As Easter weekend closes in, an array of brands are once again tapping into the opportunities available to them to generate physical and mental availability for their audiences.

Aaron Poole, marketing executive, PML Group with this week’s Out \ Look on Out of Home.

Eggcellent Easter Campaigns on OOH

The last few months have offered opportunities for brands to leverage Out of Home as an event-based marketing channel. Valentine’s Day and St. Patrick’s Day Outdoor activity have shown brands are acutely aware of OOH as a location medium and its capacity to be hyper-relevant to events happening across the physical and virtual landscape.

As part of our Media Impact Study results, key occasions were noted to be crucial opportunities for brands to influence the buying decisions of consumers. As Easter weekend closes in, an array of brands are once again tapping into the opportunities available to them to generate physical and mental availability for their audiences.

Cadbury Worldwide Hide

Cadbury’s Worldwide Hide campaign returns to once again show that generosity is at the heart of the chocolate brand. The virtual Easter egg hiding experience lets you hide an Easter egg anywhere in the world for someone you love, sharing a personalised clue to help them find it.

Planned by Spark Foundry and PML, the campaign’s Outdoor elements are running across a range of classic and digital formats including Bus Shelters, Metropoles, Commuter Squares, and a variety of Digital 6s. The location-cycling copy by VCCP features iconic Irish locations where participants can hide their egg including Cobh, Lough Gur, The Forty Foot, and Spanish Arch.

From our research, 74% of people agreed that customized posters are more noticeable, 68% said they made a brand look more innovative and creative and 66% agreed they were more memorable.

Baileys

Planned by PHD and Source out of home, Baileys is once again highlighting how the product can be used to amplify your Easter experience. Driving appetite appeal the creative features a pair of cocktails prepared within Baileys and served in two Easter eggs, drizzled stop by the Irish cream liqueur in a more than inviting spread. This is sure to attract a provocative glance from consumers passing Digipanels, Adshel Live Roadside, Digital Kiosks, Tesco Live, and Digitowers.

Avonmore

Playing into the more luxury side of Easter treats, Tirlán’s Avonmore Fresh Cream is running across a mix of classic and digital formats including 6 sheets, trolley PopAds, Dunnes Stores Store Points, SuperValu Screens, and Adshel Live Retail. Planned by Carat and PML, the enticing creative displays an inviting home dessert creation. Incorporating seasonal chocolate flanked by fruit, encased in dollops of the titular fresh cream, ‘Nothing tops Avonmore cream at Easter’ is a tagline we’re inclined to believe!

Lindt

The bow-wrapped gold bunny has long been a signature shelf occupant throughout the Easter period and beyond. This Easter Lindt is bringing its iconic confection to Outdoor, advertising on 6 Sheets throughout cycle 7. Planned by Starcom and Source out of home, the creative taps into the joy of chocolate giving with the tagline ‘make them smile ear to ear’.

Motor Mindset – Emergence of EVs

As 2023 began, the Society of the Irish Motor Industry (SIMI) noted an 81% uplift in the registration of electric vehicles among Irish drivers. A total of 15,678 new electric cars were registered throughout 2022, comparing to 8,646 over the same period throughout 2021 (+81.3%) and 3,444 in 2019 (+355.2%).

As 2023 began, the Society of the Irish Motor Industry (SIMI) noted an 81% uplift in the registration of electric vehicles among Irish drivers. A total of 15,678 new electric cars were registered throughout 2022, comparing to 8,646 over the same period throughout 2021 (+81.3%) and 3,444 in 2019 (+355.2%).

Having previously examined consumer opinions and perceptions associated with the market, we are now revisiting these customer sentiments as part of our ‘Motor Mindset’ research, featuring up-to-date information and fresh perspectives on how EVs, plug-in, and standard hybrids are perceived by consumers of the Irish motor market.

The findings are part of our ongoing iQ insight programme, which was conducted on our behalf by Ipsos MRBI among 300 residents of the capital, aged 16-54.

The results are indicative of an increased sense of openness and awareness toward alternative options in the market. 13% of respondents noted as owning an EV presently, while others continue to contemplate options available to them compared to a traditional (petrol or diesel) motor.

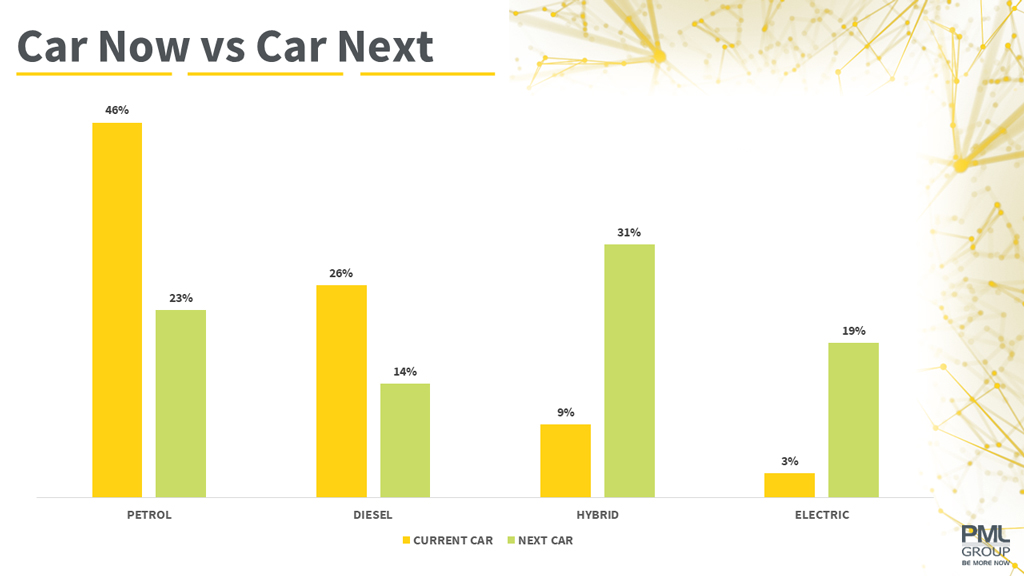

While findings show 72% of those surveyed currently own a traditional (petrol or diesel) motor, there has been an overall reduction of 3% in this figure YoY. Additionally, when asked about their next motor purchase, 23% of current petrol and 12% of current diesel motor owners noted as intending to purchase a different motor type.

Of those who currently own a traditional motor, there been a change when it comes to who those drivers are. Scoring highest in this ownership category are those in the 45-54 age bracket (96% of males and 69% females), replacing 35–44-year-olds as the highest age category in 2022 who see an annual decrease of 4%. This may imply that younger generations are beginning to manifest their purchase considerations following on from the past year.

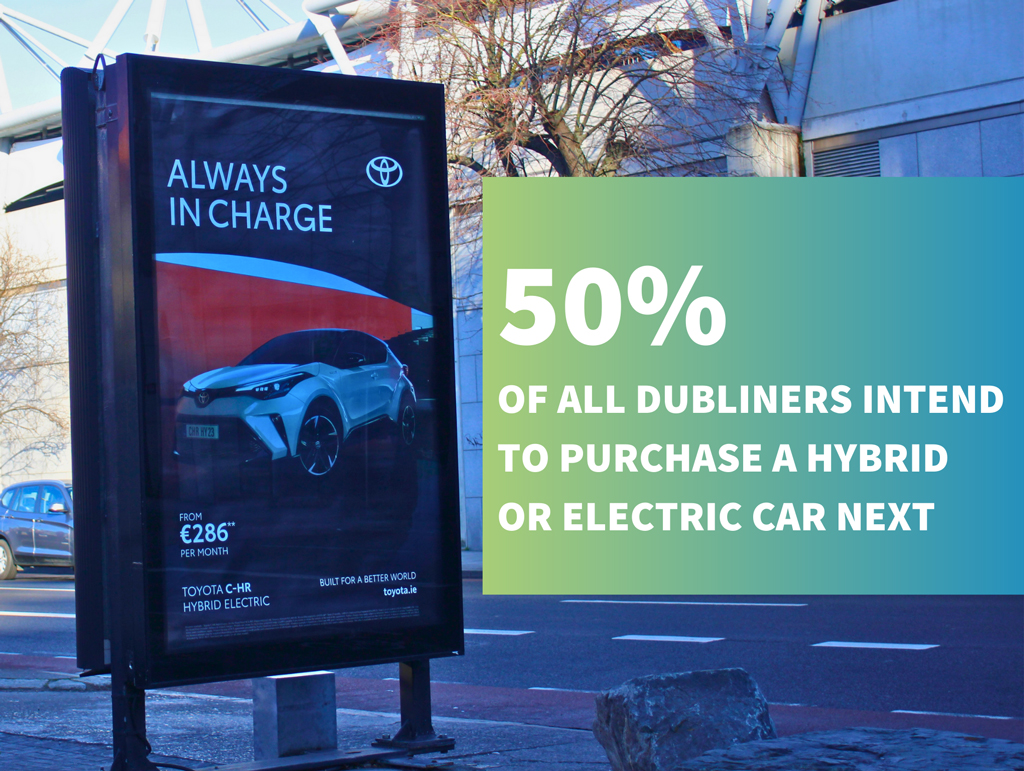

These sentiments are reflected in a continuing sense of positive consumer demand trends for the EV market looking toward the future. 50% of respondents marked their intent to purchase an EV or hybrid motor as their next vehicle – an increase of 37% compared to current car ownership – compounding data from SIMI and implying an ongoing sense of movement away from traditionally fuelled motors toward more efficient, environmentally friendly options.

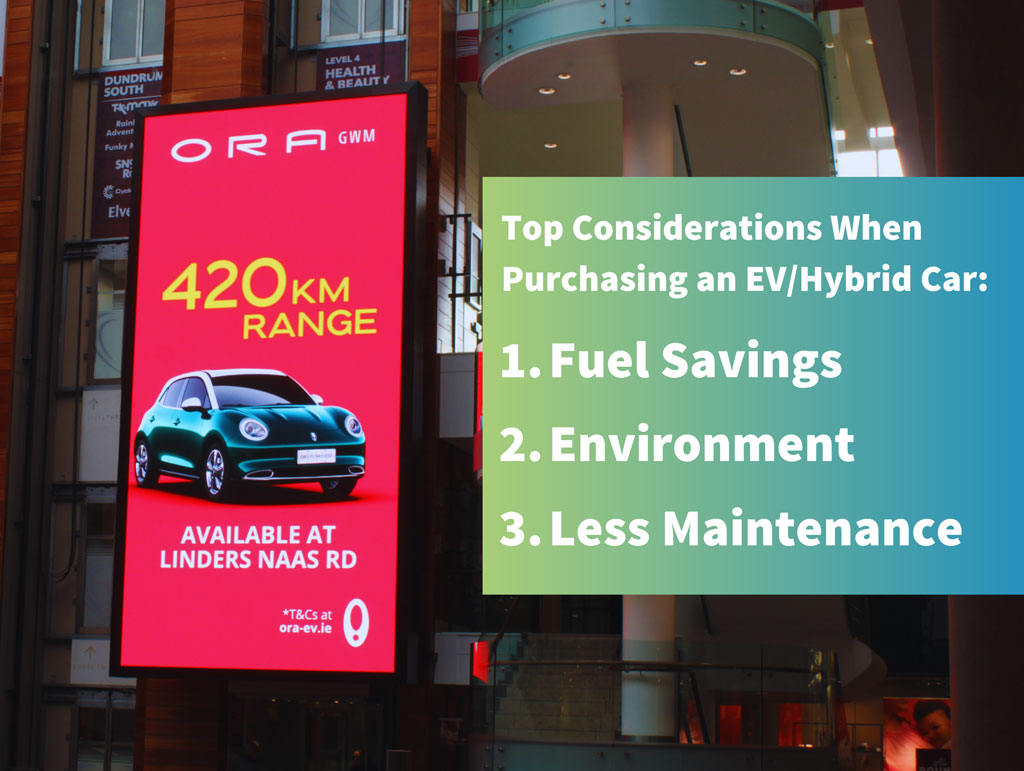

This is reflected in reasoning behind sentiments toward non-traditional motors. When asked to rank reasons surrounding contemplation to purchase electric car models, the most frequently cited options were fuel savings, environmental benefit, and less maintenance at 35%, 30%, and 11% respectively.

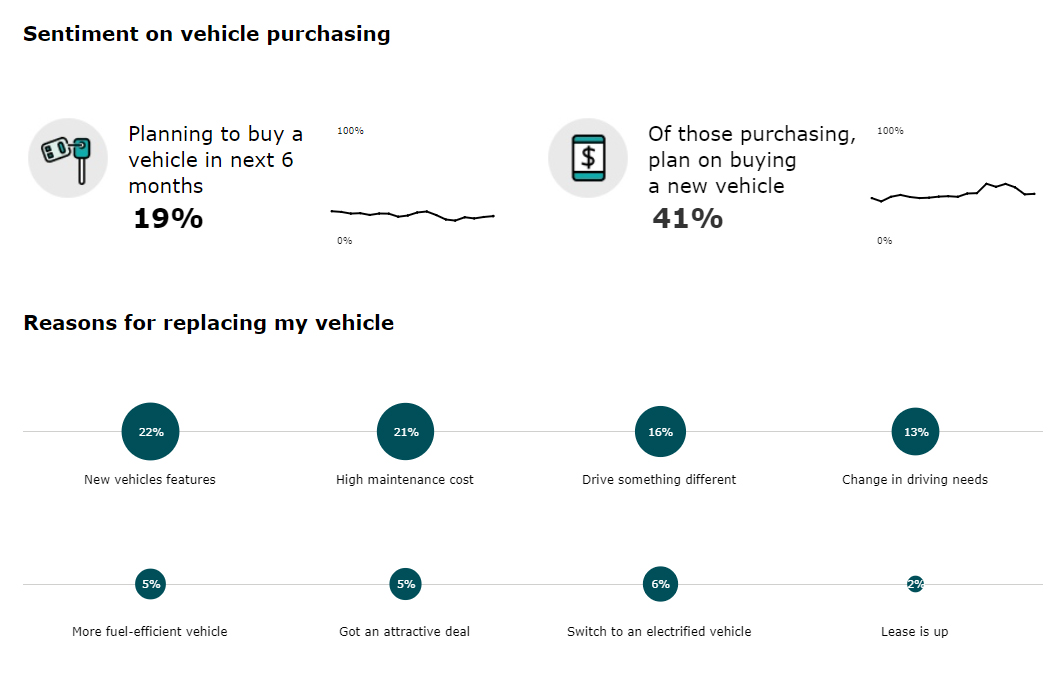

Comparing with with data from Deloittes’s most recent ‘Global State of the Consumer’ study, Irish consumer sentiment for vehicle purchasing shows 19% of consumers plan to buy a vehicle in the next 6 months. Of those who plan to purchase a new vehicle, 6% responded as looking to switch to an electric vehicle. In alignment with our study, 5% cited fuel efficiency while 21% cited high maintenance costs.

As a medium with a tangible presence in public spaces, the Outdoor industry continues to help drive Ireland’s journey to becoming a more sustainable society. OOH plays an important role in driving awareness for electric car brands and presents major opportunities for brands to take advantage of this growing interest. Some examples in the last few months include Opel Mokka, Fiat 500e, Toyota C-HR, and ORA Funky Cat.

Mario gets Super Animated on French OOH formats

To coincide with the release of The Super Mario Bros. Movie, Universal Studios went one step beyond the warp pipe to advertise on French OOH formats.

Through innovative use of JCDecaux France’s Colonnes Morris, the cylindrical display located on Paris’ Champs- Élysées was fitted with a green puck complete with emerging Mario to emulate the iconic travel medium the video game-turned film franchise.

This comes as the latest innovative use of the medium which has decorated French roadsides since the 1800’s. Previous film releases Early Man and Despicable Me 3 have also incorporated special build elements, making use of the unique format which is positioned on one of the highest footfall streets of the French capital.