The OOH sector is in good health in 2024, with latest figures from the OMA (Outdoor Media Association) showing the sector more than 25% up on 2023. PML Group’s WATCH H1 2024 Market report sees this growth trajectory continuing with the market value to the end of June nearing +30% versus same period in 2023.

According to WATCH, fifteen of the top twenty categories on OOH have shown growth in 2024, with Retail continuing to lead the way this year. Retail advertisers, including supermarkets such as Dunnes Stores and Lidl, have invested 33% more on OOH in H1 this year. The Media category, home to advertisers such as Disney+, RTÉ and Sky, has more than doubled its OOH investment and is the second largest category on the medium. Of the top ten categories, only Beers (-19%) and QSRs (-3%) have decreased in display value year on year.

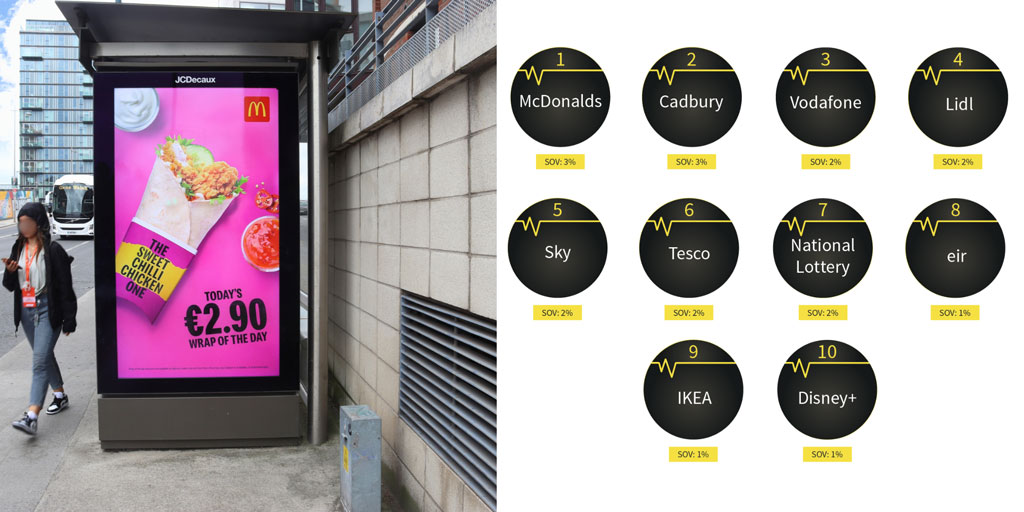

The WATCH figures, compiled from PML Group’s comprehensive market monitoring, reveal that McDonald’s, Cadbury and Vodafone are the three leading brands on OOH so far this year, followed by Lidl, Sky and Tesco. The top ten is completed by National Lottery, eir, IKEA and Disney+.

Diageo remain the largest overall advertiser on the medium, with brands Guinness and Guinness 0.0 its two biggest on the channel in 2024 to date. Unilever’s display value has increased by more than 150% to take them to second place on the advertiser list, with Lynx and HB among its active brands. Between them, the top ten advertisers have averaged a display value increase of +68% in H1 this year.

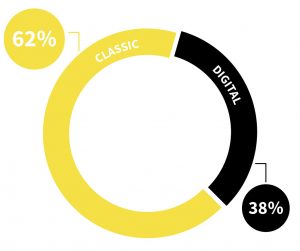

Digital OOH accounted for 38% of display value in Jan-Jun, with Classic taking 62% of advertisers investment, which demonstrates the enduring power of mixed formats delivering the greatest return on investment.

60% of investment in H1 was on roadside formats, compared to around 20% on both retail and transport environments.

WATCH is PML Group’s market intelligence service, offering clients a 100% view on the OOH market, fueled by our Verify service. It is the most comprehensive information and design library in the Out of Home market.

It measures the formats, weights, value and timing of every Out of Home campaign in every cycle.