Niamh Manning, marketing executive PML Group, with this week’s view from Out of Home.

Next Monday sees the accelerated phase 3 of the government’s roadmap come into play. As a result, the majority of businesses and sectors will now reopen, travel limits lifted and sports and leisure activities due to resume.

The lifting of restrictions will be a significant social and economic moment, one that Out of Home is uniquely placed to participate in. As we move through the three-week phase, we can expect an increase in audience mobility and uptake in social activities. OOH in the next two phases will be an invaluable way for advertisers to reach the public across many different environments.

Mobility

Dublin City Traffic Back to 75% of Pre-Covid Levels

Traffic volumes in Dublin city have returned to 75 per cent of their pre-coronavirus levels, according to new figures from Dublin City Council.

The number of vehicles travelling in and out of the city at morning and evening peak times began to drop rapidly from the first week in March, hitting a low at the end of the month when strict Covid-19 restrictions on travel were introduced.

At that point, when travel was restricted to 2km except for essential reasons and most businesses were closed, traffic volumes fell to just over a third of their normal levels.

However, despite no change to the restrictions over the following month, traffic crept back to more than 40 per cent of normal levels at the start of May.

Since then, peak-time traffic has risen steadily as travel and business restrictions have eased, with the largest jump seen from the start to the middle of this month when most shops in the city centre reopened.

At the end of the first week in June, traffic was at about 60 per cent of its pre-pandemic volumes and by June 21st, it had hit 75 per cent. Because of the reduction in public transport capacity because of social distancing the DCC and NTA are aiming at a 100% increase in pedestrians and a 300% increase in cyclists.

The National Road Car Traffic Report released by the TII on Thursday shows that traffic volumes increased 5% in seven days and stood at 62% of the same day in 2019.

Apple’s routing requests mobility data to Tuesday 23rd June shows driving in Ireland is up 7% in the past week and now stands at over 90% of the start point in January. Driving in Northern Ireland is now above parity with baseline.

Continued Rise in Use of Transport Hubs

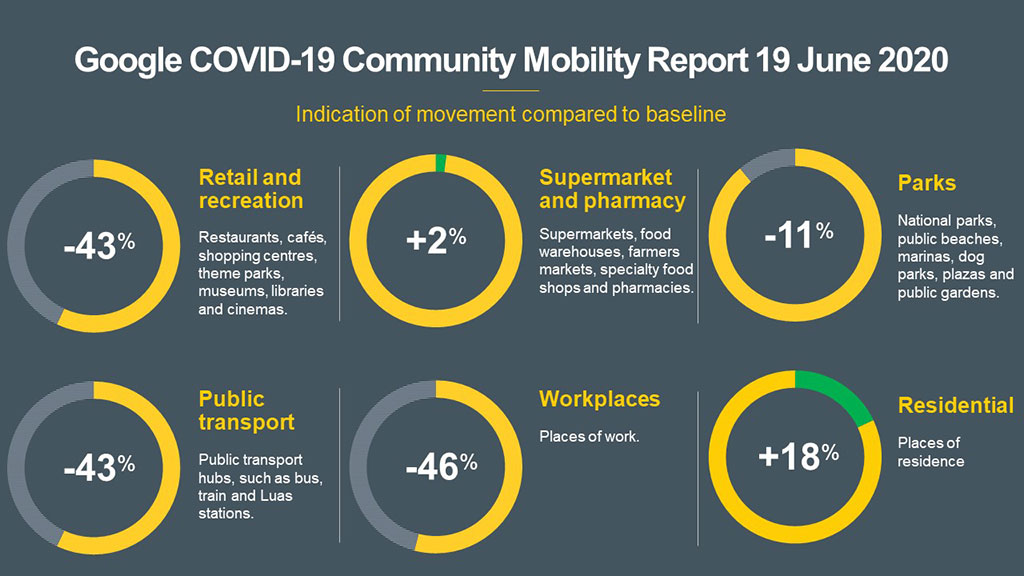

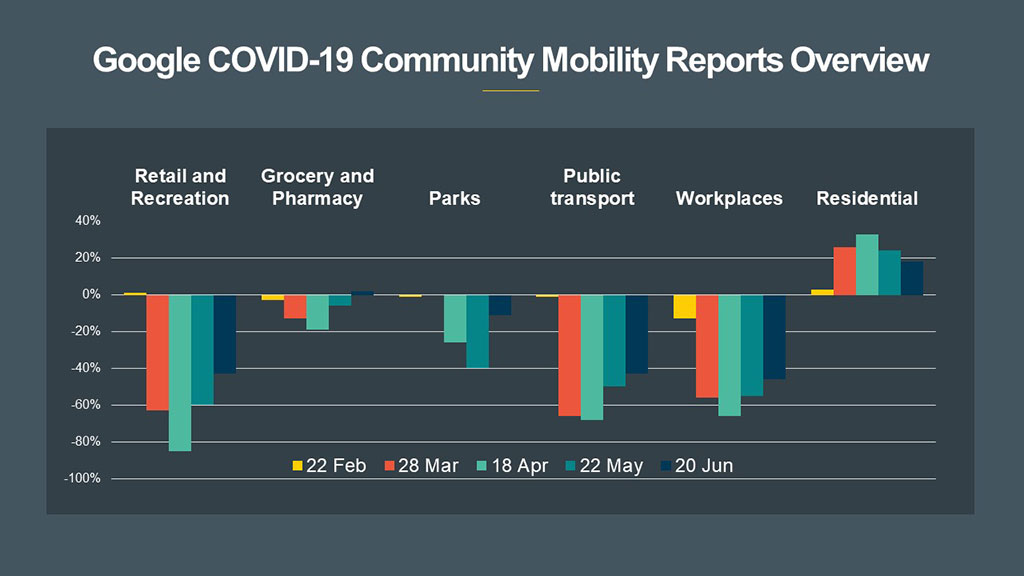

Google’s Community Mobility Reports chart movement trends over time by geography, across different categories of places such as retail and recreation, groceries and pharmacies, parks, transit stations, workplaces, and residential. The data shows how visitors (or time spent in) categorised places change compared to baseline days. A baseline day represents a normal value for that day of the week. The baseline day is the median value from the 5‑week period Jan 3 – Feb 6, 2020.

From a low point across much of April there has been a steady increase in activity in measured out of home environments including transit stations. The latest report on June 19th shows audiences in supermarkets and pharmacies are now above baseline.

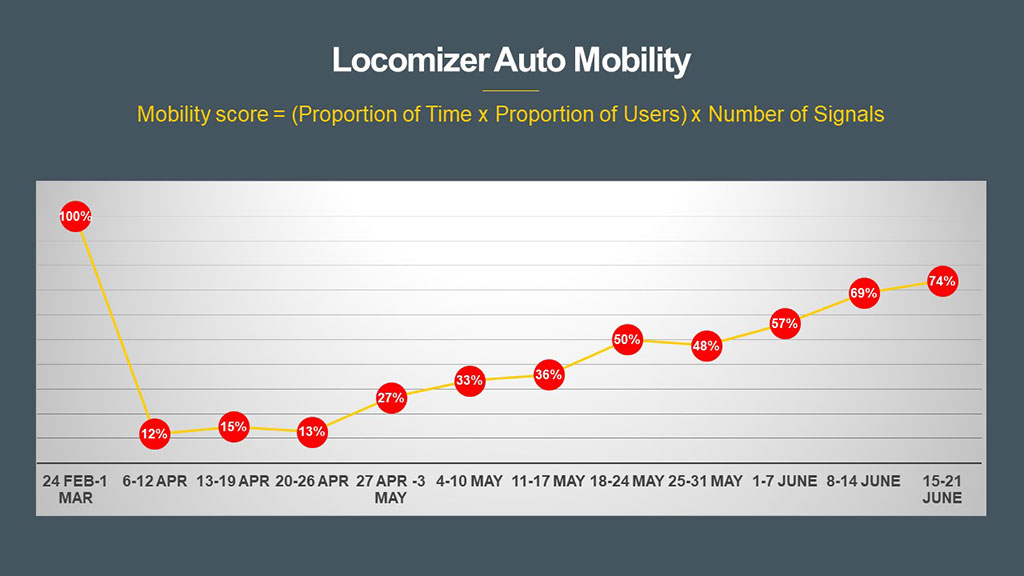

Latest data from Locomizer, based on analysis of mobile phone location data via anonymised app reporting, shows the growth in mobility across Ireland over the course of the pandemic, and as restrictions ease. Mobility levels, which are calculated though a combination of mobile users, time and signals, are now at 75% of where they were pre-Covid-19.

Sentiment

As part of this Now Near Next thought leadership series, we have investigated opinion among the Dublin population in relation to key OOH topics in the coming months – effectiveness, comfort levels by environment and ad content. Some topline salient outputs are published below. (Fieldwork by Ipsos MRBI)

Creating an Effective Media Mix

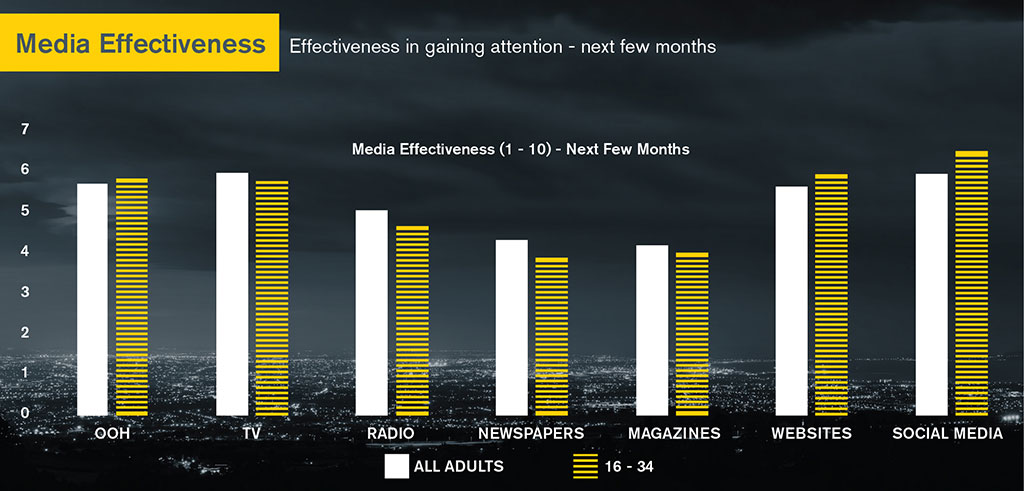

Looking at effectiveness, we asked a panel of 300 Dublin respondents how effective or ineffective advertising platforms will be in gaining their attention in the next few months.

OOH rated highly in terms of effectiveness with over half of respondents stating it will be successful in capturing their attention in the next few months. The medium outperforms most traditional media platforms and on par with website advertising.

Delving into the demographics, OOH’s highest effectiveness levels are among 16-34 year olds, AB adults and females aged 25-34, reaching a high of 68%. This echoes research that points to OOH’s effectiveness in reaching younger demographics. According to a global study by Kantar Millward Brown, OOH is the #1 preferred ad format among Millennials and Gen Z.

At present, retail is an important environment for audiences and advertisers and will remain so. As brands look to connect with audiences in this space, OOH will be successful in securing the majority of main shoppers’ attention.

TV and Social Media ads measure slightly higher than other media in terms of effectiveness. However, OOH is a natural fit to accompany other media, being uniquely placed to act as a complementary and supporting media.

Boosting the business effects of other channels, OOH is proven to amplify messaging and content through a strong synergy with traditional and non-traditional media.

What Dublin Consumers Want From Advertising

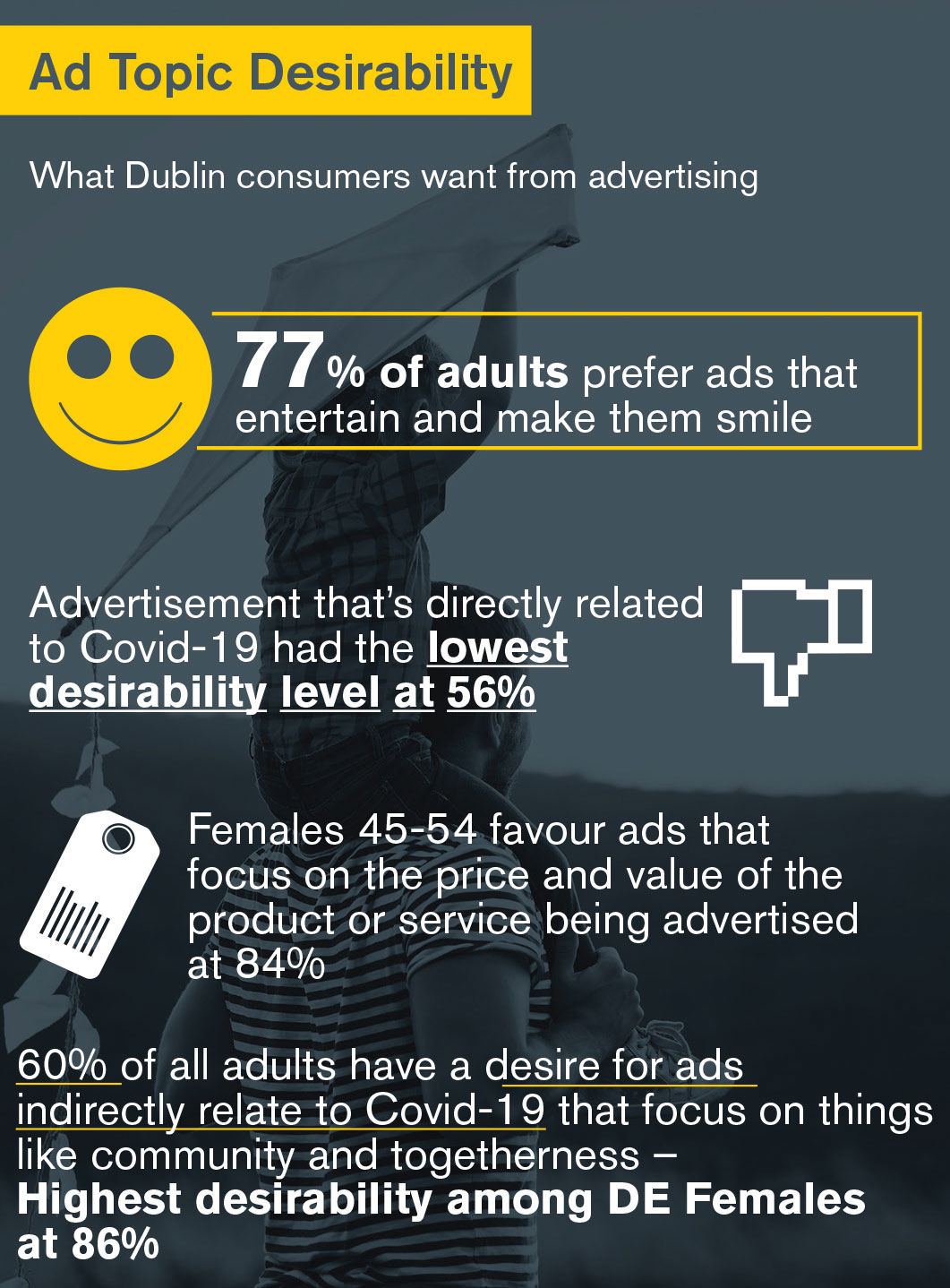

Another aspect of the research looked at the nature of advertising and different themes that are perceived as desirable to audiences.

The research shows ads that are entertaining and place a smile on peoples’ faces are the most preferred. 77% of adults want to see ads that entertain with females more likely to favour this theme of ad (84% v 69%).

Three- quarters of the respondents cited ads that focus on the qualities of the product/services as desirable. Older age groups (45-54) favour this type of advertising most at 79%.

A focus on the price and value of the product/service followed with 71% stating it was a topic they would like to see in advertisement. Males were 10% more likely than females to favour this advertisement subject.

Covid-19 related ads and ads that indirectly relate to Covid-19 rate the lowest in terms of desirability and it appears the public do not want this narrative in the advertising they consume.

As we begin to re-engage with day to day life, it is vital for advertisers to get reconnected with consumers. Concluding from the research, consumers may be moving beyond Covid-19 related ads to seeking more regular brand messaging. A focus on creativity and ad content that delivers relevancy to audiences at a particular moment is imperative more now than ever. Not only does it increase positive brand sentiment, but it increases recall and awareness.

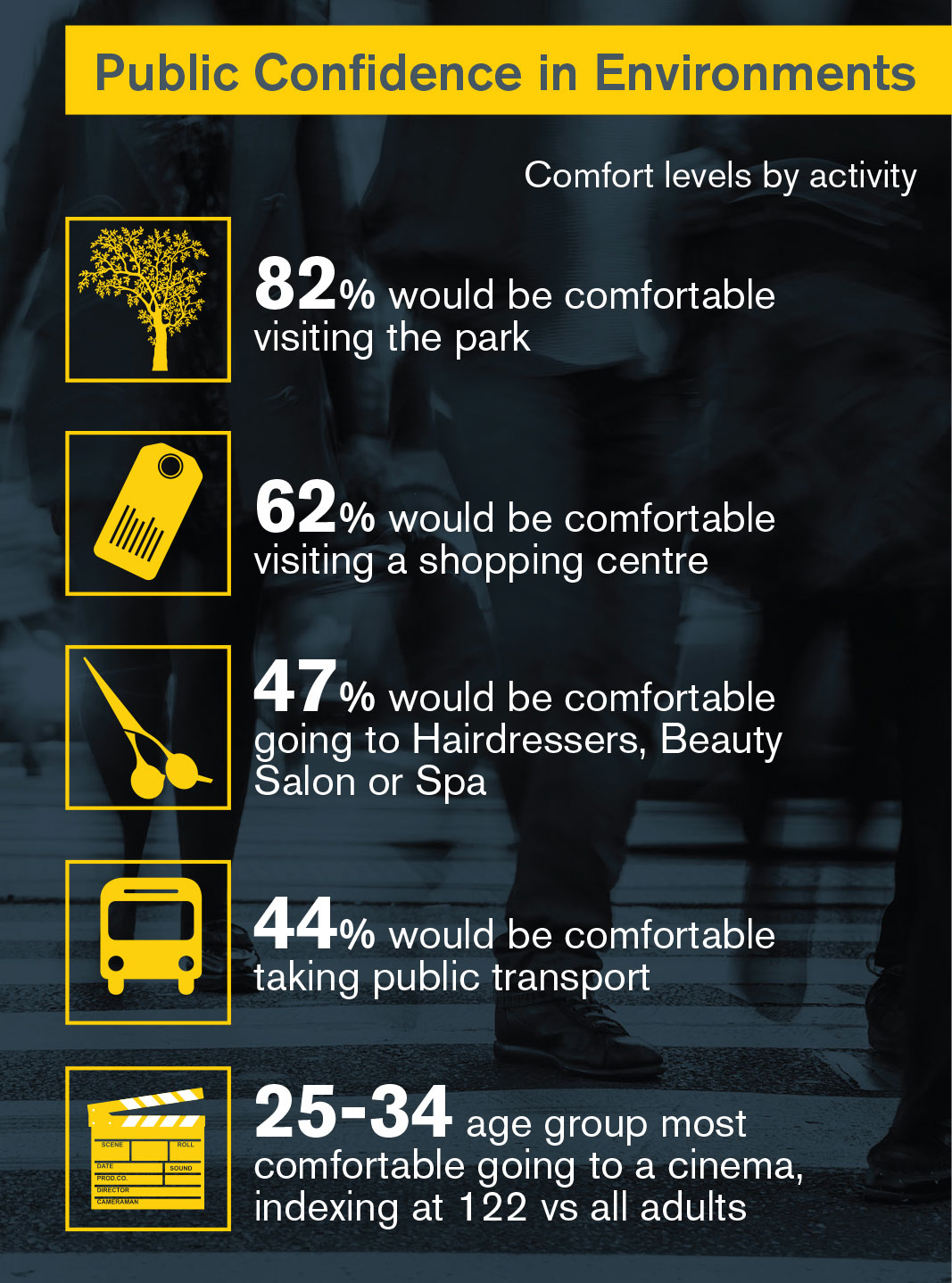

Comfort Levels by Activity

Public confidence in certain environments was also researched to assess people’s comfort levels in taking part in activities as restrictions ease and society reopens.

The research suggests that activities and environments that have already reopened or stayed open reported high levels of comfortability. Visiting supermarkets (80%), shopping centres (62%) and parks (82%) recorded high levels of comfortability among respondents.

With cooking fatigue setting in, half of all adults are confident in visiting a restaurant. While 57% of females aged 25-34 feel comfortable visiting a hairdresser, beauty salon or spa.

Environments that were due to reopen in later stages show slightly lower levels of comfortability. Over a third of respondents would be confident visiting a pub, the 45-55 age group are the most relaxed about going to a pub (index 125).

Similar levels of confidence were recorded for cinema/theatres and concerts. The 25-34 age group are most comfortable going to a cinema, indexing at 122 vs all adults.

A quarter of respondents would be comfortable returning to the gym, increasing to 47% for males aged 25-34.

Consumers may be slightly cautious about the initial return of some activities in the next phase. With the public closely watching to see how each individual activities and business reopens, we can expect comfortability levels to increase as the reopening is more established.

Leisure

Leisure and Hospitality Sector Set to Open their Doors

Bringing a bigger sense of normality to our lives, the series of relaxation measures sees the hospitality and leisure sector reopening on the 29th of June with restaurants, cafés and hotels due to resume trading.

As we come out of the other side of lockdown, there are several things that people are eager to see reopen — The pubs, the hairdressers, and the gyms. Anecdotal stories of relentless demand and long waiting lists was conspicuous in the media this week.

Ireland’s themes parks and zoos are now all operational with Tayto Park announcing its reopening date. The Ashbourne park, which is a hit with families, will reopen its doors on Monday. Fota Island and Dublin Zoo reopened at earlier dates.

Pints… and a Substantial Meal

With new safety protocols in place, pre-booked visits and the length of stay limited to 90 minutes, pubs and restaurants will be radically different to the ones we were accustomed to. However, pub goers don’t seem deterred according to research commissioned by the Licensed Vintners Association.

The research indicates that 74% of people who visited pubs once a month or more pre-restrictions plan on visiting a pub within one month of them reopening. 59% of the general public plan on returning to pubs within the same period.

Pubs and bars that don’t serve food will reopen on the 20th of July. Drink giant Diageo announced plans to launch a $100m global fund to help pubs and bars recover following the Covid-19 imposed shutdown. €14million of the fund is allocated to Ireland.

The fund called ‘Raising the Bar’ will be focused on the provision of equipment, confidence building measures for consumers and hygiene provision in bars, according to Diageo.

Return of the Silver Screen

While Netflix kept us entertained during lockdown, movie fans will be pleased that cinemas across the country will be reopening from Monday. And it seems Irish people can’t resist a trip to the movies, earning us the highest rating in Europe for cinema attendance per capita. Additional cleaning and social distancing measures are in place to reassure movie-goers before this summer’s high-profile releases.

Our Pinpoint mapping platform has more than 77 cinemas plotted across the country. With cinemas returning, more OOH formats will be onboard with networks located in the environment now available.

Irish Consumers are Keen to Take a Holiday

A survey commissioned by travel insurance provider Allianz Partners, details how Irish consumers are now contemplating holiday options. The survey shows that 80% of people are keen to take a holiday sooner rather than later.

With travel limits lifted at the end of the month, 43% of consumers want to take a post-lockdown trip within Ireland. With some uncertainty still lingering on travelling aboard, 37% said they were looking forward to foreign travel this year.

The reopening of hospitality and leisure sectors are welcomed from both a societal and OOH point of view. The increase in activity means exposure to OOH will increase in intensity. Hospitality and leisure venues are full of OOH advertising opportunities and like the retail environment, dwell times are high, and audiences are more receptive to advertising in this setting.

Retail

Shopper Audience Behaviours Altered

‘Shopperwatch’ conducted by B&A on behalf of Checkout magazine shows how we have altered some of our consumption patterns to acclimatise to restrictions and our temporary new way of life.

The research reveals 7 in 10 people have changed the day/time they do their main grocery shop, with midweek mornings and evenings now the most popular among shoppers. The change of routine is most pronounced in Dublin, with almost three-quarters (74%) of shoppers making a change.

A lack of traditional deals and promotions was noticed by shoppers with 38% stating they feel store promos are worse than usual.

The main takeaway from the above is the change in time/day shoppers are doing their main shop, with midweek mornings and evenings now the most preferred times. With such changes in patterns, OOH is well placed to adjust brand communications in the retail sector. With flexibility and day part options available to brands, advertisers can best meet the needs of consumers at different times of the day, ultimately influencing product choice.

Almost €600 million Spent on Contactless Payments in May

Another trend that has emerged since the outbreak is our reliance on contactless payments. New figures from Banking and Payments Federation Ireland (BPFI) shows almost €600 million was spent by consumers using contactless payments in Ireland in May – the highest monthly total to date in 2020.

On average consumers made €19.3million worth of contactless payments daily. Expanded spending limits resulted in an increase in the average transaction, averaging €15.30 compared to €11.92 in February.

Irish Consumers Want to Make Purchases In-Store.

According to Deloitte Ireland’s State of the Consumer Tracker, more than half (58%) of Irish consumers want to make purchases in-store.

The most recent data was gathered between 9 and 13 June, immediately following Ireland entering the second phase of the lifting of restrictions. The emergence of the ‘convenience consumer’ remains, with 45% now stating they are happy with spending more on convenience.

Confidence in visiting physical stores is up by 3% with 56% of consumers reporting that they now feel safe visiting a store. This puts Ireland as joint third in Europe for this measure, an encouraging sign for the high street. The data suggests that consumers are planning to travel domestically too, with a 23% increase in intended spend on vehicle fuel/oil.

More emerging behaviour shows consumer are making socially conscious purchase, with 35% stating they will purchase more from brands that have responded well to the crisis. Bargain hunting is on the rise with 55% stating if they found a good deal on non-essential items, they would buy it today.

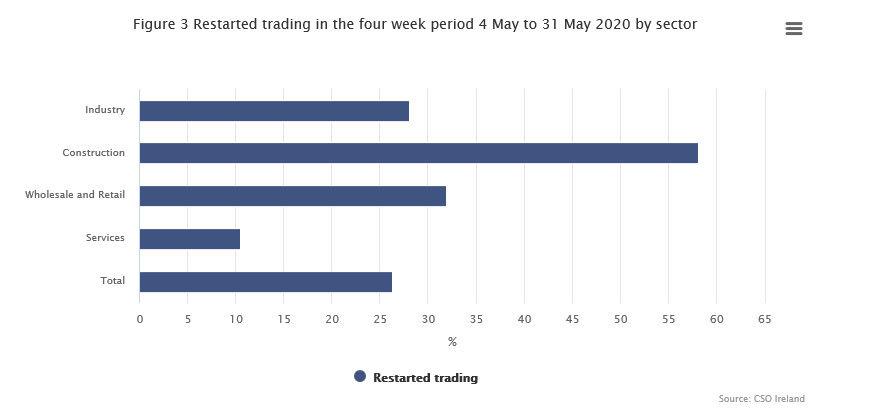

90% of Businesses now Trading ‘in Some Capacity’

The Central Statistics Office (CSO) has published the results of the third wave of its Business Impact of Covid-19 Survey (BICS).

The results show that 89% of responding enterprises were trading in some capacity, on 31 May 2020. Three in ten responding enterprises has increased turnover since the easing of restrictions on 18 May 2020.