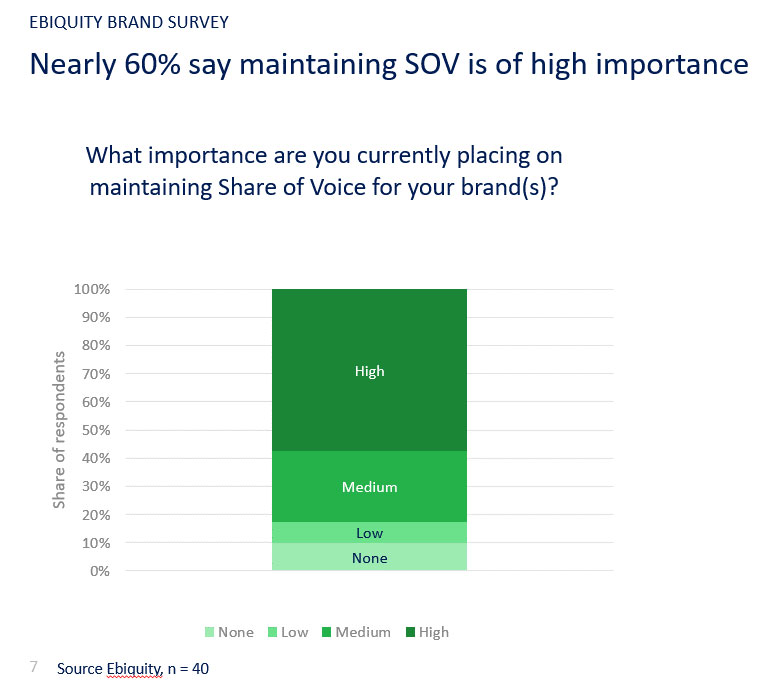

60% of Irish Brand Owners say maintaining SOV is of high importance

New research from Ebiquity Marsh reports that while brands in Ireland are likely to spend less on advertising this year, 60% of marketers are placing more value on maintaining share of voice (SOV).

This echoes researcher Peter Field’s standpoint that maintaining or even increasing SOV during a downturn is extremely important in helping brands recover from such crises.

Noting the strong correlation between SOV and market share, Field references the tendency for brands to revert to short term strategies at the expense of long-term brand building. The ‘Advertising in a Downturn’ study concluded ‘going dark’ in response to a crisis poses significant risk to brands that could take up to 5 years to recover from.

In keeping with Field and Binet’s 60:40 rule, it appears advertisers are placing more importance on maintaining brand presence and visibility while navigating this difficult climate. The same Ebiquity Marsh study found 80% believe data insights are “very or extremely important” at this time.

Approval for Running “Normal” Advertising Campaigns

GlobalWebIndex has found that internationally there is widespread – and growing – approval of brands advertising as normal. Across the 20 countries surveyed including Ireland, only 12% of consumers disapprove of brands running “normal” advertising (which aren’t related to coronavirus). Conversely, there are small but consistent decreases in approval for coronavirus-related advertising. Although overall approval for this remains very high in all countries, the numbers have successively ticked down in over twelve of the seventeen countries where there is trended data available across March-April. When asked about brands and businesses returning to normal (e.g. opening shops, running regular advertising, etc), it’s 9 in 10 globally who think this is important.