Colum Harmon, marketing director PML Group, with this week’s view from OOH.

Colum Harmon, marketing director PML Group, with this week’s view from OOH.

Stepping Out – Retail

Understanding audience behaviour is the cornerstone of how we manage our clients’ Out of Home marketing objectives at PML Group. As location marketing specialists, insights into where people live, work, and play form the basis of choice we make regarding environments and formats. For many years pre-Covid, throughout the period of this pandemic and into a post-pandemic future, we continue to invest in research and data to inform our planning and to make great OOH marketing campaigns.

This week we publish the first of two parts of the most recent piece of such research – the latest wave of Stepping Out. Today, we focus on frequency of visits to various retail settings and next week we will focus on recreational environments.

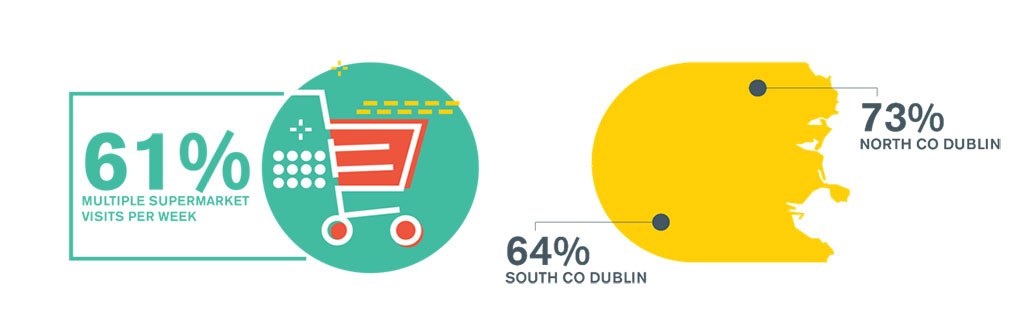

Supermarkets have been an oasis of activity over the course of the past eighteen months and the research, conducted among 300 Dubliners, shows that six in ten are visiting a supermarket more than once a week. Among 35-44s, this increases to 70%. The gender breakdown is 65% females and 57% males. Those living in North Co. Dublin are the highest frequency supermarket customers, with 73% there more than once a week.

The High Street is of course fully reopened again, and the study indicates considerable support for retailers in these environments among the Dublin public. 39% are visiting the high street once a week or more. There is no significant gender difference but the outstanding age cohort in this regard is 25–34-year-olds, at 45%.

I’m sure any readers who’ve visited a retail park recently are aware of the massive volumes of people they attract throughout the week, and particularly at weekends. Almost one in three respondents are visiting these locations at least once a week. 25-34s are the most frequent visitors, at 35% and there’s quite a gender gap here with 34% of males visiting a retail park once a week or more, compared to 23% of females.

Pharmacies are receiving visits from 47% of respondents once a month or more, with females being more frequent visitors (52% v 41% male). Regarding Off-Licences, 28% of Dubliners are purchasing alcohol from these outlets once a week or more. This breaks down as 37% among males and 26% among females. Among age cohorts, highest is 25-34s (37%) and lowest is 18-24s (19%).

With all retail locations mapped and overlaid with proximity OOH panels, this is just one example of how we can translate research data into real world marketing solutions for our clients. More from Stepping Out next week.

Decline in Online Supermarket Spend

The Stepping Out research coincides with the latest release of Kantar’s retail figures. They are reporting a slight decline in online grocery spend during the past 12 weeks, when shoppers spent almost €1m less online, with basket sizes down by 4.4 percent.

According to Emer Healy of Kantar “Online shopping has been one of the most effective barometers of consumer confidence throughout the pandemic – when online orders decline, it shows that people are growing more comfortable to venture to physical shops and eat out again,” Ms Healy said.

SuperValu once again captured the largest share of the grocery market during the period with a 22.6 per cent market share with customers visiting 5.8 per cent more often adding €37 million to the grocer’s sales.

The sector remains ultra-competitive though and according to Ms Healy “During lockdown, shoppers returned to making big weekly shops and became increasingly loyal to one supermarket to feed their families. Now that everything is opening up again, they are happier to mix it up and pop into different shops and Tesco, Dunnes, Aldi and Lidl all saw new faces in store this period as a result,” she said.

Posterwatch – July on OOH

PML Group’s Posterwatch service measures all OOH activity via cyclical monitoring of 100% of OOH advertising panels in the country. In July (cycles 14 and 15), Posterwatch shows Retail was the most active category on the medium. Supermarkets make up the bulk of this activity with SuperValu, Centra and Tesco all prominent.

Musgrave Group were the second most active advertiser in the month, behind Diageo. Guinness, Carlsberg and Rockshore were among the active brands for the drinks company. Cadbury Dairy Milk activity put Mondelez among the top three and the top five was rounded out by Coca Cola and Sky. These brands are all reflective of the top spending categories with Confectionery, Beers & Ciders Soft Drinks and Media all featuring behind Retail.

More detailed Posterwatch category or product breakdowns for more than 25 years are available – feel free to contact us.

Another Special Week

Another week and another array of impressive Outdoor Special Build posters on the streets. Our innovation team has pulled out the stops again on three impactful, attention-grabbing specials.

Glanbia are currently running an Avonmore promotion, giving away sets of bikes for families. A special build poster on Rathgar Road is helping build awareness by incorporating 2D bikes and sun into the 48 Sheet design.

Disney+ are back with more Outdoor specials to promote The Walking Dead series on the streaming platform. 3D zombie hands and lettering spell out the programme title on locations in both the north and south of Dublin city.

Samsung’s new Galaxy Flip and Fold options are appearing on Outdoor formats including buses, digital bridges retail digital screens and a special build on Wexford Street. The 2D approach means the larger phone appears to fold.

And Finally….

This week was the first of cycle 18 and in addition to the special builds mentioned above, numerous impactful new campaigns have hit the streets. Boxing streaming service DAZN are packing a punch with their campaign featuring Katie Taylor. Guinness 0.0 is here and is featuring on large format, 6 Sheets and a variety of digital networks. McDonald’s has launched its Monopoly promotion and RTÉ is all drama across classic and digital OOH.