Colum Harmon, marketing director, PML Group with this week’s view from OOH.

H-OOH, H-OOH, H-OOH!

2020 has been a year like no other for the OOH sector. A series of lockdowns, phases and levels that altered audience movement and behaviours presented a challenging year for OOH, and society as a whole.

At PML Group we rose to this challenge. Combining our expertise with bespoke insight and third-party research, that we have continually shared via this Now Near Next series, we were able to deliver the best return on investment for advertisers at every turn.

Throughout the pandemic, OOH has been an effective mechanism to communicate with audiences – whether transmitting public health and safety advice, messages of togetherness and support, or serving advertising to audiences in key environments and at a local level.

Looking ahead to 2021, we can be optimistic with plans for the vaccine rollout revealed and a likelihood that we will see a return to normal life in the coming months. According to MAGNA’s adspend forecast for 2021, OOH is expected to register one of the biggest increases in investment next year.

With the likelihood that we will see continued restrictions in the new year, our experience and acquired knowledge tells us that people will still be out and about during times of restrictions, enjoying their local neighbourhood, socialising, doing the school run, exercising and venturing to retail environments.

OOH will remain a relevant choice in 2021 and will be an effective way to build brands and engage. Audiences are more receptive to OOH messaging than ever before as we are more alert and aware of our surroundings and therefore tending to pay even more attention to the messages surrounding us.

In this final Now Near Next of the year, we look at the latest trends in mobility and retail. We also highlight some key trends and insights from WARC’s marketer’s toolkit for 2021 as we look to the year ahead.

Mobility

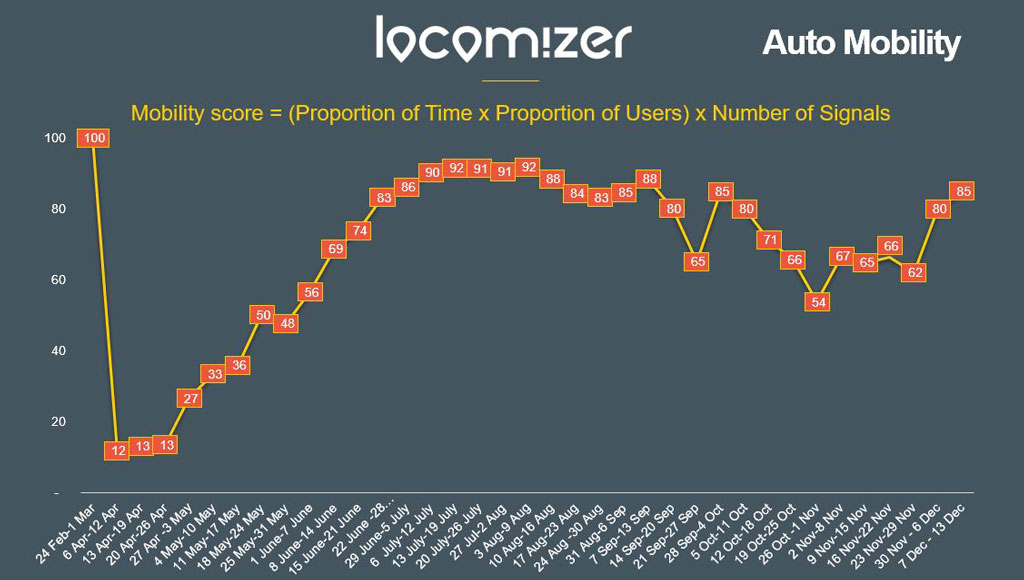

ROI Auto Mobility at 85% of Pre-Covid

Locomizer mobility data is based on analysis of mobile phone location data via anonymised app reporting. Latest figures (w/e 13th December) show that the auto mobility level in ROI, which is calculated though a combination of mobile users, time, and signals, is at 85% of where it was pre-COVID-19 recorded at the end of February.

This is the highest average weekly figure since it reached 88% in early September and has jumped from 62% in the past two weeks.

The chart below shows the weekly mobility index from the start of March to date, highlighting the peaks and troughs of auto mobility throughout the period of the pandemic to date.

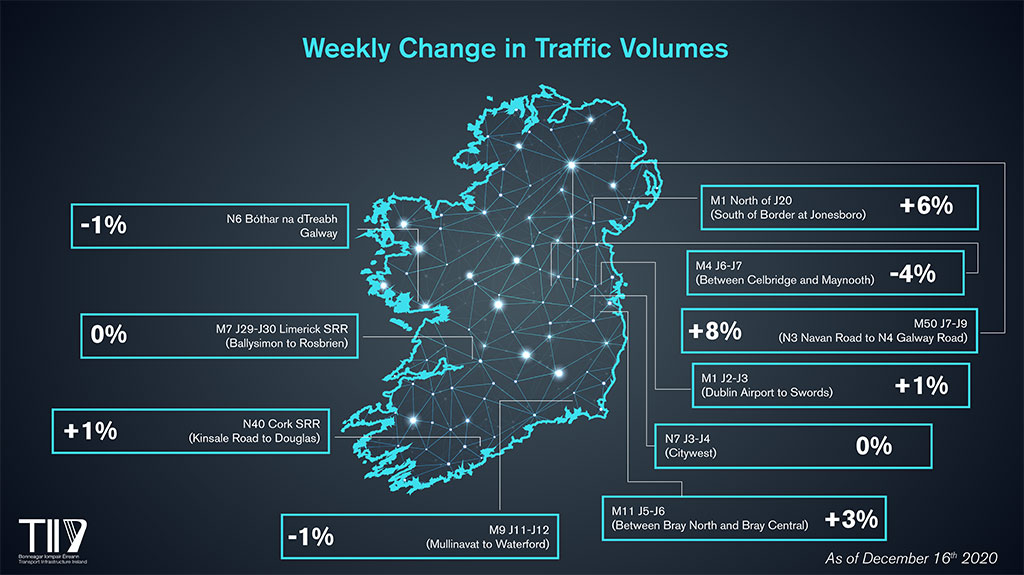

National Road Traffic Increases by 2% in past week

TII’s latest traffic trend information is generated from a sample of ten traffic counters located on the national road network. Traffic figures are measured from 7am-10am each day.

An increase of 2% overall in volumes was reported on Wednesday 16th December, compared to the same day previous week and stand at 82% of the same day last year. Overall, across a majority of the traffic counters, volumes that morning were above the levels experienced before the implementation of Level 3 restrictions.

For car traffic volumes on the radial routes into Dublin, comparisons with the same day prior to the start of the Level 3 restrictions on 5th October are as follows: +1% on the M1 at Swords to Airport, +3% on the M11 at Bray, 0% on the M4 at Celbridge-Maynooth and up +1% on the N7 at Citywest.

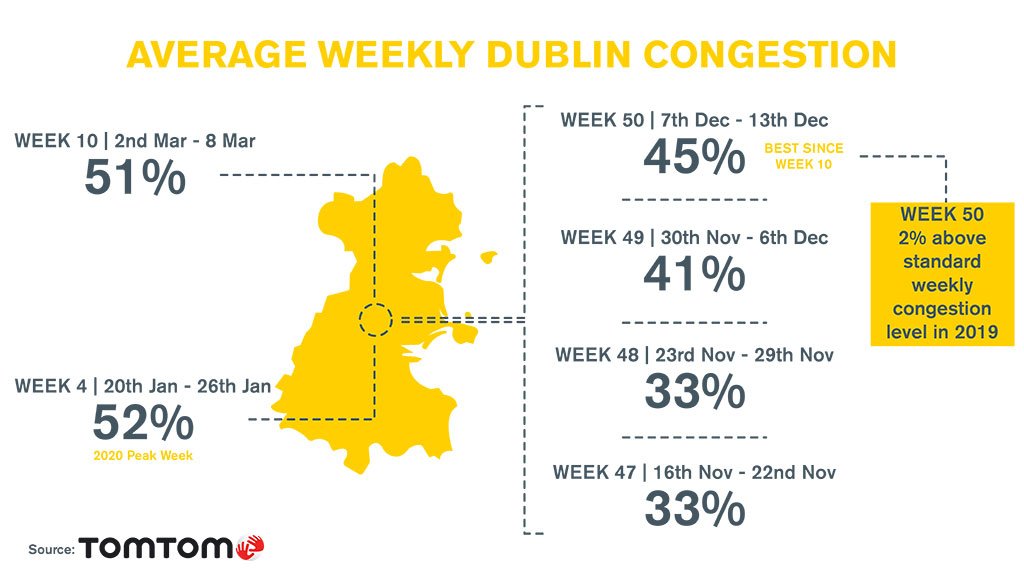

Dublin Congestion Hits Nine Month High

Figures from TomTom continue to show a sharp increase in traffic congestion in Dublin. Just like the week previous, this latest week has seen the largest levels of congestion since March. TomTom measured Dublin congestion levels at 45%. A 45% congestion level means that a 30-minute trip will take 45% more time than it would during Dublin’s baseline uncongested conditions. This compares to a level of 41% the week previous and is the highest since the March figure of 51%. The peak for the entire year was week commencing January 20th, at 52%.

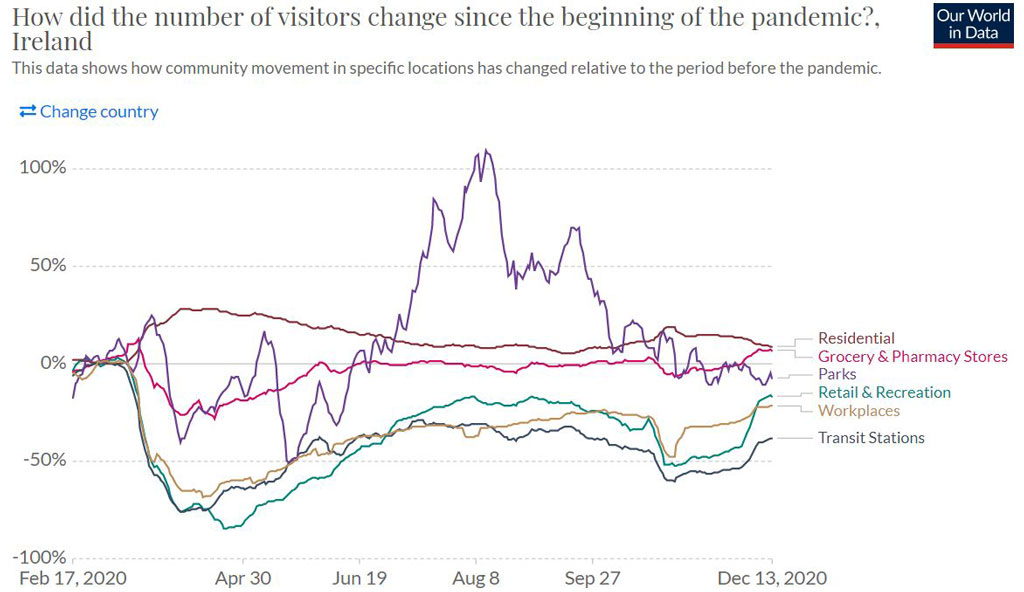

Latest Google Mobility Data

The chart below visualises the latest data from Google’s Covid-19 Mobility Reports. Using anonymized data provided by apps such as Google Maps, the company has produced a regularly updated dataset that shows how peoples’ movements have changed throughout the pandemic.

This dataset measures visitor numbers to specific categories of location (e.g. grocery stores; parks; train stations) every day and compares this change relative to baseline day before the pandemic outbreak. Baseline days represent a normal value for that day of the week, given as median value over the five‑week period from January 3rd to February 6th 2020. Above the baseline are locations such as residences and grocery outlets and while transit stations and workplaces remain below the baseline, they are showing steady increases over recent weeks and months.

Retail

Retail Sales Boost During Lockdown

Kantar has released its monthly analysis of the grocery retail sector which shows take-home grocery sales accelerated 16.4% during the 12-week period ending 29th November 2020.

As Ireland went into a second lockdown, shoppers spent over €1 billion on groceries in November, the busiest month since the height of the previous lockdown in June. An additional €164 million was spent when compared to last year.

With the countdown to Christmas underway, baskets were filled with noticeably festive items – alcohol sales were boosted by 33% while €82,000 was spent on mince pies and sales of Christmas biscuits soared by €793,000 in November.

Branded products and items proved popular with an additional €85 million spent on household names in the latest four weeks, Kantar reports. Sales of branded products over the latest 12 weeks increased by 18.6% across the market.

Looking to market share all retailers experienced strong growth in the past three months.

Dunnes Stores currently holds the biggest share of the market at 22.1%. Kantar reports that the retailer captured the highest spend per buyer among all the retailers, with shoppers parting with €7.76 more on average per trip when compared to the same timeframe in 2019.

SuperValu saw growth of 18.5% over the past three months benefitting from its local infrastructure. Shoppers picked up an average of 1.5 additional items per trip, the grocer holds the 2nd highest market share at 22%.

Tesco also saw trolleys expand with an additional 3.5 extra products picked up by shoppers which helped the retailer achieve 17% growth and 21.5% of the market share.

Lidl witnessed the strongest growth at 24.4% to hold a market share of 12.5%.

City Centre Experienced Busiest Weekend Since March

As Level 5 restrictions lifted in the 1st week of December, Dublin city centre experienced its busiest weekend since March.

The figures released by the Dept. of the Taoiseach revealed the night of Saturday 5th Dec was 80% busier than the previous Saturday. The busiest time over the weekend was between 2pm and 3pm.

The data collected from the 1st weekend after the reopening recorded a 40% increase in traffic volumes surrounding some of Dublin’s biggest shopping centres.

Senior civil servant Liz Canavan, of the Department of the Taoiseach said; “There are no surprises in these increases of people moving around, and nothing we didn’t expect in terms of pent up demand. But it is important to emphasise that compliance within businesses was very good, and everyone is doing their very best to keep us safe,”

Retail Excellence is expecting another busy weekend ahead, with the number of shoppers set to increase as travel limits are lifted. The organisation said destination shopping areas such as Dundrum Town Centre will see further increases in trade as a result.

Sentiment

WARC’s Toolkit Looks Ahead to 2021

WARC has published its annual Marketer’s Toolkit for 2021, a guide to the trends and challenges of the coming year. Carrying out a survey on a range of topics and featuring third party research from throughout the year, we have outlined some key points from the report for the year ahead.

62% of the toolkit respondents are optimistic about the year ahead and expect 2021 to be better than this year. While marketing budgets will remain lower than pre-pandemic times, nearly six in ten anticipate some budgetary improvements next year. WARC points to opportunities for brands to maintain investment in brand building. For those who can, brands that increase marketing budget during times of uncertainty recover considerable faster as consumer confidence returns. WARC outlines how brands in a position of strength will have an unprecedented opportunity for share of market growth.

Value Driven

In 2021 consumers will be driven and focused on getting the greatest possible value – in terms of efficacy, quality and reliability.

Asking respondents to the toolkit survey what areas their brand is adopting to respond to this desire for value; marketers will be focusing ad spend on specific product lines (33%), running price promotions and sales (30%) and reducing product portfolio (21%). Four in ten say they are developing new products to cater for post-pandemic consumer preferences.

New Consumer Habits

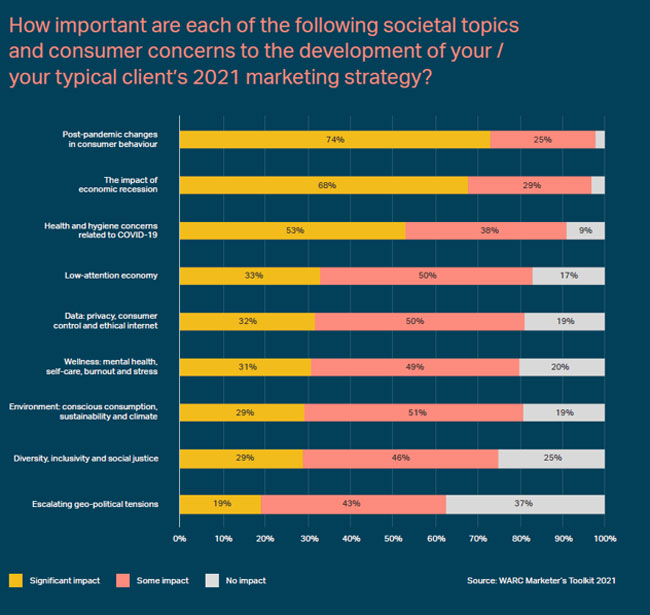

The report also outlines how marketers will be focusing on new consumers habits. Three quarters of the brands and agencies surveyed said post-pandemic behaviour is having a significant impact on strategy for 2021. The shift to increased time at home (52%), demand for greater value (36%) and re-evaluation of lifestyle choices (32%) as well as a focus on health and hygiene (29%) are just some of the factors that marketers are assessing when looking to 2021.

Local is a Key Consideration

A decline in travel and leisure spend is a concern for marketers; 32% said consumer cutbacks in this type of spending was having an impact on the planning. As a result, the toolkit looks at how local areas will be a key consideration for marketers in 2021.

Consumers have a newfound awareness of their local communities and areas. The report references location and Posterscope’s ‘Mobility Mindset’ research that showed 65% of UK consumers are paying more attention to what is going on in their local areas since the pandemic and are placing value on the outdoor space around them.

And as they look to their local communities, many consumers feel a need to support them. Research from McKinney showed that 63% of consumers said they were trying to shop locally to support small businesses.

Marketers Revisit Brand purpose

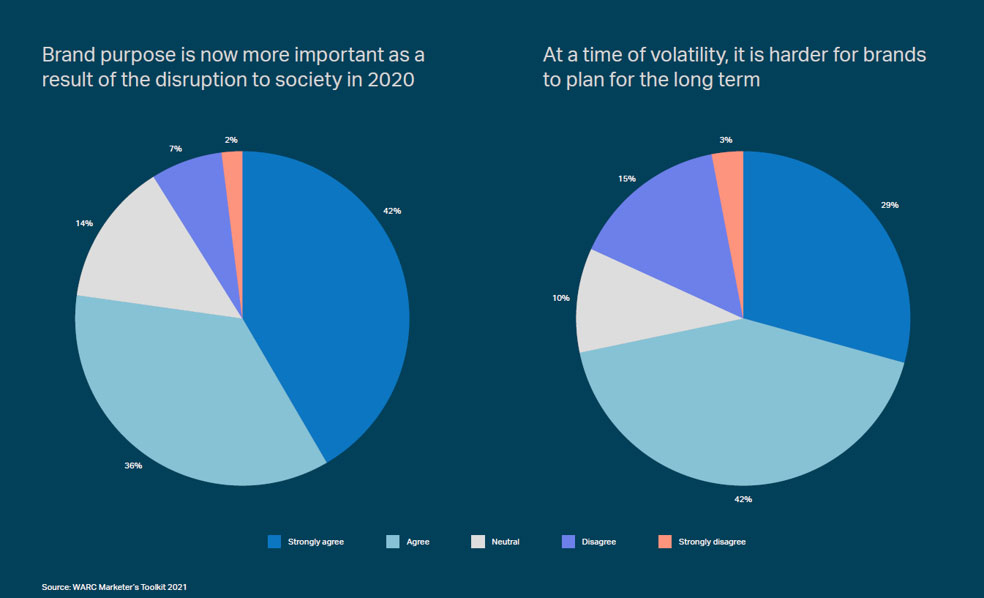

The upheaval of 2020 has seen brand purpose gain new relevance in the marketing industry. More than three-quarters (78%) of respondents to WARC’s Marketer’s Toolkit survey believe that purpose is now more important.

Health and Hygiene

The toolkit survey revealed that health and hygiene concerns will have an impact on marketing plans in 2021 (74%). A Euromonitor survey reports that 90% of global consumers agree the COVID-19 has made people more aware of the importance of immunity. While another research study showed three quarters of consumers are trying to eat healthier as a result.

The pandemic has made health and hygiene a necessity for everyone with WARC emphasising the point that brands have a role to play in supporting healthy lifestyles and wellbeing.

And Finally…..

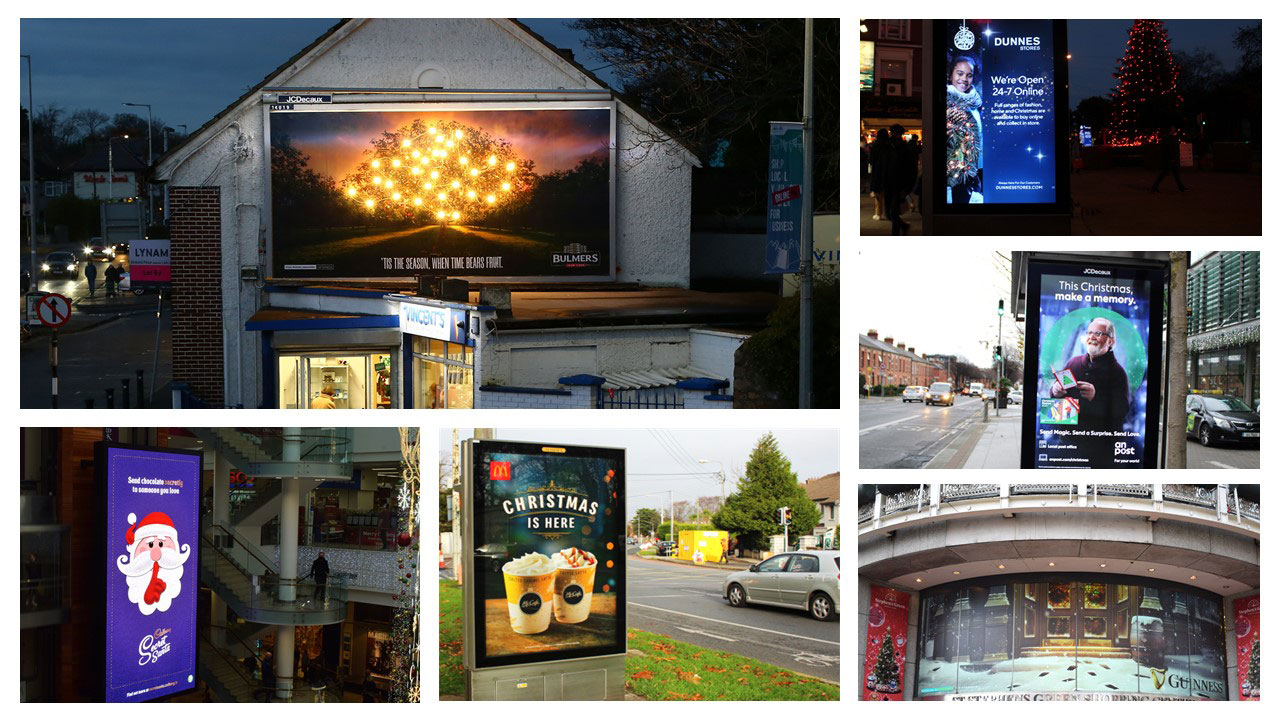

Isn’t it nice (and kind of comforting) to see some good old-fashioned Christmas advertising across media this month? Advertising can be emotive, nostalgic and offer a sense of normality after such an abnormal year. Great Irish and international brands such as Guinness, An Post, Cadbury and Dunnes Stores feature on OOH at the moment and we love it!

A very Merry Christmas to you all.