With the Christmas season upon us, Sophie Hamilton, marketing executive, PML Group looks at the some of the key trends that will have an impact on OOH over the festive season.

Younger People Set for Bigger Christmas Spend

Christmas is on the horizon and this week we publish research on spending intentions in the run up to the holiday. Conducted on our behalf by Ipsos MRBI, the iQ study covered 300 Dublin respondents, aged 16-54.

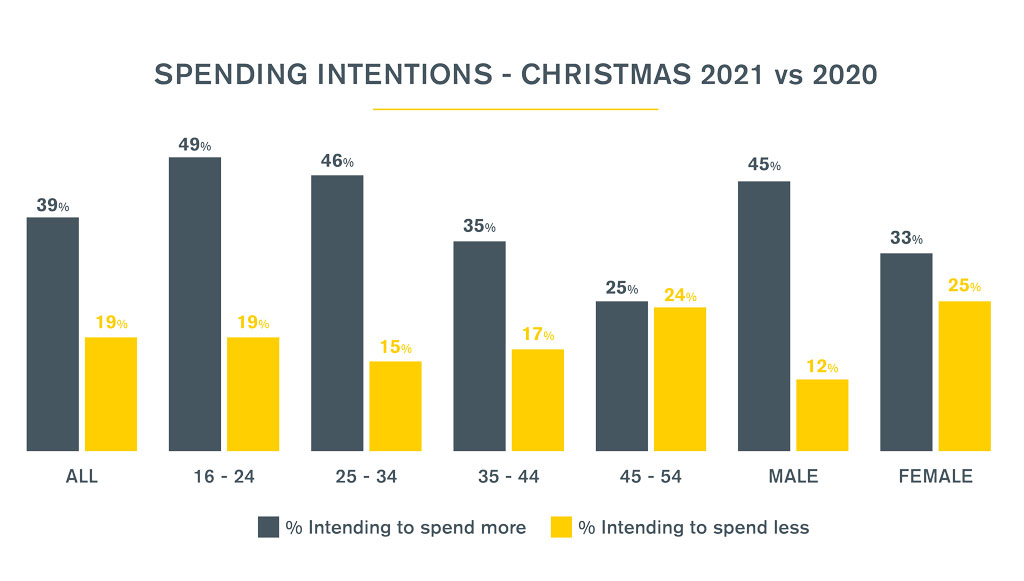

A large majority (81%) intend to spend at least as much as Christmas 2020 with 19% saying they will spend less this year than last. 39% will be increasing their spend on food, drink and presents, rising to 49% among 16-24s and 46% among 25-34s. One in four aged 45+ intend to spend more this year. So, a disparity among age groups, but also between genders. 45% of males are more likely to be spending more this year and 88% spending at least the same amount. For females, the equivalent figures are 33% and 25%. Peak age and gender is 16-24 year old males, at 56%. With regard to social classes, 42% of ABC1s will spend more compared to 33% of C2DEs, perhaps reflective of levels of disposable income.

Among customers of the various supermarket chains, 46% of SuperValu shoppers will be spending more this year, compared to 43% Dunnes Stores, 43% Aldi, 39% Lidl and 31% Tesco.

The most organised among us will have at least some presents ticked off their list at this stage but for the majority, no shopping has been done as yet. In fact, the study suggests that 62% of respondents will buy their presents within 4 weeks of the big day itself. This is even more so the case among 25-34s, with 68% still to do all their shopping in the coming weeks. 3% of respondents must enjoy life on the edge and will leave shopping until a few days for Christmas! So, not too late for brands to have a major influence on consumers in the coming weeks, especially in or around retail environments.

And it is in those physical retail environments where the majority of shopping will still take place. One in three females will be doing less than 25% of their shopping online. Only 8% of all respondents will be doing more than three quarters of their buying online. This rises to 14% among 16-24s but is single digit figures across all other age groups and drops to just 3% among 45+.

Overall the study suggests that people will be spending more this year and they will be spending in physical locations such as the high street and malls. And the good news from brands perspectives is that the majority of shopping has yet to begin. Out of Home can capture these shoppers in the right environment and at the right time….and with the ideal mindset.

Marketers are Underestimating the Power of WOM

Nearly all US consumers (93%) say friends and family are their most trusted source of information when it comes to brands, products and services. Despite being the most impactful channel for new brand information, the latest report from RR Donnelley found that marketers may be selling word-of-mouth short.

Word-of-mouth (WOM) has long been a favourite way for people to learn about new products, as nearly half (46%) say the opinions of their friends and family are very important to their purchase decisions. Most WOM takes place offline, which could make it difficult for marketers to attribute it to sales. Earlier data from Engagement Labs shows that while social media, phone calls and text messages play a small role in WOM, two-thirds of WOM takes place face-to-face, accumulating about 14 billion offline impressions per week in 2020.

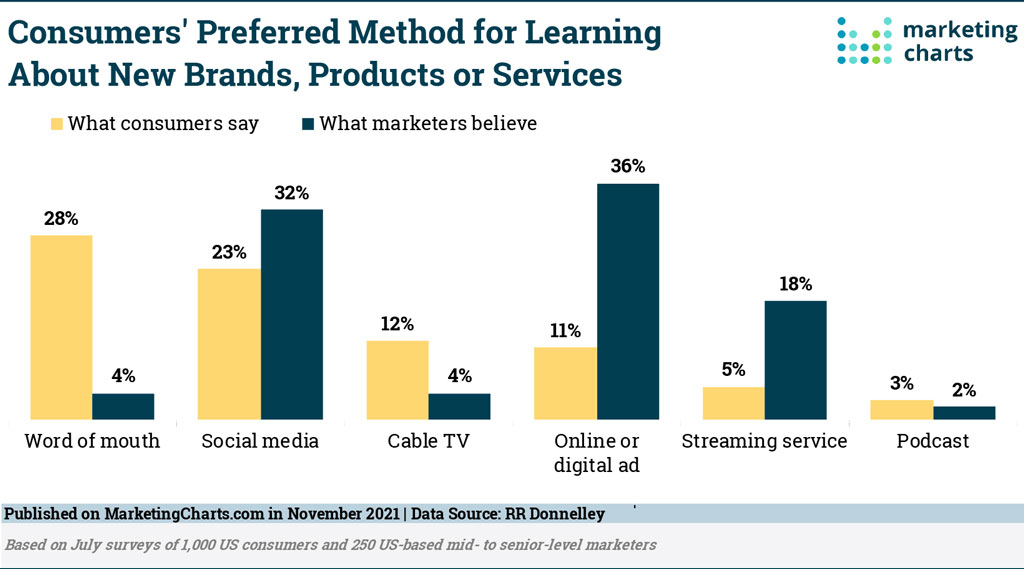

Per RR Donnelley’s surveys of 250 mid- to senior-level marketers and 1,000 US consumers, only 4% of marketers believe WOM is consumers’ preferred method for learning about a new brand, product or service. Instead, they believe consumers prefer to get information via digital or online ads (36% share) or social media (32%).

However, for nearly a third of consumers (28%), word of mouth is the preferred method for learning about a new brand, product or service — outpacing social media (23%), and online/digital ads (11%). At the same time, a mere 4% of marketers identified word of mouth as a consumer preference for learning about new brands, products or services.

Indeed, more than half (55%) of consumers say they have discovered a new brand, product or service via word-of-mouth, while slightly fewer (53%) say they have discovered something new via social media, and 37% say the same about digital and online ads.

Marketers also underestimate WOM when it comes to purchases. While fewer than 1 in 10 (7%) of marketers say WOM is a channel that results in a purchase, WOM has the highest research-to-purchase rate of the channels measured — outpacing social and online ads. Indeed, 4 in 10 say they have purchased a product they learned about via WOM.

While 82% of marketers believe influencers drive consumer purchases, the reality is that just over a quarter (26%) of consumers say that influencers make them more likely to purchase new products or services.

The report concludes that’s it’s time it’s time to redefine and re-engage word of mouth in the real world.

On the Move

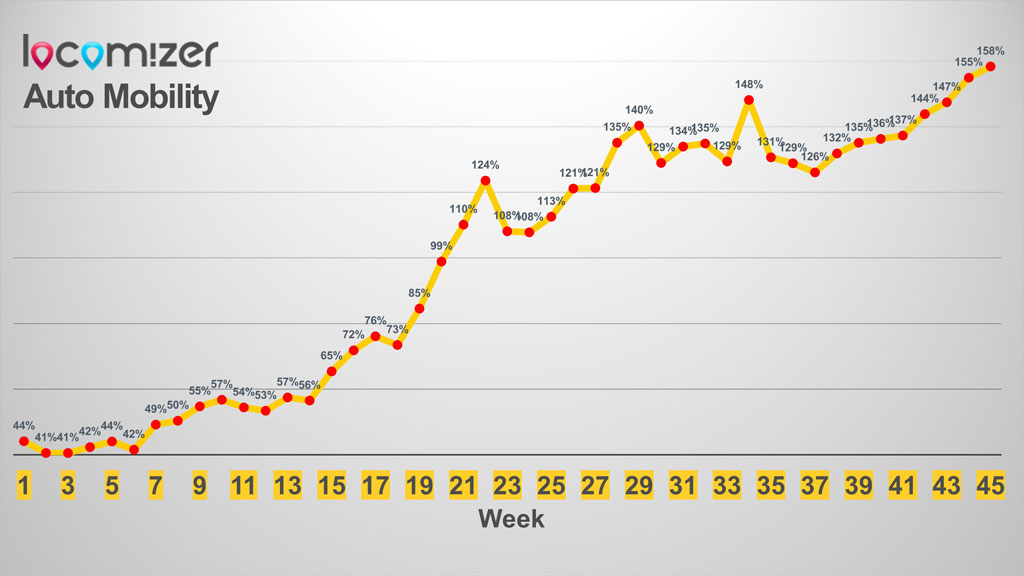

Last week’s national Locomizer mobility data, based on analysis of mobile phone location movements via anonymised app reporting, shows an increase on week previous, to +58% of pre-pandemic levels. This metric was still below baseline in mid-May.

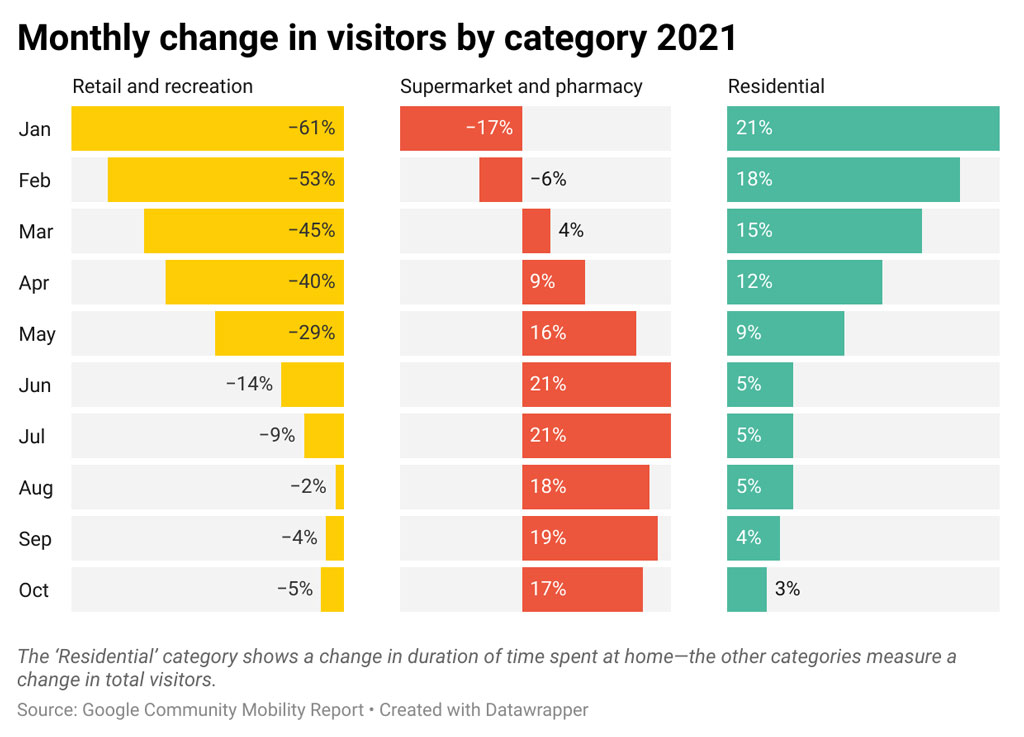

Google Mobility data shows how visitors to (or time spent in) categorised places change compared to baseline days. The baseline day is the median value from the 5 week period Jan 3 – Feb 6, 2020.

Retail and recreation covers mobility trends for places such as restaurants, cafés, shopping centres, museums, libraries and cinemas. From a low of -61% at the start of the year it is close to baseline at -5%.

Visits to supermarkets and pharmacies has flipped from -17% to +17% while conversely time spent in places of residence has declined from +21% in January to just +3% to date this month, indicating that Irish people are increasingly spending more time out of home.