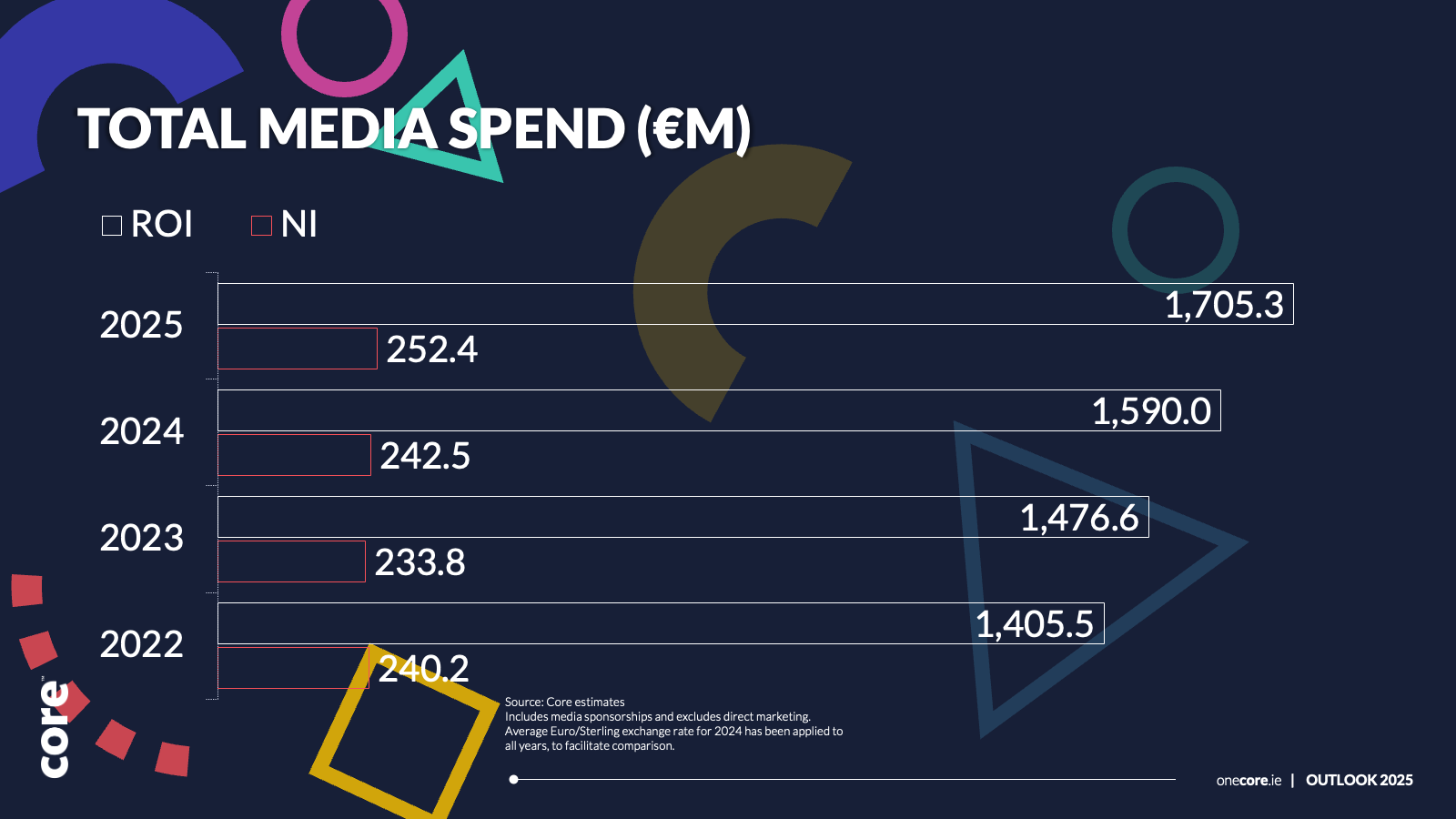

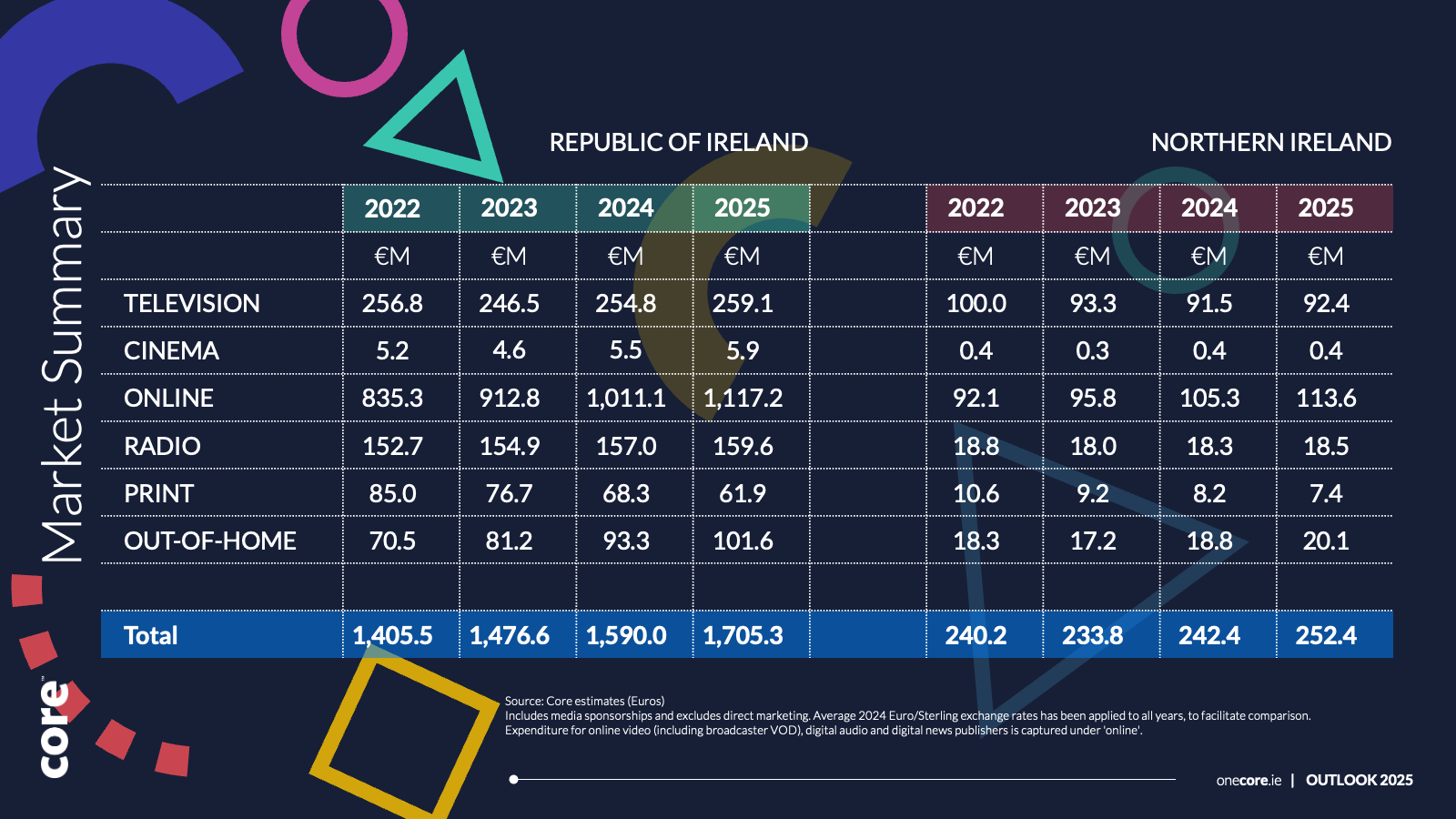

The Irish advertising market is forecast to grow by 7.3% to €1.7bn in 2025, according to the annual Outlook report published by Core.

This compares with a 7.7% growth in 2024 which saw advertisers invest around €1.59bn in the various media channels.

According to Core’s forecasts, increases in digital and out-of-home advertising will power much of the growth in 2025. Core is forecasting that online advertising spend in 2025 will rise to €1.11bn while OOH spend will rise by 8.9% to €101.6m.

Overall, Core is expecting offline media spend to increase by just 1.6% in 2024 while digital channels will grow by 10.5% to €1.11bn.

“The Irish advertising industry is set to build on its resilience, as it navigates a continually evolving economic and technological landscape. With digital advertising spend continuing to rise, we will see further convergence across media channels. Connected TV (CTV) will disrupt both traditional linear TV and online video consumption, while Digital Audio will reshape radio listening habits, particularly among younger audiences,” according to the Outlook report.

With digital advertising expenditure in the Republic of Ireland growing 10.8% last year, Core notes that this represented 65.5% of total advertising revenue. “Alphabet (Google) and Meta (Facebook and Instagram) lead, accounting for 80% of digital ad spending,” it says.

“Despite increased competition from TikTok impacting their growth rates, these two giants remain dominant players in the market,” it notes.

Digital

Within digital, social media was the fastest-growing category for the second consecutive year, rising by 21.3% to €502.9m, according to Core.

“Video advertising followed, increasing by 17.8% to €479.2 million, driven by YouTube, Broadcaster VOD, and Social VOD,” it says.

“Core forecasts a 10.5% increase in the online advertising market in 2025, with ROI total expenditure of €1,117.2 million. Digital will account for 65% of the market. Social media and Video will be the key drivers, with anticipated rises of 15% and 16.9%, respectively.”

TV

According to Core, “2024 proved to be a standout year for TV performance in recent times. Live or scheduled programming took centre stage, driven by major sporting events such as the Paris Olympics, Euro 2024, and the Six Nations, which topped the programming charts. Viewership grew across most demographics, with commercial impacts (advertising availability) rising by 2% to 8%, depending on the audience segment. This led to a 3.4% increase in TV market revenue in the Republic of Ireland, reaching €254.8 million in 2024.

“Core projects further growth in 2025, albeit at a slower pace of 1.7%, bringing the total to €259.1 million. However, with fewer high-profile sporting events scheduled for 2025, this could be a critical challenge to monitor in the coming year.”

Core notes that 2024 was also a good year for online video, including social video. “Online video enjoyed another strong year in 2024, with broadcasters reporting a 25% increase in revenue to €39.7 million, largely driven by live sports events and popular shows such as Love Island All Stars, Celebrity Big Brother, and various soap operas.”

It also points out that “broadcasters are expanding content access through platforms like Free Ad-Supported Streaming Television (FAST) channels and YouTube, positioning the category to grow by 20% to €47.7 million.”

Signalling a note of caution, however, Core says broadcasters will need to tread carefully to avoid “cannibalising viewership on their proprietary platforms as they increasingly monetise content on YouTube. On the upside, this strategy could attract a larger number of younger viewers,” it notes.

Core is also forecasting that online video – including social media video- to grow by 16.9% to €560.2m with spending on YouTube alone forecast to grow by 25% to €88.5m,

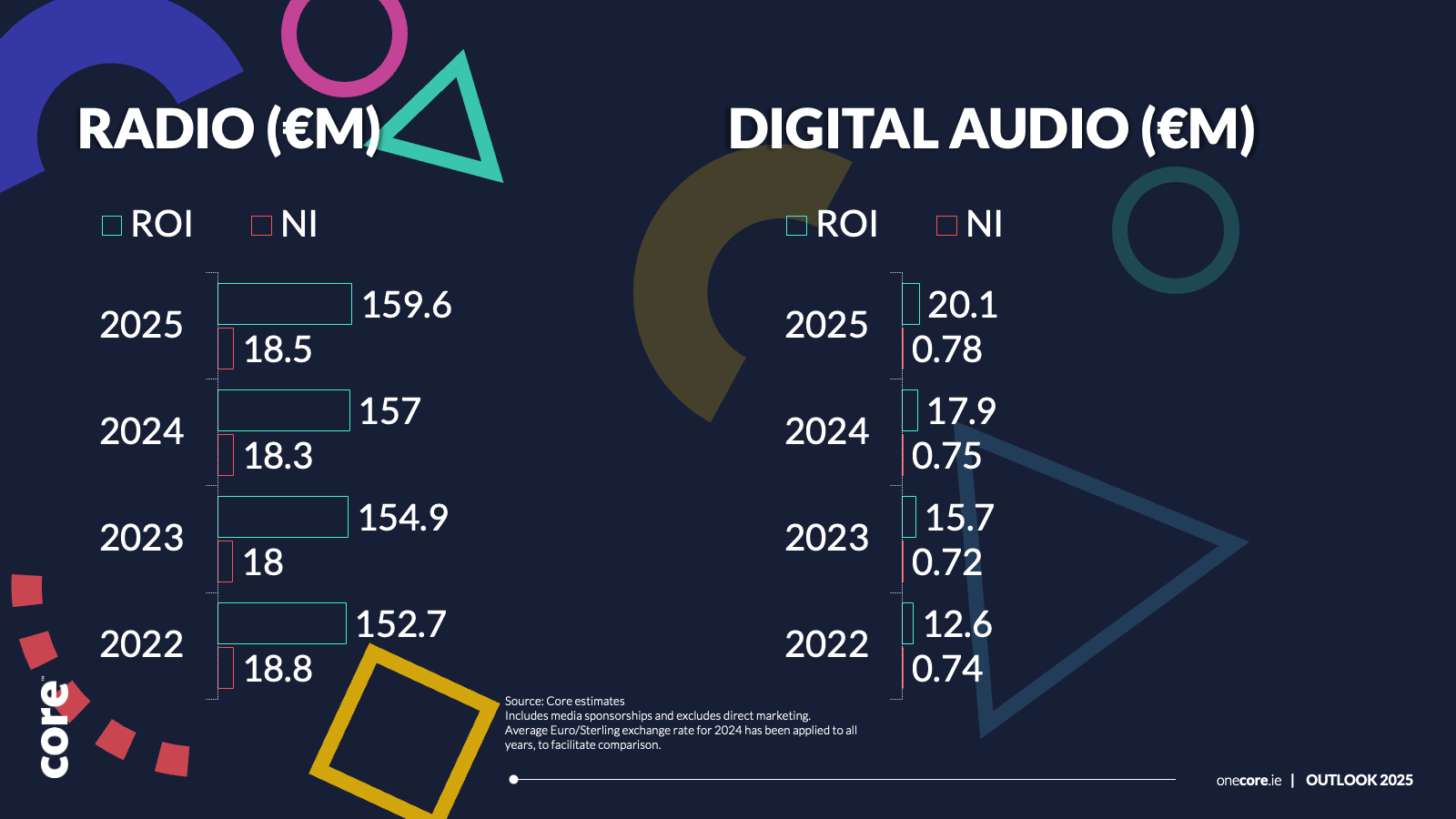

Audio

According to Core’s Outlook report, radio advertising revenues are forecast to grow by 1.7% to €159.6m in 2025 while digital audio advertising will continue to grow to €20.1m this year, a 12.3% increase of 2024.

Given the strong performance of digital audio over the past few years, Core notes that “with the continued growth in popularity of digital audio, advertisers will need to review their investment in this space.”

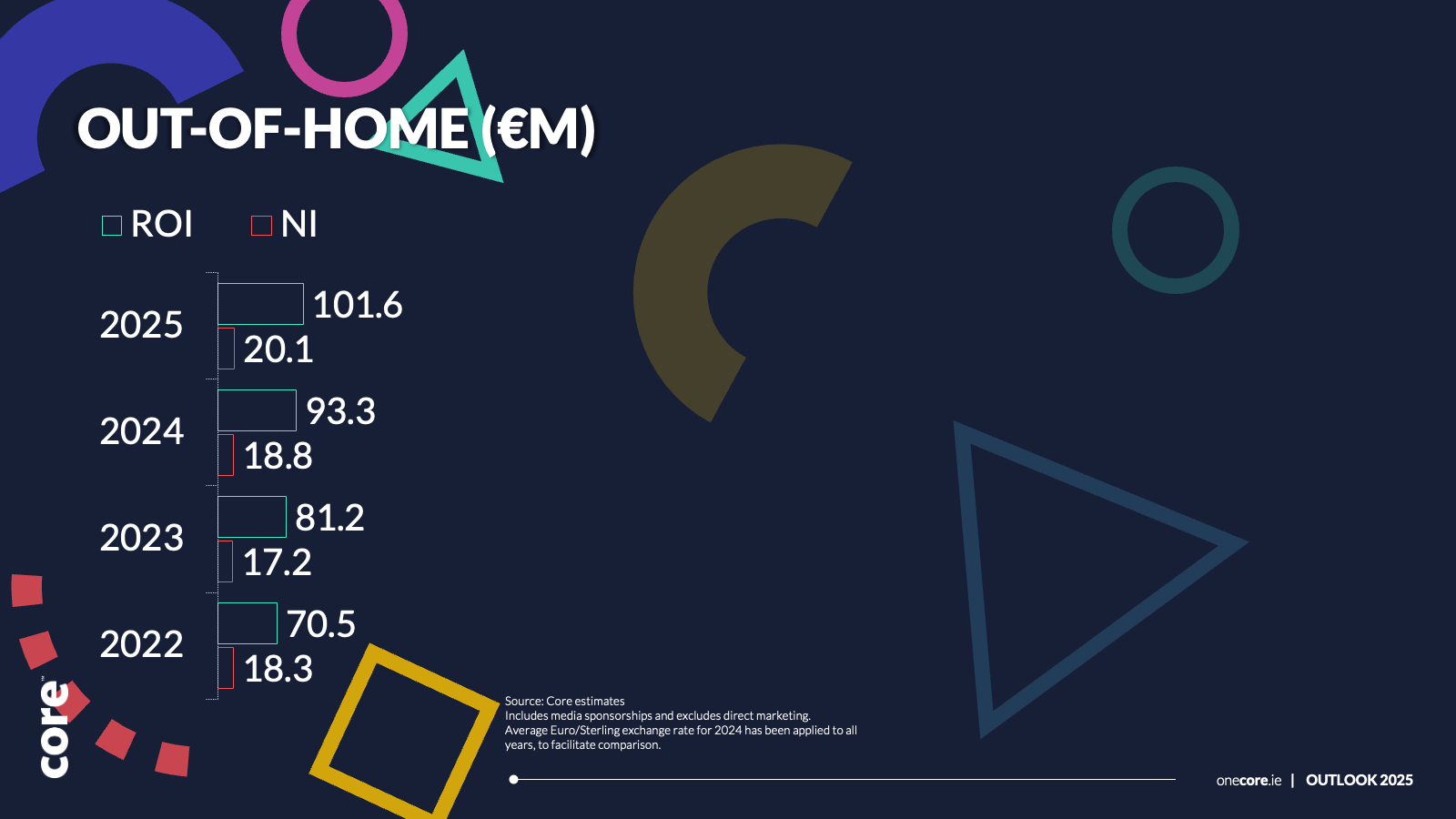

Out Of Home

Elsewhere, Core notes that the strong growth in the OOH market “provides brands with compelling reasons to embrace the medium.”

“We believe the OOH market in ROI grew by 15% in 2024, reaching €93.3 million, surpassing pre-Covid spends,” it says.

“We forecast that the OOH market will grow by 8.9% in 2025, to €101.6 million,” it adds.

“Retail emerged as the most active category, representing 14% of the market, up from 12%, while Food accounted for 9%. Media brands, including streaming platforms, social media companies and TV, increased their investment by 33%,” Core says.

Pointing to the growth in retail OOH media, Core’s Outlook report notes that “the retail OOH media ecosystem is expanding, and 2025 will see more brands leveraging its potential for building mental availability. Brands are expected to adopt a ‘home-to-store’ strategy, delivering contextually relevant messages along the path to purchase, driving both in-store and online actions.

News Media

With online news consumption now the dominant source of news in Ireland, according to the 2024 Reuters Digital News Report, the outlook for traditional news media remains challenged with Core estimating that print advertising declined by 10.9% to €68.3m. For 2025, Core sees this decline continuing, pencilling in a further decline to €61.9m.

Against this, however, online advertising revenues generated by news media organisations rose from €29m in 2023 to €30.4m last year and Core is forecasting this to increase again to €31.6m in 2025.

Cinema

Elsewhere, Core says that “the cinema industry continues to face challenges in the post pandemic era.” For 2025, it is forecasting revenues of €5.9m, up from €5.5m in 2024 and €4.6m in 2023.

“Admissions in 2024 increased slightly by 1% from

2023, with the industry still feeling the impact of the writers’ strike and growing competition from streaming platforms. However, as we ended 2024, Q4 saw large growth in admissions of 21%, driven by a strong lineup of films such as Gladiator 2, Wicked and Moana 2. This upward trend is expected to carry into 2025 with major releases including Avatar 3, Jurassic World: Dominion and Captain America.”

To download a copy of Core’s Outlook report for 2025, click HERE