James Byrne, Marketing Manager, PML Group, with this week’s take from the world of Out of Home.

Data Led Planning

The fundamental principle of the OOH medium is its ability to engage audiences in the right location, at the right time and with the right message. Location and site selection are crucial to our planning strategies and in a recovering marketplace are even more imperative.

Using the data points collected in our Now, Near, Next series along with our bespoke planning tools such as Pinpoint and Locomizer, we can identify OOH hotspots to help brands take advantage of available audiences and provide the best return on investment by select sites, locations and environments that deliver the highest impact.

Overlaying data with the relevant ‘go-to’ retail and leisure location points of interest allows us to identify where audiences are, when they are out of home, and when they can be reached. As lockdowns fluctuate and change, often by county now, we can provide accurate insights and data into audiences to deliver the right message to the right people, at the right time.

In this week’s Now, Near, Next we cover the latest mobility data, showing Limerick’s on par with 2019, and the usual mix of news from the leisure and retail sectors with city centre footfall figures suggesting a steady recovery.

Mobility

BusConnects will see services increase by 23%

Starting this week with a look to the ‘Next’ and news of the finalised redesign of Dublin’s bus network. The Irish Times reports that ‘a new bus network for Dublin, which will result in the first complete overhaul of the capital’s bus services with changes to all existing routes, will be implemented from next year.’ The redesign is part of the NTA’s BusConnects programme and will result in the creation of 230km of dedicated bus lanes and 200km of cycle tracks.

Overall, the level of bus services in the Dublin network will increase by 23% as a result of the new network, according to the NTA.

The network aims to create a more coherent service for the capital that will eliminate overlapping routes and improve journey times. A map of the new network is available at busconnects.ie.

Dublin in Motion

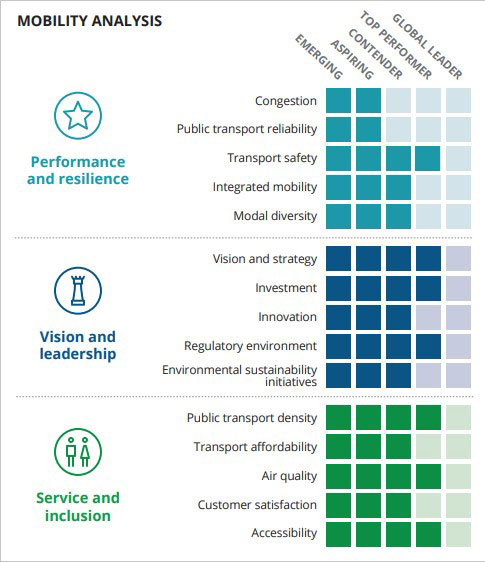

Deloitte City Mobility Index 2020 looks into the quality of urban mobility in 36 cities across the globe. The research spanned the two years from March 2018 to March 2020, and hence was mostly before the impact of COVID-19 lockdowns on cities and transport around the world. The index offers rankings and comparisons based on three major criteria.

Here is how Dublin performs:

The report concludes; “Dublin has improved its challenged transport system, focusing on efficiency gains by integrating the various transport modes. As the city population grows, supply will need to expand further into the commuter belt. A number of transport plans address this through investments in network expansion of buses and trains, improvements in ticketing, and an increase in the cycling infrastructure. However, the biggest share of transport budgets goes into roads – just 20 per cent goes to trains, buses, trams and cycling infrastructure. The government wants to encourage a shift from private vehicle use, and experience to date suggests that Dubliners are keen to get out of their cars and into other modes of transport – they just need the supply to match their (latent) demand.”

Here and Now

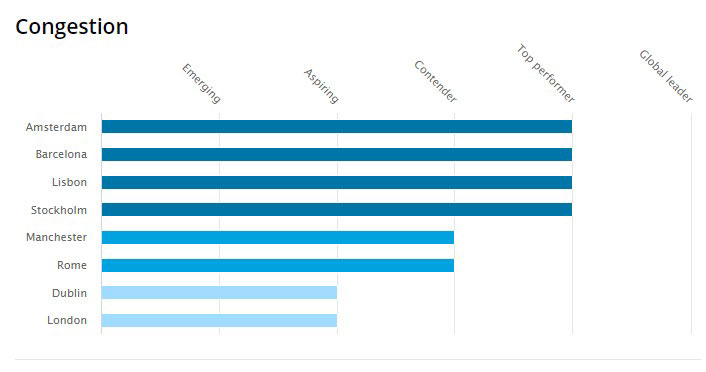

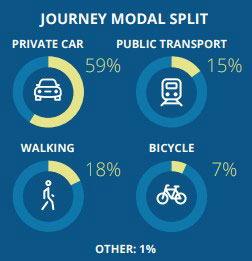

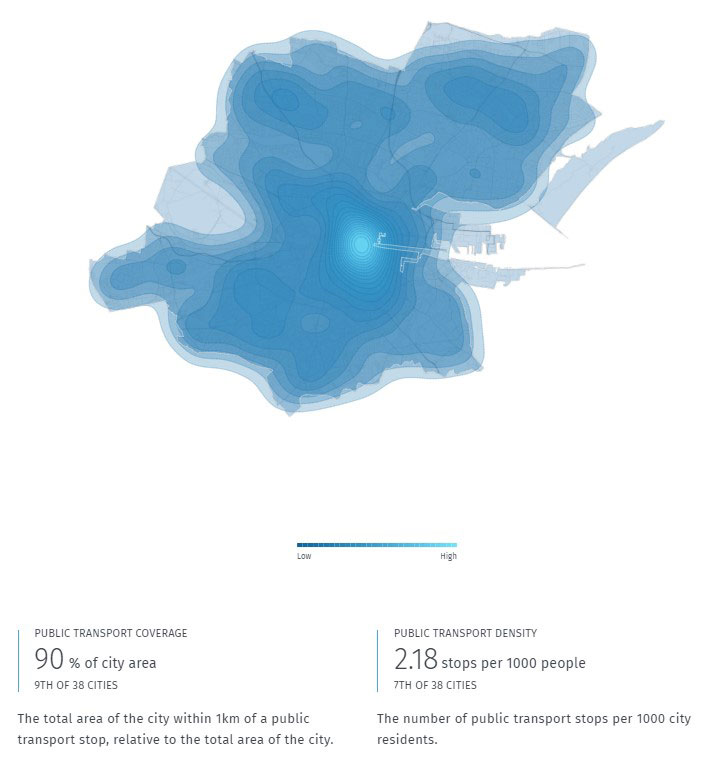

The Here Urban Mobility index assesses the mobility of more than 35 leading cities to build a picture of how they are enabling rapidly changing urban mobility environments. This is how Dublin performs on key metrics:

In terms of traffic congestion, Dublin ranks a lowly 33rd of 28 cities in terms of time delay at 52 mins per 100km, and 35th for percentage of roads congested at peak times (18.5%).

The picture is better in terms of public transport coverage and density:

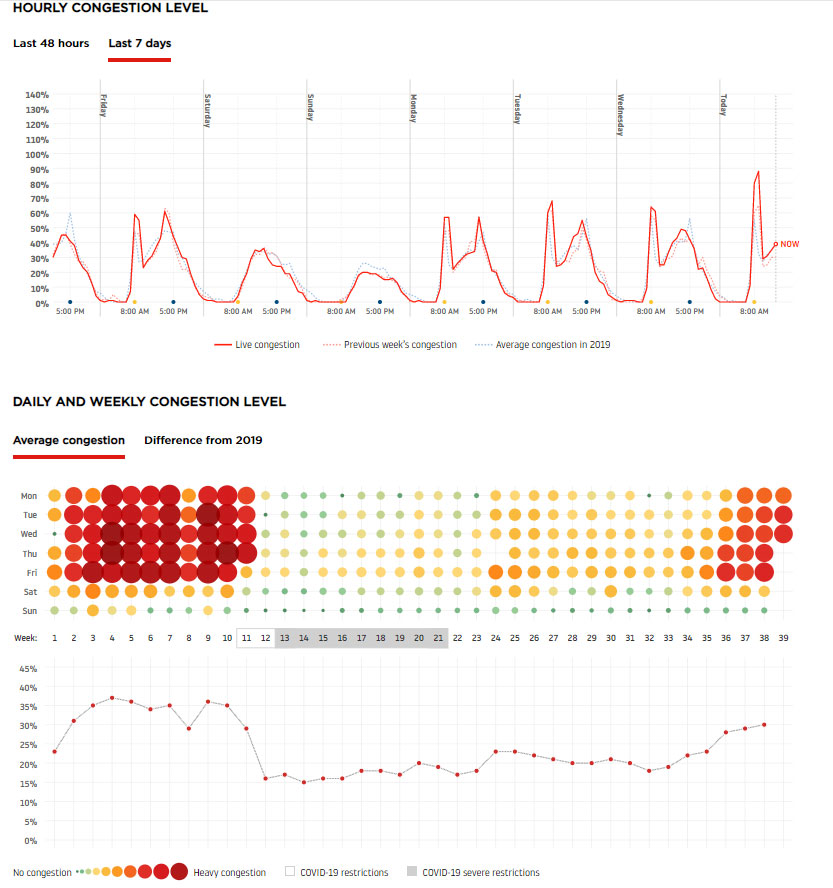

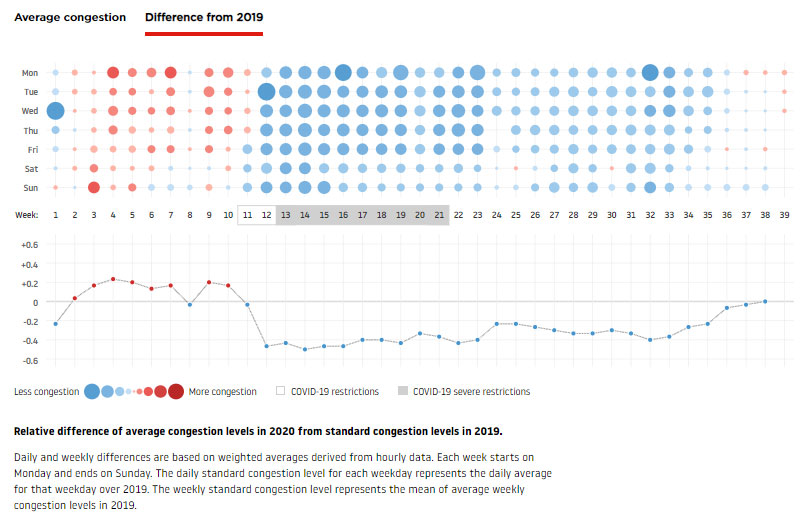

Traffic in the Treaty County – Focus on Limerick

Traffic in Limerick has recovered best of Irish cities and is now on a par with last year’s levels. The TomTom Traffic Index provides detailed insights on live and historic road congestion levels in cities around the world. Last week’s congestion level in Limerick at 30% is the highest recorded since the outbreak of the pandemic and up from 22% four weeks previous. Figures so far this week show a rise of 2% and moving above last year’s level. Rush hour also very much back as illustrated below.

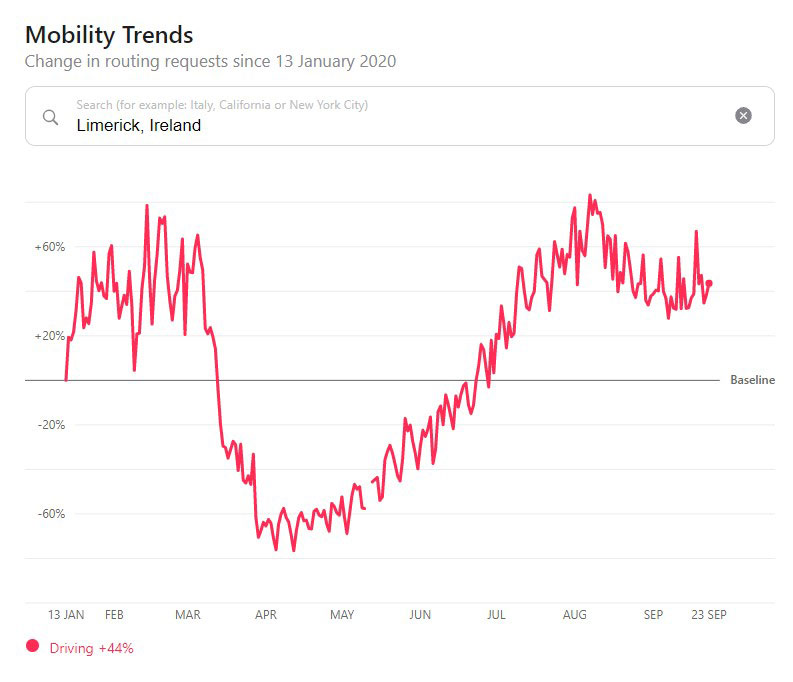

Apple’s routing requests mobility data on Wednesday 23rd September August shows driving in the county is +44% above January’s baseline.

Retail

Path to Purchase

Supermarket shoppers have started to return to more normal habits following the extraordinary spending seen during the height of the pandemic.

Take-home grocery sales in Ireland slowed to 13.7% year on year during the 12 weeks to September 6th, the latest Kantar figures reveal.

While grocery sales still remain higher than pre-pandemic level, compared to April and May, shopping patterns are much closer to normal. The research suggests people are visiting grocery stores more frequently than they were in June with an average of 19 shopping trips over the course of the past 4 weeks. With this increase in frequency, OOH in the retail environment can strengthen brand awareness and message frequency with audiences exposed to retail formats more often. Where frequency is high, advertisers can deliver multiple messages to create impact on consumers at the right time.

Looking at the latest four-week period of sales, an extra €19million was spent on groceries coinciding with a number of local lockdowns with people in certain parts of the country spending more.

In the last 12-week period, Dublin had the strongest growth in Ireland with an additional €141 million spent on groceries compared to last year. Branded goods continue to outstrip private sales by 18% equating to an extra €205 million spend year on year.

SuperValu is still holding firm with the highest grocery retail market share at 22.1%.

Dunnes Stores now holds the second highest market share (21.3%) inching ahead of Tesco (21%). The research concluded Dunnes benefitted from the back to school trend as households with children increased their spend by 9% in store and the retailer performed the best in sales of school necessities such as packed lunch items.

Lidl was top of the table in terms of overall growth rate, growing by 21.2% year on year to boost its sales by €63.3 million. Aldi holds a 12.6% share of the market this period, with growth driven by an increase in volume per trip and higher average prices.

Cheers to the Fastest Growing FMCG Category

According to new figures released by Nielsen, alcohol was the highest-growing FMCG category in the four weeks up to the 30th of August. Sales were up 37% on the same period last year.

In other alcohol news, the Department of Finance’s Tax Strategy Group papers show that people consumed more alcohol in the seven months to the end of July than in the same period in 2019 despite the pubs being shut. In Q2, wine volumes showed an increase of 10% year on year, the paper reports.

With off-trade sales buoyant, a new DOOH network has been established in the off-license section of SuperValu. Media Owner Magmal has launched its Instore Connector network that is currently in 23 SuperValu stores. There are 3 screens per store and averages 150 impacts per hour.

Leisure

Outdoors is the New Indoors

With the new indoor dining restrictions in the capital, the Dublin Chamber of Commerce is calling for pedestrianisation trials to continue in the city centre.

According to a DCC online survey of 1,588 people, 96% were in favour of keeping the area around Grafton Street pedestrianised permanently. While many businesses and restaurants noted an increase in footfall during the trial period at the end of August.

This week, DCC announced new measures to increase its support for businesses. They said, “In relation to restaurants, cafés and pubs that serve food seeking to utilise the public footpath, designated car parking spaces, and other areas of the public domain under the control of the City Council, requests will be accommodated for the duration of level three restrictions.”

DCC’s latest COVID-19 mobility measure update shows footfall figures in the area between Grafton Street and Henry Street are recovering steadily. Footfall figures in this core area were at 60% of pre-COVID levels at the beginning of September. Henry street is seeing higher footfall figures than that south of the Liffey.

While it will be interesting to see how the new restrictions will affect city centre footfall, an abundance of articles has promoted the idea of a ‘daycation’ and are highlighting venues that are open for outdoor dining and takeaway.

Publin.ie released a list of venues that are open for outdoor dining with 49 venues across Dublin on the list so far. Anecdotally, venues in Dublin have shown their resilience as they adapt to the new restrictions with many creating outdoor dining spaces to continue operations.

Hotel booking trends in August

Net Affinity, the hotels booking engine technology company has released its latest booking trends report.

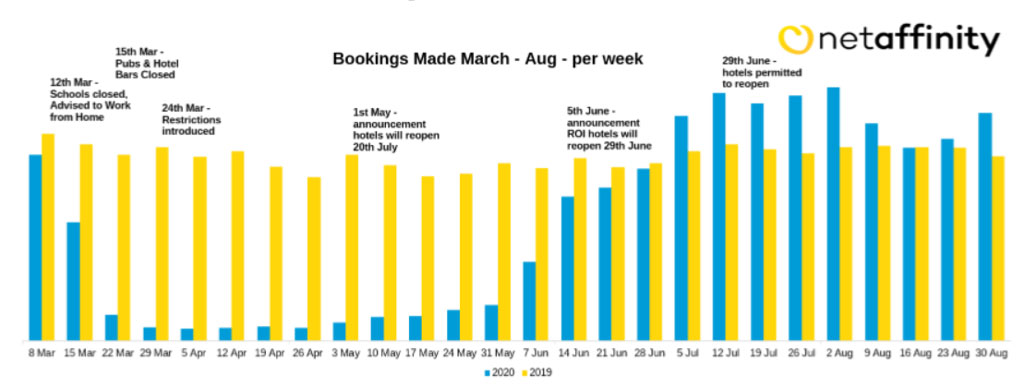

This graph highlights the impact on the volume of bookings made for all Net Affinity clients from March 1st to August 31st. It shows the volume of bookings missed during the lock down period compared with 2019.

Interestingly, it also shows how this summer has seen higher levels of bookings than last year. Unfortunately, this of course doesn’t make up for the business that was lost earlier in the year.

As you can see, bookings pick up on the June 5th, as soon as the announcement about the earlier than expected reopening of hotels (June 29th). Bookings kept going up as we got closer to the reopening date, and they continued going on strong throughout July, for arrivals in July and August.

Then, bookings that were made since mid-August saw a much narrower gap with last year than earlier in the month. Expectations are that this will probably drop significantly what with the kids being back at school, no corporate travel and the over 55s not travelling – not to mention the unsettling increase in cases of Covid-19 across the country.

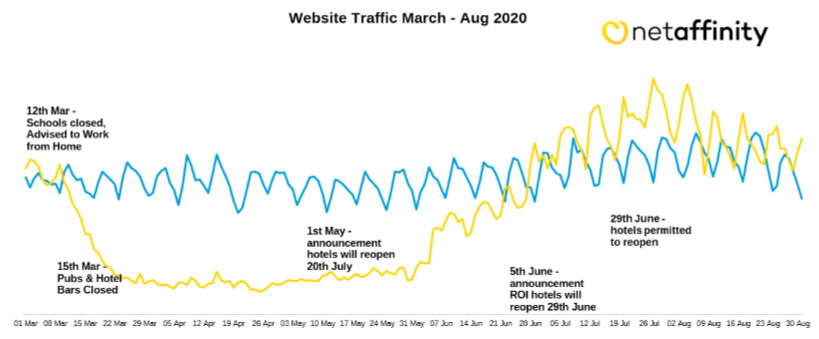

The graph above shows the level of traffic to Net Affinity clients during the same time period and it indicates the same impact on hotel website visitors.

An increase was seen since June 5th, with it beginning to surpass last year at the end of June and maintaining until the end of July. August traffic has dropped, similar to what is witnessed with the bookings. The fluctuations between midweek and weekend are very visible here and are reflective of normal user behaviour trends. Overall, bookings made by ROI guests were up 24%, UK guests (inc NI) down 13% and US bookers were down 89%.

Looking ahead, it looks like resort properties are the main beneficiaries of bookings once again, whereas city properties continue to experience lower booking volumes and occupancy. Properties that are seeing a higher number of bookings are outside of the bigger cities, where people can be outdoors – this has been a huge trend over the summer

Insights / Sentiment

The Near and Next Intentions of the Dublin Population

As part of our Now, Near, Next thought leadership series, we have continually carried out bespoke research to investigate the views and opinions of the Dublin population to help our clients gain insight into consumers, at a time when consumer behaviour and habits have shifted dramatically and beyond anything we’ve seen before.

In our latest wave of research, we delve into the future intentions of the Dublin population on a range of activities to gauge their intentions for the next 6 months.

This week, we take a look at switching intentions in the coming months.

In the data, we found a quarter of Dubliners intend to switch utility providers in the next 6 months. Males in the AB category are most likely to make an energy/gas switch at nearly half (42%).

Myinsightsontime released correlating research which shows only 12% of parents have never switched energy providers while 17% switch annually. Over two thirds of parents state the number one reason they stay with their current provider is value for money.

Slightly higher intentions were found for switching broadband and phone providers. Nearly a third intend to switch their broadband provider in the coming months with the highest intention level found in 35-44-year olds.

Entering into the winter months and with the New Year on the horizon, consideration for switching providers will be higher and consumer attention will increasingly turn to investigating offers.

Utility and Telecom companies are strong OOH investors and use the medium to great effect. Being a trusted and one-to-many medium, such providers can market to large audiences in a relatively short period of time.

Communicating on price, speed, and with sustainability of such high importance now, providers can increase consideration, influence switcher decisions and ultimately gain competitive advantage.

However, in a packed media landscape, advertisers can deliver smarter advertising solutions by embracing the full creative capability of digital and dynamic OOH. Advertisers can increase the relevance of campaigns with the use of dynamic triggers that are associated with their line of business such as real time weather data.

Green Nation

iReach has surveyed adults in Ireland to determine their views on this matter and the impact that COVID-19 has had on the environment. Findings include:

- Over 1 in 4 (27%) agree that it is more difficult to be environmentally conscious during the COVID-19 pandemic.

- 41% agree that the COVID-19 pandemic has made them more aware of environmental issues

- 35% agree that they have become more concerned about environmental issues since COVID-19.

- 36% agree they have had to prioritise other things over positive environmental actions since the COVID-19 pandemic began.

- 7 in 10 (70%) adults have made a conscious effort to support local businesses due to the impact of COVID-19.

The nationwide survey ran between 3rd September and 10th September and received over 1,000 responses.

Commenting on the research, Oisin Byrne iReach MD states “While Covid-19 is the main concern amongst adults in Ireland, attitudes to environmental issues remain important and is in fact is increasing awareness of environmental issues as well as increasing concerns about such issues”.

And Finally…

Twitter’s billboards in the US went viral this week as they launched a new campaign to encourage people to wear facemasks.

In the light-hearted campaign, the social media platform found witty, eye-catching tweets about wearing masks and turned them into Outdoor ads. The campaign showcases tweets such as “Best thing about these masks is I can sing along to my music without looking like a weirdo,” and, “Why do I feel like everyone’s giving me Resting Mask Face?”

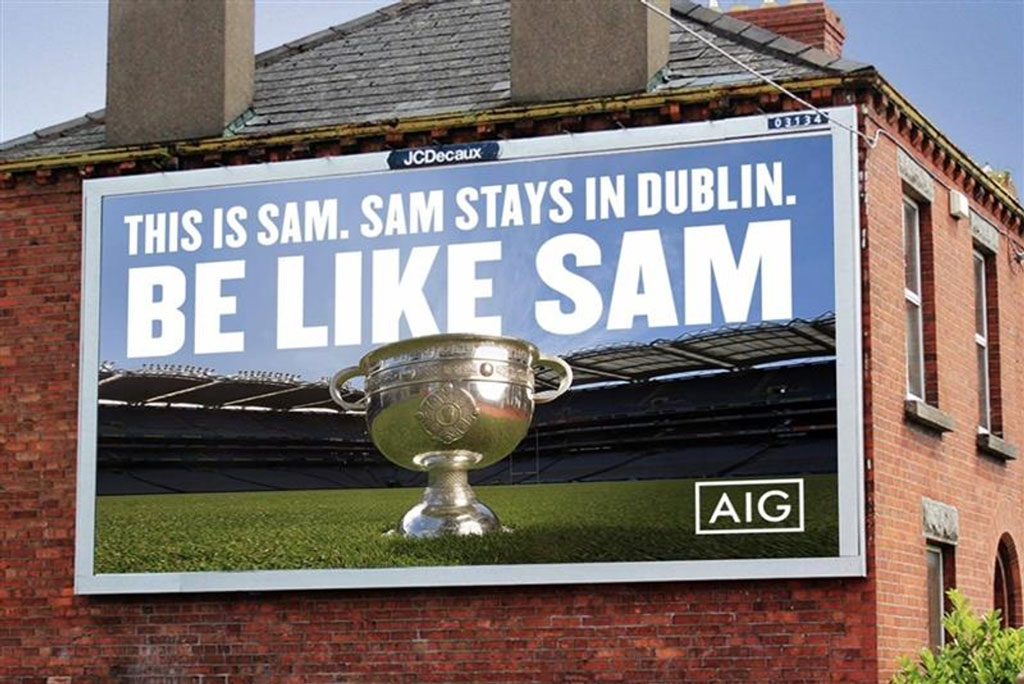

Closer to home, a spoof billboard popped up on Twitter which gained significant traction, showing how even mockups can garner social currency.

By creating share-worthy content and making it relevant and relatable to consumers, both examples demonstrate how OOH and social media can have a symbiotic relationship. Both visual mediums that have shareability, these campaigns highlight OOH’s power to drive engagement and conversation online and connect with audiences on both channels.