Colum Harmon, marketing director, PML Group with this week’s view from OOH.

Shopping Mall Footfall Surges as OOH Momentum Gathers Pace

It’s been a full agenda for Out of Home this week and our team at PML Group were delighted to take part in webinars for IAPI and The Marketing institute. On Tuesday, as part of the Institute’s webinar series, we launched the Moments of Truth – a ground-breaking study designed to inform and educate the marketing industry on how dynamic Digital OOH (DOOH) maximises DOOH performance and consumer response. More on that research features below. We also discussed the implications for OOH of shifting audience behaviour as a result of the pandemic in IAPI’s Media Focus series.

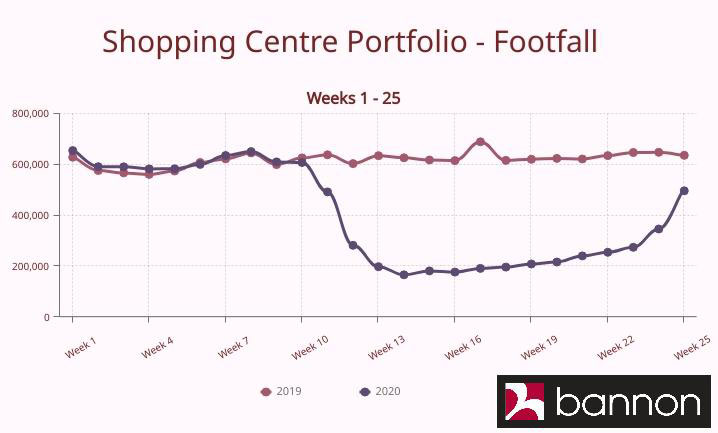

This week’s Now Near Next highlights continuing positive trends in OOH audience data. Recently published figures from Bannon, managers of shopping malls including Swords Pavilions, Blanchardstown, The Square, Marshes and McDonagh Junction shows a footfall across its portfolio of approx. 500,000 for the week ending June 21st. This is approx. 80% of the same week in 2019 and is around double the figure of two weeks previous.

As audiences have returned in great numbers to key OOH environments, brands have reacted. Cycle 14 (29 Jun – 12 Jul) has seen a further sharp increase in OOH activity with advertisers including AIB, Diageo, National Lottery, Heineken, Kellogg’s, Sky, Volkswagen and SuperValu on the streets.

Mobility

The Rush Hour is Back

Dublin Live last week advised that Friday evening commuters were in for a shock as heavy delays were reported by TomTom across the capital.

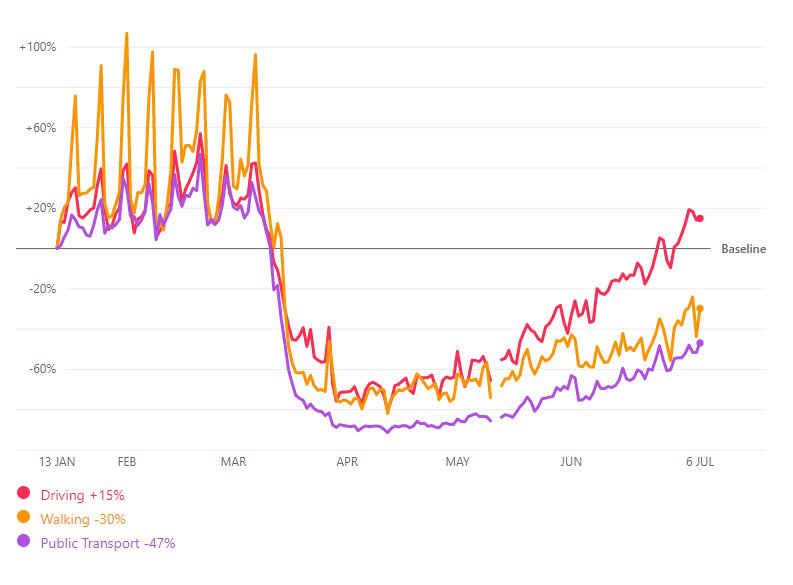

Apple’s routing requests mobility data to Monday 6th July shows driving in Ireland is 15% above January’s baseline and up 34% in the past fortnight. Figures indicate public transport is now above 50% of pre-COVID-19 levels. Driving in Northern Ireland is now 19% above baseline, while the UK has reached parity.

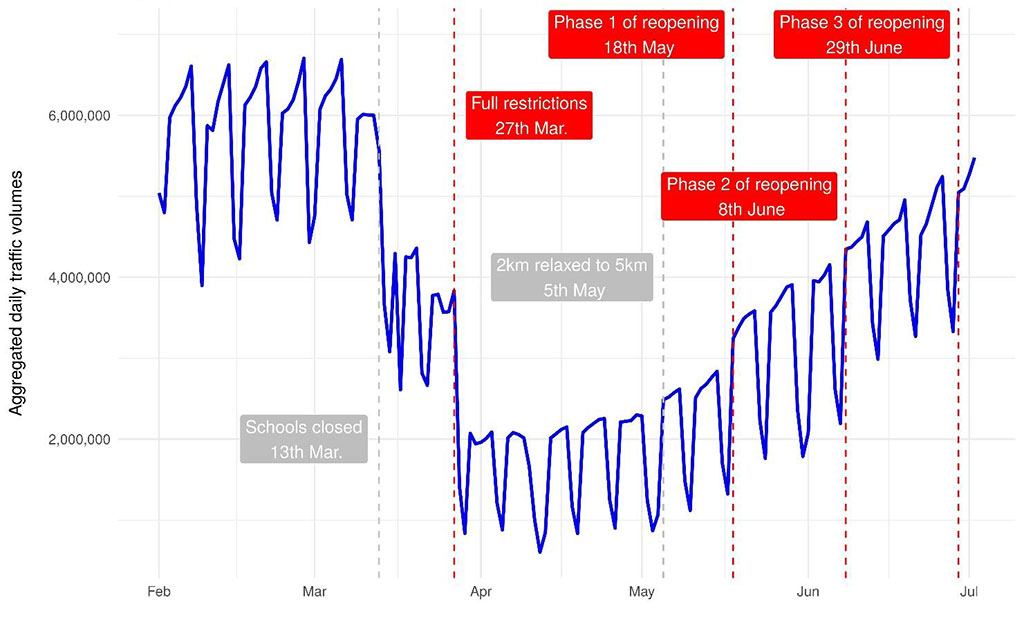

The National Road Car Traffic Report demonstrates the recovery in traffic levels. Traffic volumes, since the restrictions imposed on March 27th, initially reduced by 60-70% have now recovered to a reduction of 15-20% from typical conditions in 2019. By Thursday July 2nd, overall traffic volumes were 168% above the average volumes on the network during the full COVID-19 restrictions.

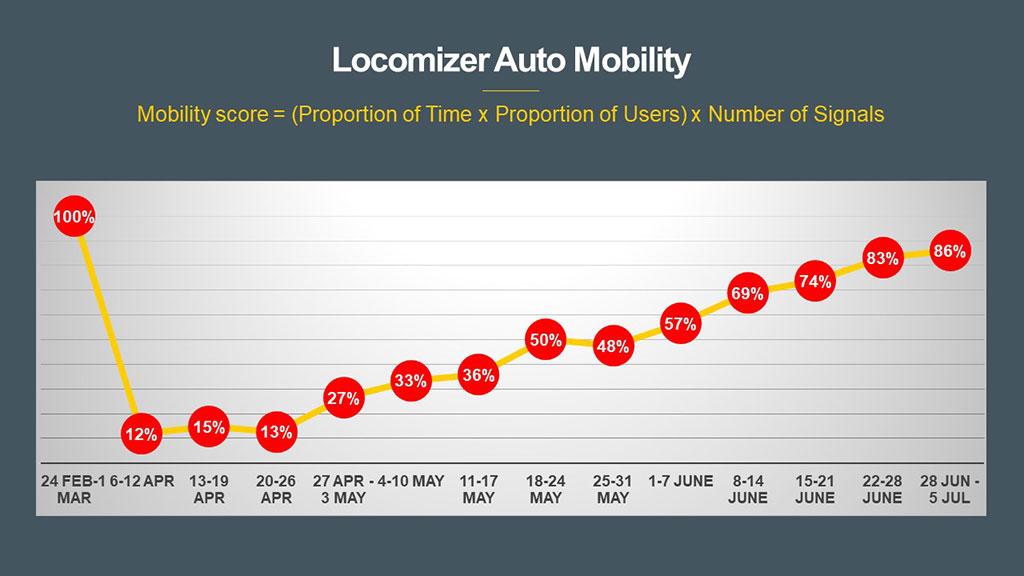

Latest data from Locomizer, based on analysis of mobile phone location data via anonymised app reporting, shows the growth in mobility across Ireland over the course of the pandemic, and as restrictions ease. Mobility levels, which are calculated though a combination of mobile users, time and signals, are now at 86% of where they were pre-COVID-19.

A Return to Workplaces

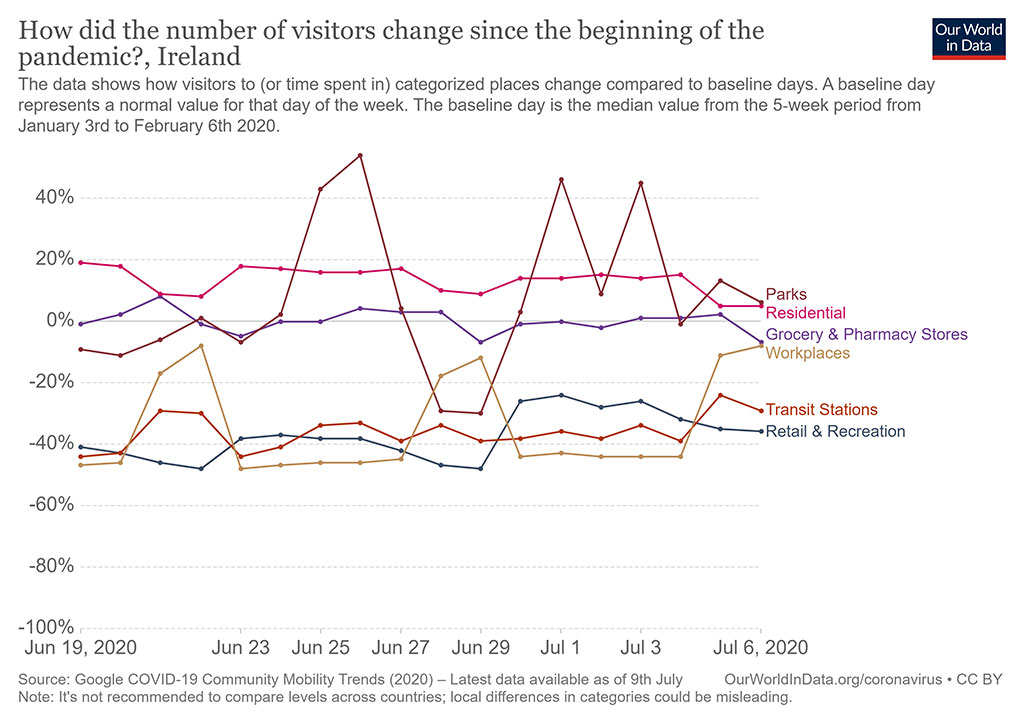

Google’s latest COVID-19 Community Mobility Report to July 6th shows a major jump in workplace visitors with a corresponding drop in residential levels.

JUST EAT dublinbikes Deliver More and More Journeys

New figures from JUST EAT dublinbikes and JCDecaux show that the bike sharing scheme has experienced a massive increase in journeys across the past two full calendar months as restrictions on movement have gradually eased and a bigger audience has returned to Dublin city centre. Compared to the low base month of April, journeys have increased by 108% to end of June, with an 18% increase on June v May.

Retail

Shopping Centre Footfall Close to 2019 Levels

Property consultant Bannon’s review of its shopping centre footfall shows a sharp and significant increase in the weeks following the lifting of retail restrictions in mid-June.

As illustrated in the graph below, footfall across its portfolio reached 500,000 in the w/e June 21st, almost doubling in a two-week period, and swiftly approaching 2019 levels.

The retail agency manages 50 centres nationwide with Blanchardstown, The Ilac, Athlone Shopping Centre and Nutgrove among its retail portfolio.

With strong numbers returning to shopping centres since their reopening, OOH in the retail setting presents itself as an important platform, offering an invaluable opportunity to target and influence audiences in an engaged mindset.

The Grand Reopening

Since the grand reopening, retailers are reporting steady footfall in retail hubs across the country. With most businesses opening Monday last, retailers are positive about the reopening.

As reported in the Irish Times, the city centre’s average daily footfall climbed to more than 200,000 last week, encouraging signs as we build back to normal pre-COVID-19 levels. The city centre was experiencing an average footfall of 162,000 in early June.

Queues are still evident across many retail hubs and sectors. IKEA’s retailer’s marketing manager, Martyn Allen stated the typical wait is 30/40 minutes. He also reported storage items, summer furniture, pots and pans, candles and picture frames are in high demand.

Dundrum Town Centre managing director Don Nugent told the Irish Times, footfall in the shopping centre is steady and on an upward trajectory. The Town Centre is witnessing consumers spending more and gift card sales have been particularly strong.

Strong Sales in June

Woodie’s retailing outlets experienced a successful reopening in Ireland, setting a new record for monthly sales in June. Strong demand in June represented an important milestone on the road to recovery and growth was attributed to exceptional sales of seasonal products.

The Grafton group also reported home improvement specialists Chadwick’s recorded growth of 7.3% in average daily like-for-like revenue in June. This growth was mainly driven by strong demand in the repair, maintenance, and improvement segment of the housing market.

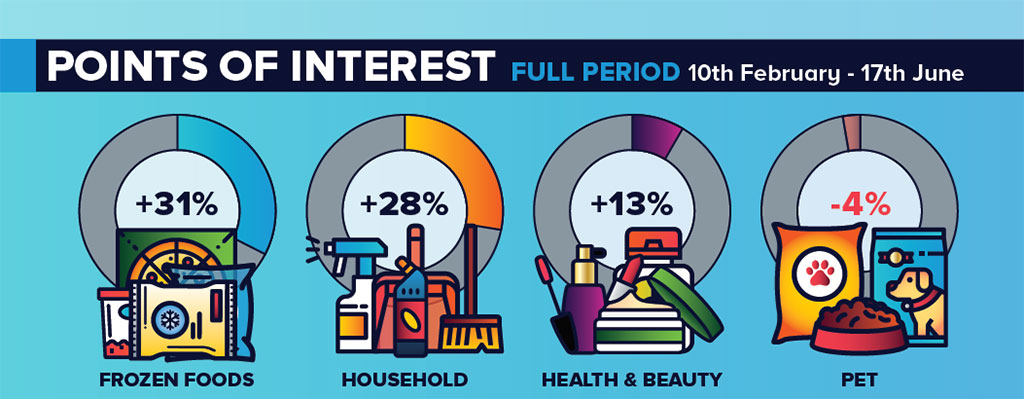

Tesco‘s long term sales analysis, provided by Clear Channel and dunnhumby Ireland, shows points of interest for consumer across lockdown. Measured between February 10th and June 17th, frozen foods gained a sales increase of 31%. Household cleaning products have been continually in demand with 28% increase in sales.

Appearance and hygiene were of high importance for consumers during lockdown with health and beauty product sales up by 13%.

Trading in the reopened stores of Primark/Penneys has been encouraging with Penney’s owner, AB Foods revealing robust sales. With Primark in the UK reopening at an earlier date, cumulative sales for the seven weeks up to June 20 amounted to £322m, 12% down on the same period last year.

However, in the week ending June 20 trading in Ireland and UK was ahead of the same week last year.

Spending Sentiment Shows Signs of Improving

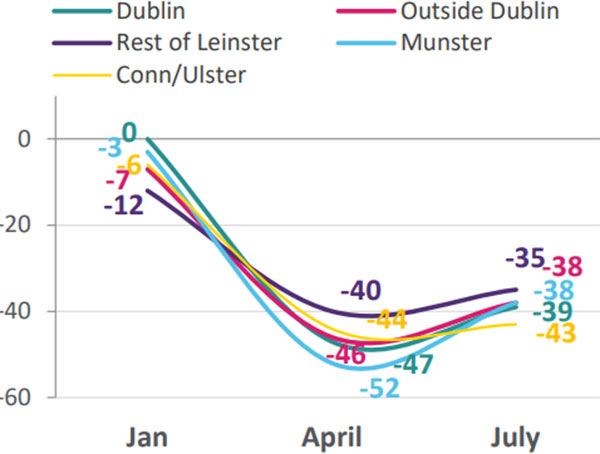

The latest wave of B&A’s consumer confidence report shows an uplift in spending sentiment among Irish consumers.

While caution is still evident, spending sentiment improved by 8 points from a low of -46% in April to -38 % in July.

7% of the respondents stated they intend to purchase more compared to last year. While 41% will maintain their spending in line with last year. Similar levels were found across the country with little difference between other counties and Dublin. The rest of Leinster reported the highest level of positive spending sentiment at -35%.

Store Openings Illuminate Retail Confidence

News of store openings were prominent in the media this week with major retailers and new entrants announcing store openings across the county.

Dealz has announced expansion plans, opening three new stores. Located in Dublin, Cork and Donegal, the outlets will open on July 16th.

Meanwhile, Colombia Sportswear opened its first ever standalone Irish store on Saturday 4th July. The outdoor clothing company’s Irish store is located on Trinity street in Dublin city.

JYSK also announced this week plans to open its first Dublin Store at Gulliver’s Retail Park, Santry in October.

Such store openings and expansion plans highlight and cement the importance and value retailers place in maintain a physical retail presence and shows confidence in the retail audience.

Leisure

Pedestrianised Streets Come to Dublin

As reported in last week’s Now, Near, Next, Cork City Council’s decision to pedestrianise streets and create outdoor dining areas has been popular with the public and has boosted business and footfall in Cork City.

Plans have now been announced to pedestrianise streets in Dublin city centre, with five streets being trialled. The trials will run between 11am and 7pm on four consecutive weekends beginning 25 July. The streets included are Anne St South, Duke St, South William St, Drury St and Dame Court – locations popular for socialising and with a large volume of hospitality and leisure venues.

Hotel Bookings Increase for Summer Months.

Data published by Net Affinity shows hotel bookings made in June from ROI has increased. Hotel bookings are down 29% compared to those in June 2019. However, it shows a huge improvement on the -90% decrease that occurred in April.

Looking at hotel bookings made in June, 48% were made for July while 29% of bookings were for August.

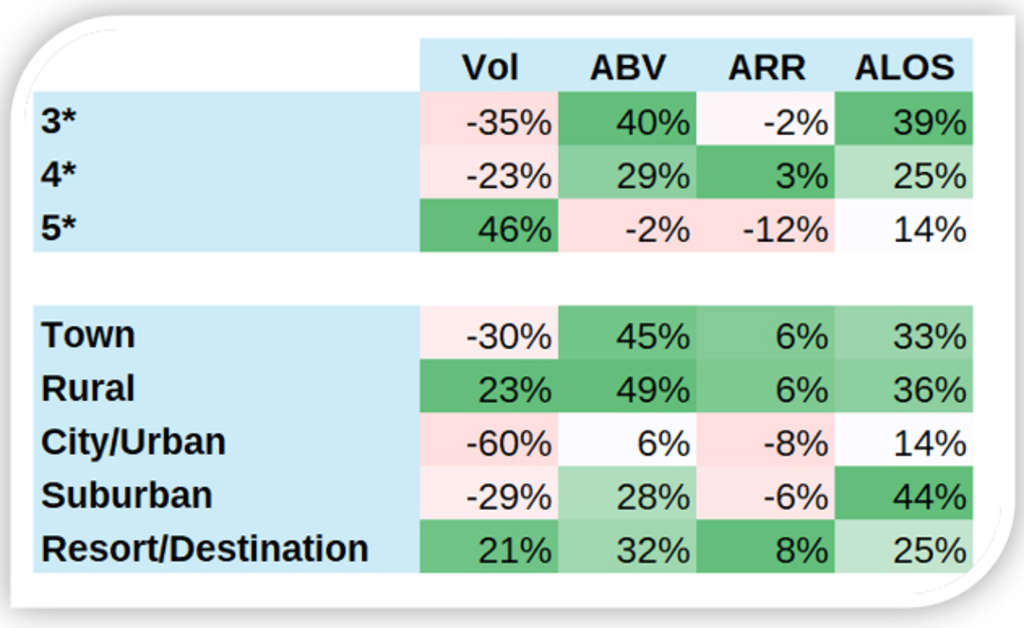

Looking at where people want to stay, the research found luxury holidays are popular with the 5* market seeing the highest increase in volume of bookings year on year. Rural and resort type holidays are proving attractive seeing large growth in booking volumes.

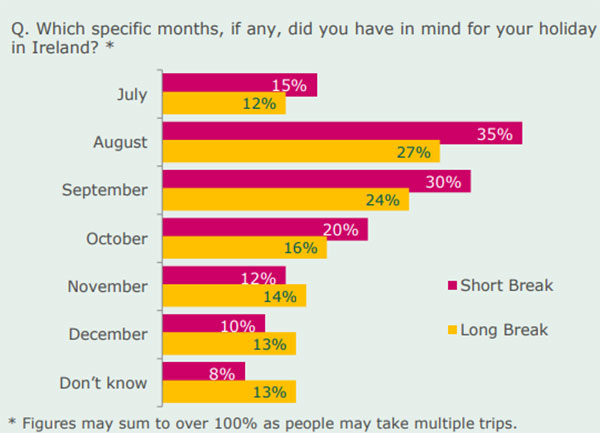

According to Fáilte Ireland’s recent consumer sentiment research, intentions to take a short break in Ireland has increased in recent weeks with 57% of Irish consumers now planning a staycation in the next six months.

Shorter staycations are firmly on the agenda, however intentions on longer breaks in Ireland were less positive. Only 23% indicated they plan on taking a longer break in Ireland within the next 6 months. Many are planning to fit a short staycation into the summer months before the new school year starts, with 35% planning a short break in August.

The key motivators for domestic travel across all life stages was relaxation and escape. However different life stages are seeking different experiences. Unconstrained adults place greater emphasis on fun and exploring new destinations, couples on food and drink, families with pre-school children a place the kids will enjoy.

Reconnecting with nature and historical and cultural activities are in high demand as people seek variety. In terms of comfortability in engaging in activities, outdoor activities reported higher levels of comfortability compared to indoor activities.

The State of the Restaurant Industry

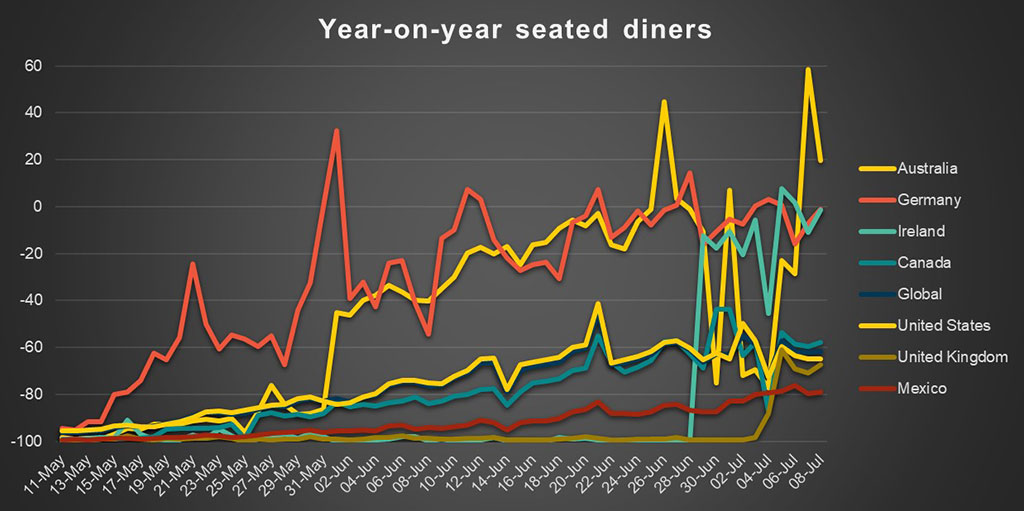

The COVID-19 pandemic has forced restaurants to limit and change operations. OpenTable, the international online restaurant reservation service company has evaluated the overall impact of COVID-19 on the industry by showing year-on-year seated diners at a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. The chart below shows movement as countries begin the reopening process. Ireland has witnessed a sharp increase in restaurant activity following the introduction of phase 3 on June 29 to reach near parity year-on-year with Germany.

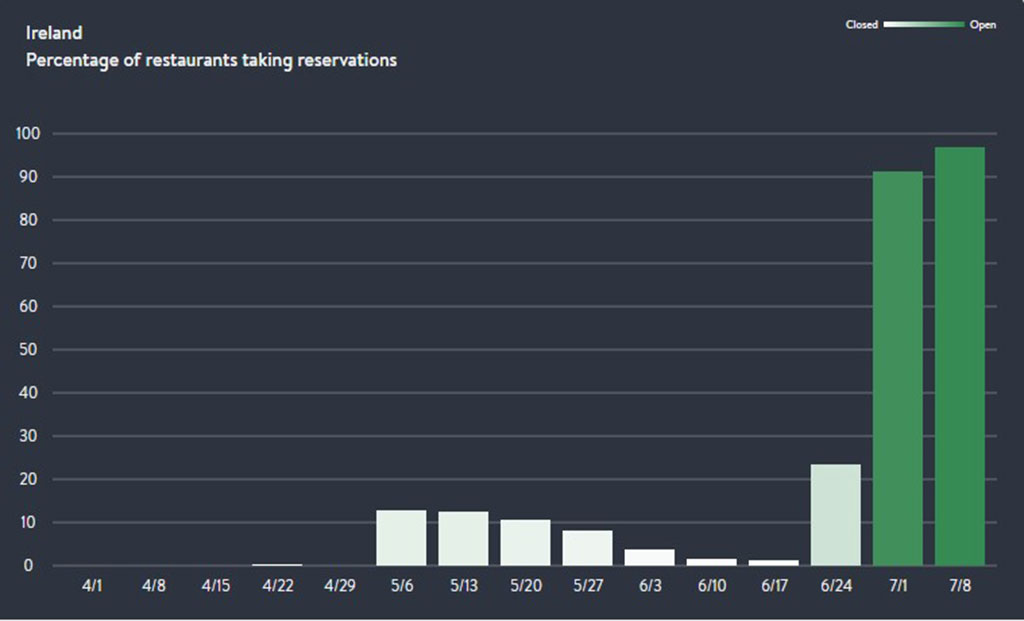

Among OpenTable’s Irish restaurants in their dataset, close to 98% are now accepting reservations.

Sentiment/Insight

The Moments of Truth

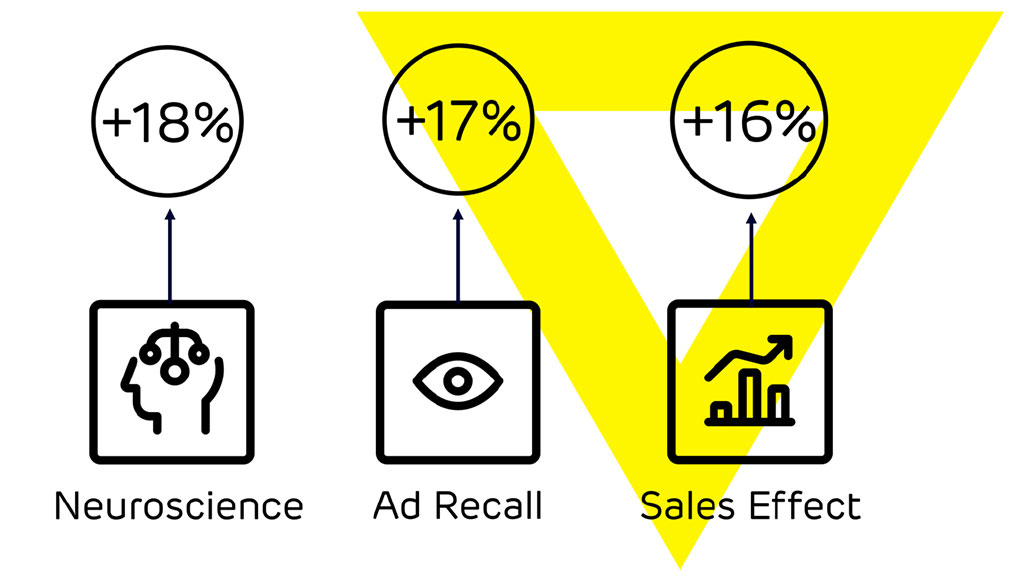

This week we launched The Moments of Truth research study in Ireland, a collaborative piece of research conducted in the UK by our colleagues in Posterscope, along with Clear Channel and JCDecaux. The study was designed to inform and educate the marketing industry on how dynamic Digital OOH (DOOH) maximises DOOH performance and consumer response. The Moments of Truth is a combination of three different research techniques, which collectively provided not only an academic understanding of contextually relevant messaging in DOOH, but also offer an understanding of how these academic insights present as real-world actions. The three research techniques undertaken were:

Stage 1 – Neuroscience:

To measure brain response to contextually relevant DOOH messages.

Stage 2 – Ad Recall:

Eye-tracking research to measure DOOH fixations, advertising recall and creative rating.

Stage 3 – Sales Effect:

Test and control sales uplift studies to understand the direct sales response.

Topline Findings

Key findings from this pioneering study reveal that consumer brain response is 18% higher when viewing relevant content in digital Out of Home campaigns, which in turn leads to a 17% increase in consumers’ spontaneous advertising recall. And ultimately it demonstrates that dynamic digital Out of Home campaigns can deliver a 16% sales uplift.

When combined, these findings give an overall campaign effectiveness uplift of +17%.

We now have a far better understanding of how and why relevance is a key component of OOH effectiveness that can both build brand equity and drive brand actions. This provides significant opportunities to optimise performance. In a Now, Near and Next when context and relevance in advertising will be more important than ever, this study provides a compelling case for OOH.

For a full presentation on The Moments of Truth, please contact your PML Group contact or drop us a note to info@pmlgroup.ie