Niamh Manning, marketing executive, PML Group with this week’s view from OOH.

Back to Business

In many senses this week is about getting back to business for OOH and for OOH advertisers. For some brands, the message conveyed through their OOH campaigns is about reconnecting, reopening and revival. Guinness are speaking directly to their customers with a simple but effective ‘ready when you are’ message while McDonald’s play on fun behavioural connections to the eat-in experience to signal the beginning of their full restaurant reopening (more on that below). Centra carry a ‘welcome back’ message across their national 6 sheet campaign.

As individuals and commercial operations get back in gear, we’ve also seen extensive activity with a business/financial theme with brands including Bank of Ireland, An Post, Allianz and AIB active this week.

But for many brands it’s simply business as usual and they’ve engaged OOH to create impact, impart information and sell product. Campaigns for brands including Heinz, Cadbury and the National Lottery tap into themes such as heritage, humour and aspiration to create appealing and effective OOH comms.

Regardless of where brands are on their pandemic narrative journey, OOH is accommodating all through a combination of effective media and relevant creative. Delivering for brands in the Now, the Near and the Next.

Mobility

Dublin traffic more evenly distributed across the day

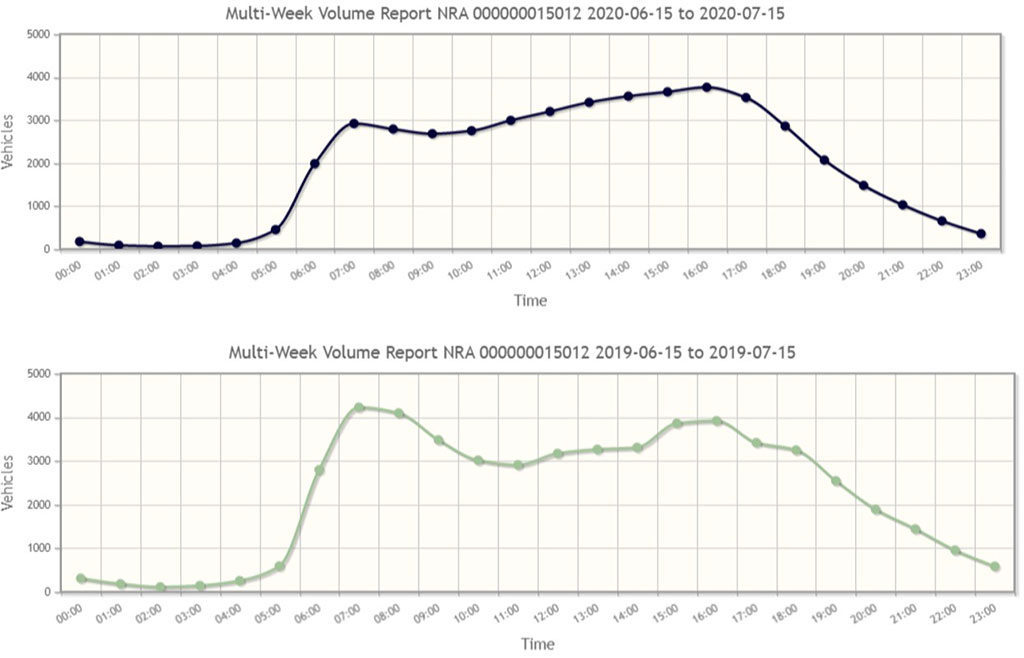

Over the past three months, Now Near Next has tracked increases in audience mobility across modes of transport including vehicular, pedestrian and cycling. Some of the latest data is highlighted below but an interesting aspect from an OOH point of view is the distribution of traffic throughout the day. Analysis of TII data would indicate changes in behaviour in this regard and that vehicular traffic is now distributed more evenly throughout the day. When looking at data from the past month compared to the same period in 2019, it would appear that the morning rush hour has become more of an elongated, evenly split period, particularly in Dublin.

The graphic below is one example of a data point from the M50 between Cherrywood and Shankill. 2019 saw a much steeper fall off in traffic post-8am whereas in the past month that curve has been flatter, suggesting a steadier flow of traffic throughout the morning. This appears to be a trend across many other data points also. Whether this a permanent or temporary change remains to be seen as office workers return to the city in greater numbers but for roadside OOH advertisers it means a consistent audience throughout the day and potential exciting applications for dynamic daypart activations.

A new way of delivering such communications to roadside audiences is on the horizon with the arrival of two new Digipoles. The JCDecaux large format digital units will be located on Amiens Street and Swords Road, Drumcondra and are currently undergoing installation and testing. Both will be available soon and will add to an ever-expanding inventory of roadside digital OOH.

Life on the Road

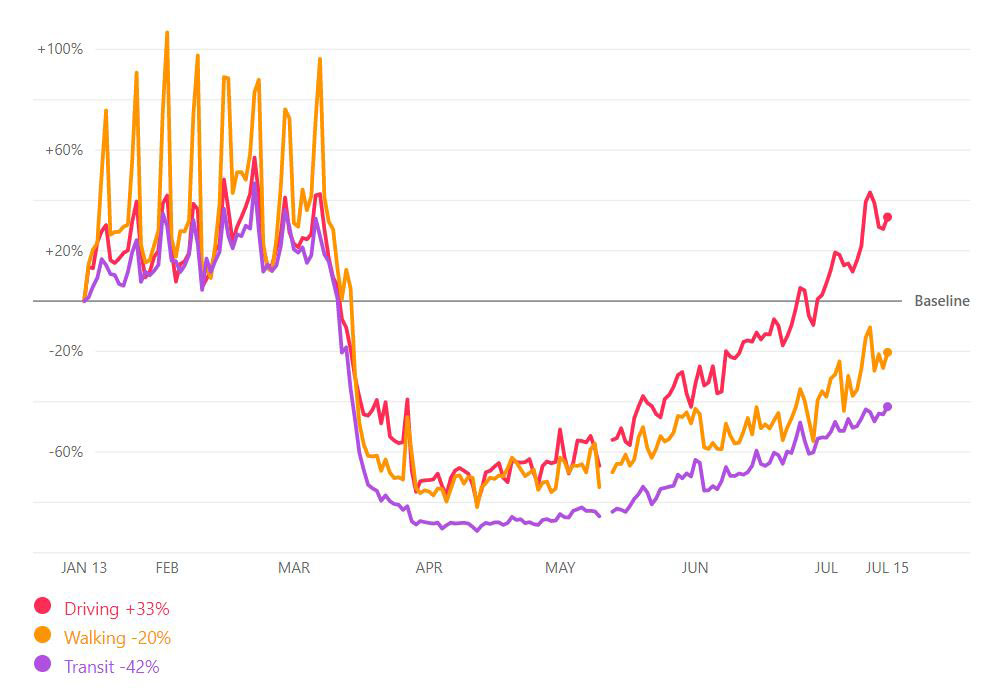

Apple’s routing requests mobility data to Wednesday 15th July shows driving in Ireland is 33% above January’s baseline and +15% in the past week. Figures indicate public transport is now 58% of pre-Covid levels and has risen by more than a quarter in the past fortnight. Driving in Northern Ireland is now 30% above baseline, while the UK is now up 8%.

Park Life

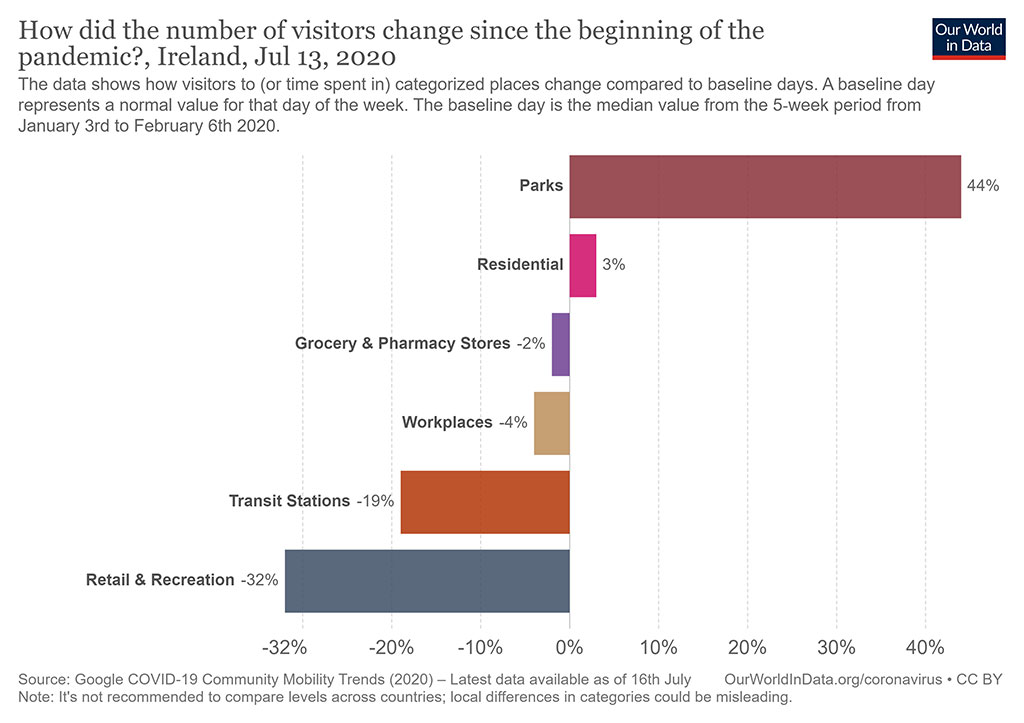

Google’s latest COVID-19 Community Mobility Report across environments as of Monday 13th July illustrates the continued trend towards workplaces from home. Relaxed restrictions and longer days sees leisure and recreation time increasingly spent outdoors, as can be seen by the uplift in parks presence. Elsewhere the deficit in transit stations has decreased from 39% to 19% in the past fortnight.

Bus and Rail internals posting again

The now legally mandatory wearing of face masks on public transport means a significant increase in capacity on vehicles such as bus and DART. Bus capacity is now estimated at 50%, up from less than 20% a few weeks ago. This is good news for brands wanting to tap into this captive audience and from cycle 16, the posting of internal formats such as Commuter Cards will resume. LUAS internals have been available again in recent cycles also.

Retail

Little Retail Loyalty

New research findings from FMI published this week provides insights into how consumer habits have changed in the months since the COVID-19 outbreak.

It seems retailer loyalty is amiss in the current climate with only 12% purchasing from one retailer and a mere 2-5% surveyed stay loyal to a retailer.

While shopping online has increased, it seems this trend may wane. Of those respondents who moved to online shopping for the first time, only 1 in 5 stated they will continue to do so. This may suggest that Ireland is still slow to adopt to online shopping with many still preferring the physical retail experience.

The spending increase which has been reported in previous Now Near Next articles was evident within the survey. The research shows 35-44-year olds have increased their spend the most at 72% compared to the overall average of 55%.

The report highlights the stark reality on brand loyalty in the retail sector, as consumers venture to many rather than one. With such figures presented, it underlines the importance of gaining customer loyalty at this time. The research suggests placing value on engaging with existing customers to improve brand loyalty.

With multiple touchpoints on the journey to purchase, retailers can develop engaging marketing communications to broadcast their value and USP to consumers to aid brand loyalty and increase its overall market share in the competitive retail sector.

Supporting Irish Produce

Innovate Solutions and MyInsightsOnTime highlighted females’ perceptions of buying Irish food in a recent report.

Women who responded to the survey stated they find SuperValu is the best place to buy Irish food products. 34% mentioned Supervalu, while Dunnes Stores followed at 22% and Aldi at 18%.

Supporting Irish and local is a theme evident in the research and has been a reoccurring trend in recent months. 42% of state they buy Irish food products to support local brands, producers, and farmers. 25% purchase Irish food products due to the quality and taste.

In terms of purchasing Irish food products, the females surveyed revealed seasonality and lack of availability are barriers in purchasing more Irish food products.

Reopenings Boost Retailer Advertising

With an increasing number of business operations resuming and more people returning to work, we are seeing an increase in retailers’ OOH activity. This week, Centra launched an OOH campaign to welcome back this workforce. Focusing on main cities across the country, the Musgrave owned retailer is welcoming people back to city centre locations and promoting the new deals available each week.

McDonald’s is also running a new OOH campaign this cycle as the fast food chain’s operations begin to return to normal. On Wednesday, the fast food chain reopened 27 of its restaurants to customers who want to enjoy the eat in experience again. Twenty-seven outlets are currently open for eat in as part of a phased roll out, with more opening in the coming weeks. The campaign is on display across the country in close proximity to its restaurants.

Leisure

Guinness Storehouse marks reopening

One of the country’s most popular attractions, the Guinness Storehouse, reopened last weekend following almost 120 days of enforced closure. A nice touch from the Storehouse on reopening was to thank frontline workers for their efforts during the pandemic, by offering them free admission to from July 11 to December 31, 2020. The Storehouse is also playing host to a Creatives Against Covid exhibition throughout July and August. During the COVID-19 pandemic, the Creatives Against COVID-19 project invited submissions from around the world to explore interpretations of the word ‘SOON’. This word inspired a sense of optimism, unity, hope and patience that struck a chord around the world – and the result was a collection of hundreds of pieces of art that truly captured a moment in time.

The team at PML Group were delighted to work with Clear Channel and Exterion Media to bring the initiative to the streets of Ireland.

The Storehouse is just one of so many brilliant Irish attractions that will be attracting a mainly domestic audience for the next while. As domestic tourism will dominate Irish families’ summer holiday plans, we will expect to see more campaigns in and around Ireland’s main national routes such as the large format campaign for Fota Wildlife Park in cycle 15. Last week in Now Near Next, we reported figures from Net Affinity showing that rural and resort type holidays are proving attractive and seeing large growth in booking volumes.

Significant Spike in Spend in Hair and Beauty Salons

Consumers have placed high importance on hair and beauty treatments since the sector was permitted to reopen at the end of June. According to data released this week, spending on beauty and hair treatments increased by 80% compared to the first week that COVID-19 hit Ireland.

Bank of Ireland analysis of spending data and debit card transaction shows the average daily spend by customers on hair and beauty appointments was €740,000, up from €410,000 before lockdown. Debit card spending increased by 79% for the sector in the week June 29 to July 5, compared with the final week of February.

On average, customers were spending €63 per transaction in barbers, hair and beauty salons, a €9 rise compared with February.

Sentiment/Insight

Re-imagining the bar occasion

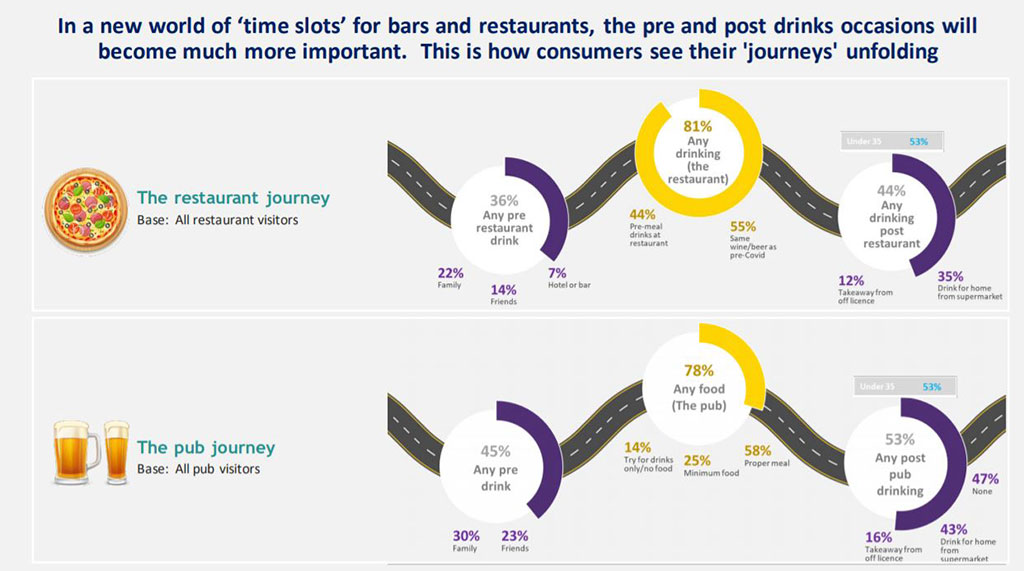

In Now Near Next a few weeks back we wrote about the importance of the path to purchase in a retail sense as insights from shoppers suggested a lack of browsing in supermarkets and a desire to get in, do the shopping, and get out again. Evidence from B&A’s latest ‘Shaping Ireland’s Future’ report suggests the path to purchase will be very relevant also for drinks companies, vis-a-vis bar sales.

Those most likely to visit a pub in the next four weeks are male (38% v 22%), under 34 (32%) and urban (35%). B&A report that 30% of all adults will visit a pub in the next four weeks. For those that do, B&A highlight a re-imagination of the bar occasion, where the traditional focus of the bar and the dancefloor are replaced with an emphasis on decentralised tables. It begs the question as to whether the impulse ‘at-bar’ decision has temporarily been replaced by a more considered and planned choice, made much earlier?

They also point to trends in ‘blended home entertaining’ with socialising taking place in home before and after the pub/restaurant visit in order to lengthen the night.

Both these factors bring into sharp focus the importance of the path to purchase and why it’s so crucial for brands in this sector to grab consumers attention as close to the purchase decision as possible. OOH can make that happen for brands.

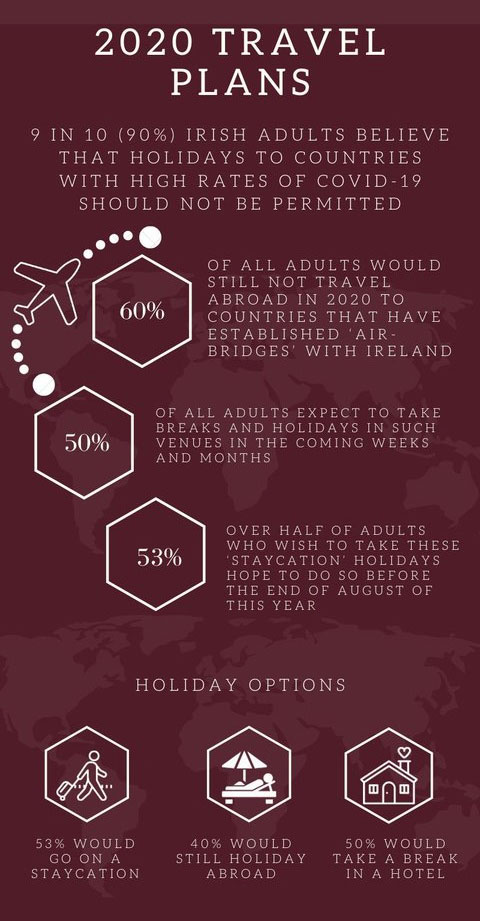

50% expect to holiday in Ireland this summer

A nationwide poll by of 1,000 by iReach Insights has found that following the re-opening of hotels in Ireland, 50% of all adults expect to take breaks and holidays in such venues in the coming weeks and months. This number is slightly higher amongst the younger generation with 59% of those aged between 18-24 and 52% of those aged between 25-34 hoping to make a stay in Ireland, in such venues, the coming weeks or months. Over half of adults (53%) who wish to take these ‘staycation’ holidays hope to do so before the end of August of this year. Those aged between 25-43 are most determined to take a staycation before the end of August, with 77% of this age group stating so. More on the study features in the infographic below.

Innovation is key to success

According to Kantar: “Our Europanel research from the 2008-2011 recession found that winning brands launched 60% more innovations than brands that lost share ‘at the shelf’ over this period. And Kantar BrandZ data shows that the stock price of the top 20 most innovative brands grew 246% after the 2008 economic crisis – almost twice the rate of the S&P 500. As we look to the post-pandemic recovery, the need for innovation has never been more relevant, and resilient organisations don’t stop innovating. Brands that maintain forward momentum and continue to innovate with a view of the longer-term fare better than those that don’t.”

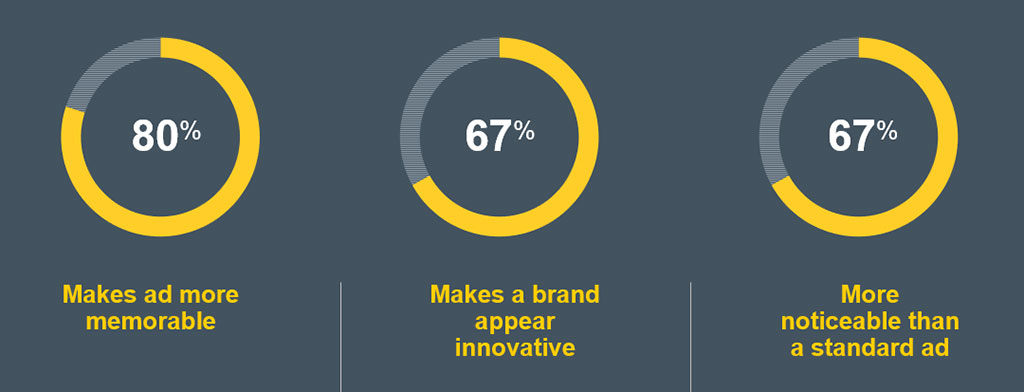

While this generally refers to business planning, operations or the service businesses provide, the same school of thought applies to Out of Home. Our iQ research has shown that brands who bring something different to their campaigns are held in higher regard than those who stick to the status quo. For brands that want to be market leaders, innovation in an OOH campaign can be the little bit extra that sets them apart from rivals.