While Ireland’s balance sheet might be looking fairly strong,, consumer confidence remains subdued according to the latest Ipsos B&A Consumer Confidence Barometer.

While Ireland’s balance sheet might be looking fairly strong,, consumer confidence remains subdued according to the latest Ipsos B&A Consumer Confidence Barometer.

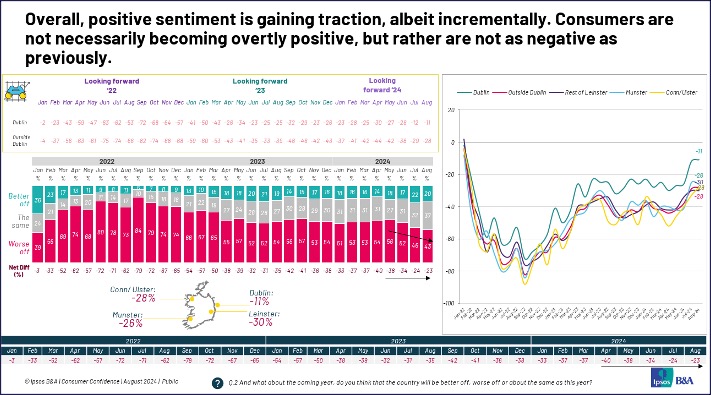

This wave of the Ipsos B&A Consumer Confidence Barometer was conducted from the 7th – 14th August 2024 and consumer confidence has improved marginally in August 2024. It now stands at a net rating of -23 (those feeling downbeat versus those feeling more upbeat), compared to -24 in July.

What is most striking is that while positive sentiment is moving slowly, the proportion of those who are pessimistic for the future continues to decrease and is now at a two and a half year low.

Indeed, confidence is at a 31-month high (stretching back to January 2022) and is up across all regions. In particular, Dubliners are more upbeat.

Females, those aged 35-54, or from lower social classes (C2DEs), and residents living outside Dublin continue to be more pessimistic about the year ahead. These cohorts have consistently been more downbeat over time.

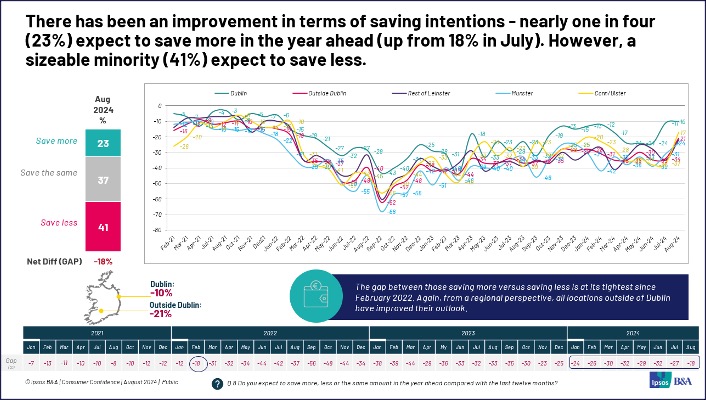

Two in five (41%) expect to save less in the coming year. However, nearly a quarter (23%) are upbeat in their savings intentions; this represents an increase of five points since July in terms of saving intentions.

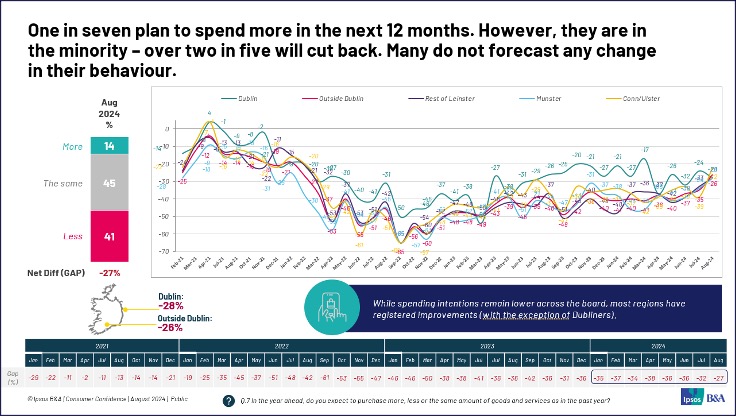

One in seven plan to spend more on goods and services in the next 12 months, but they are in the minority – over two in five will cut back. Many do not forecast any change in their behaviour.

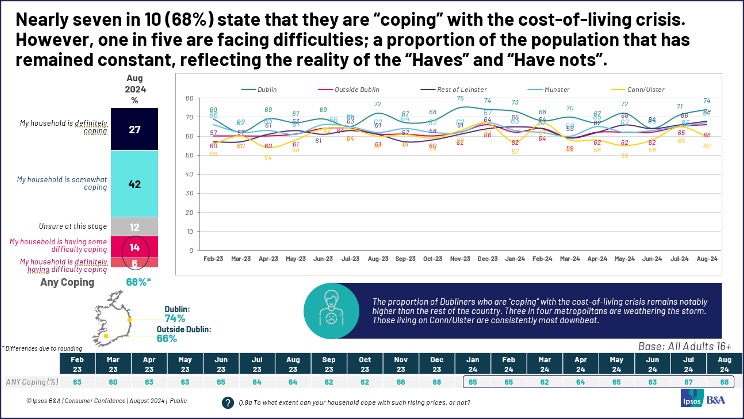

Nearly seven in ten (68%) are “coping” with the cost-of-living crisis. Against a background of lower inflation (and interest rate cuts, along with a giveaway budget to come), they have arguably weathered the cost-of-living storm. But one in five are facing difficulties; a proportion of the population that has remained constant, reflecting the reality of the “Haves” and “Have nots”.

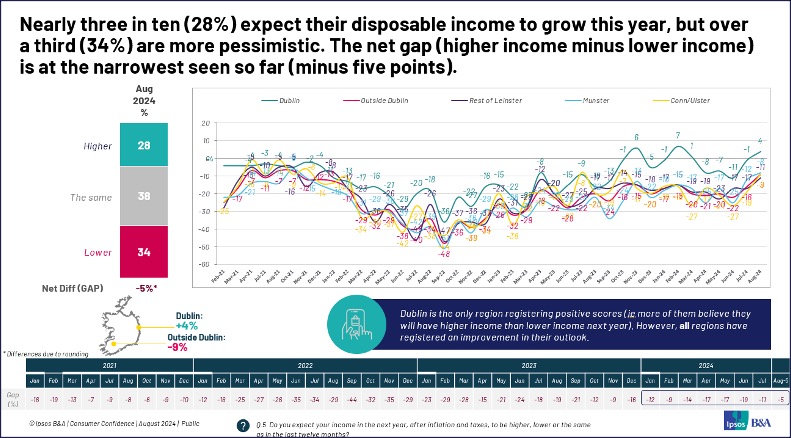

Nearly three in ten (28%) expect their disposable income to grow this year. The net gap (higher income minus lower income) is at the narrowest seen so far (minus five points).

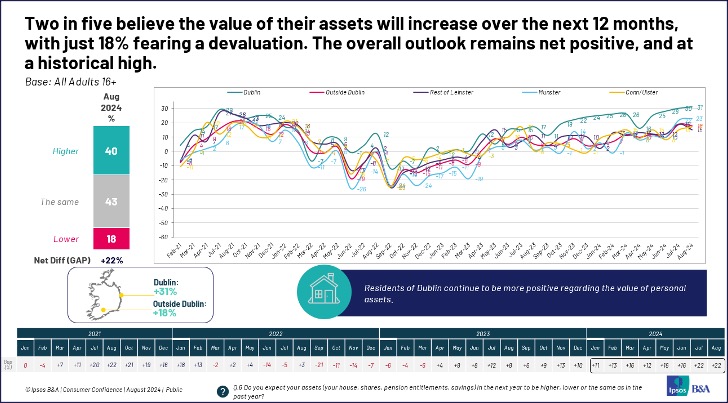

Two in five believe that the value of their assets will improve over the next 12 months. Just 18% disagree, and this represents a historical high in terms of net positivity towards asset appreciation, stretching back over three and a half years.

Survey results are based on a sample of 1,004 adults aged 16+, quota controlled in terms of age, gender, socio-economic class, and region to reflect the profile of the adult population of the Republic of Ireland. All interviewing was conducted via Ipsos B&A’s Acumen Online Barometer.

For more details and the full report or more information, please contact Jimmy Larsen, Paul Moran, or Pooja Sankhe: Jimmy.Larsen@ipsos.com, Paul.Moran@ipsos.com, or Pooja.Sankhe@ipsos.com