Niamh Manning, marketing executive, PML Group, with this week’s take from the world of Out of Home.

Flex and Adapt

This week saw the government introduce new restrictions to curb the spread of COVID-19 in communities. With the situation continually evolving and altering, from an advertiser point of view, flexibility and adaptability in brand messaging will be an integral part of navigating the road to recovery. To keep brand communications up to date and relatable to on-going changes, relevance and context will be important for advertisers to connect with audiences.

This week’s Now Near Next highlights continuing trends in mobility, retail and leisure with data pointing to an uplift in spending and public confidence.

Mobility

The TII provides traffic trend information derived from a sample of ten traffic counters located on the national road network. A weekly update for each Tuesday in which the full day traffic volumes are compared with the previous Tuesday’s volumes and with the equivalent Tuesday in 2019. As of Tuesday 18th August, car traffic volumes are down by a combined 21% on the equivalent day one year ago and up 2% on the previous week. The reduction in traffic volumes experienced last week at the M4 and N7 traffic counters, arising from the new lockdown arrangements in Kildare, Laois and Offaly, has not been repeated in the current week. Car volumes at the two counters (N7 at Citywest and M4 at Celbridge-Maynooth), have this week increased by 4%.

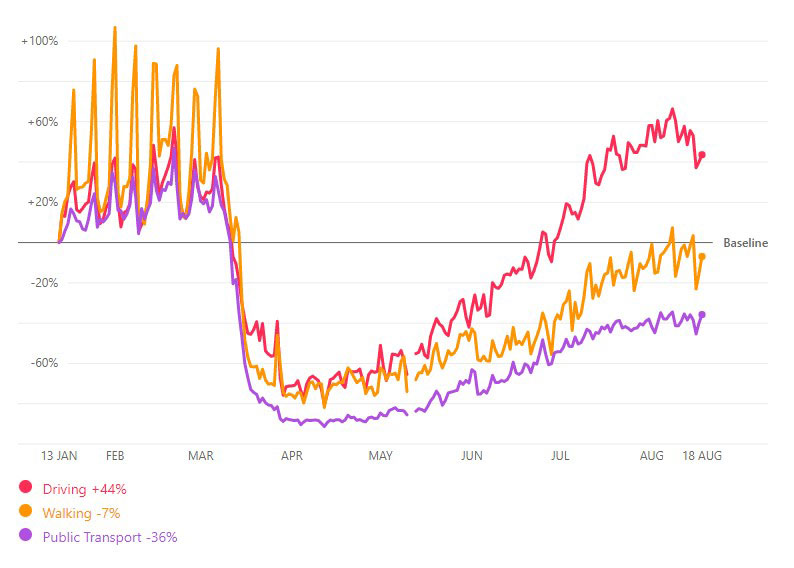

Apple’s routing requests mobility data to Tuesday 18th August shows driving in Ireland is now +44% above January’s baseline for a rolling seven-day average. Dublin’s auto mobility has stabilised at 89% of baseline. Figures indicate that nationally, public transport use as of Tuesday is now 64% of pre-Covid levels while walking has reached 93% based on a rolling 7-day average. Elsewhere driving in Northern Ireland is now +48% above baseline across seven days, while the UK stands at +26%.

Latest data from Locomizer, based on analysis of mobile phone location data via anonymised app reporting, shows that auto mobility levels, which are calculated though a combination of mobile users, time, and signals, are now at 88.4% of where they were pre-COVID-19.

Life Outdoors

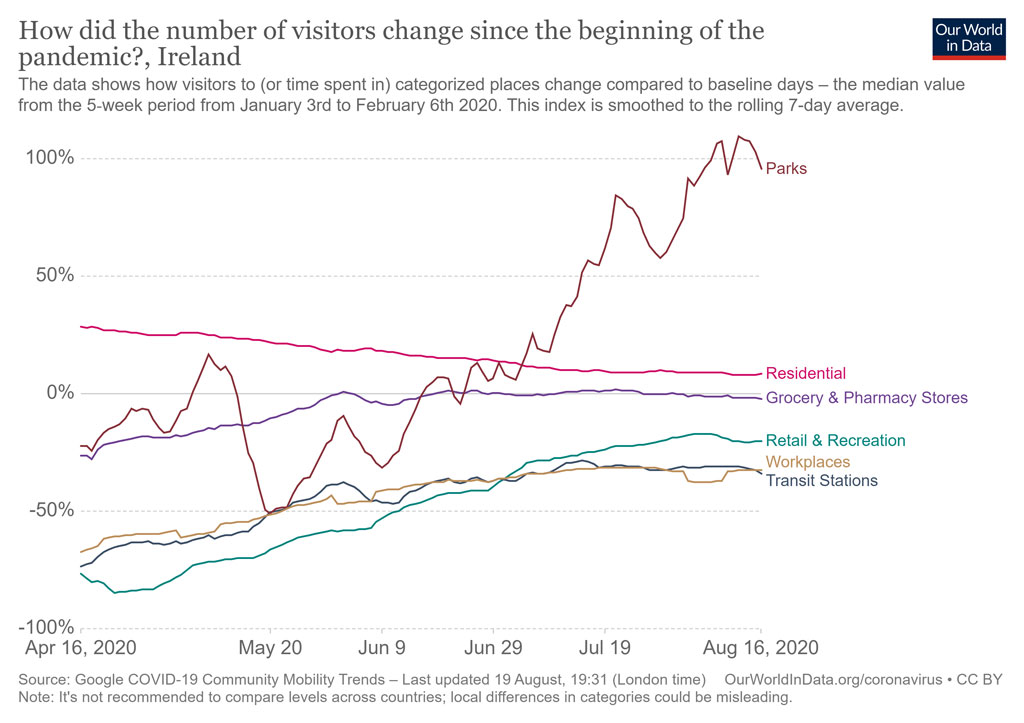

Google’s COVID-19 Community Mobility Reports shows how peoples’ movements have changed throughout the period of the pandemic. The dataset measures visitor numbers to specific categories of location every day and compares this change relative to baseline day before the outbreak.

This week we take a look at the change in visitor numbers in Ireland within the six environments over the past four months to last Sunday. Figures are based on rolling weekly average.

The clement weather experienced in many parts of the country last week no doubt encouraged visitors to parks and outdoor spaces. Of perhaps greater interest is the sustained drop in time spent in-home which now stands at just 8% above the level pre-pandemic compared to +25% in mid-April. Countering this are rising figures witnessed in out of home environments including workplaces, shopping centres and restaurants.

Dublin Traffic Patterns

The latest canal cordon report from the City Council indicates that South Dublin traffic is showing a bigger reduction in morning commuter traffic. It appears residents south of the city may be working from home in greater numbers compared to northside commuters.

According to DCC’s mobility measures car traffic currently sits at 78% of pre-COVID-19 levels. Looking at the canal cordon locations for measurement we see Harold Cross Bridge traffic is down 36% while Baggot Street saw a traffic reduction of 31%.

The biggest drop in traffic on the northside was measured at the IFSC down by 48%. However other areas on the northside of the city have seen very little reduction in traffic. Parkgate Street experienced a 6% fall in traffic and a 4% traffic reduction was reported at Summerhill.

The traffic count is measured between 7am to 10am, however other variables such as staggered work times and shift work are not factored for.

While some of these traffic reductions may seem stark, these figures provide informative and data-backed insight for us to ensure maximum effectiveness from an OOH planning perspective. With bespoke location-based tools such as our Pinpoint mapping platform and audience affinity tool, Locomizer, we can identify location hotspots and hubs of activity for the strategic targeting and planning of OOH campaigns.

Retail

Alcohol Tops July’s FMCG Category

In the latest Nielsen FMCG data to be published, take-home alcohol was the highest-growing FMCG category in the four-week period to the 2nd of August, an increase of 32% compared to the same period in 2019.

Cider sales were up 13% in the four-week timeframe while wine sales increased by 21%. Champagne and spirit sales increased by 22% and 23%. Long Alcoholic Drinks were up 41%.

With take-home sales strong, Tenvito has launched an off-trade digital screen network in 34 O’Briens Off Licences across the country, which are available for booking now.

Spending on the Rise Among Revolut Users

Data from Revolut for the month of July shows spending increased across a number of retail product categories.

Spending in hardware stores was up by a whopping 103% compared to July 2019, with an average spend of €43.29 compared to €34 last July. The demand for hairdressers and barbers is still ongoing with spend up 44% in July. With ‘wet pubs’ waiting to reopen, off-licence spending was up 25% in July.

Restaurants had a good first month after reopening, however spending was 46% lower in July. Although spend is compared to last year’s figure where no social distancing measures were in place.

Spending in pet shops near doubled with an increase of 92% and the spend in bicycle shops rose by 38%. Looking to entertain ourselves in July, spend in bookstores went up by 9%. Home entertainment still remains a priority with spending on downloadable content up 165% year-on-year.

Leisure

Following on from the decision made by the government this week to implement a number of measures in an effort to stop the spread of COVID-19, there are certain implications for a range of leisure activities.

The opening hours for restaurants and cafés have been extended by an extra 30 minutes. Premises are now allowed to remain open until 11.30.

Sporting events and matches can continue to take place but behind closed doors while the number of people permitted to attend both indoor and outdoor events have been tightened. However, businesses/services that are considered controlled environments such as restaurants and cinemas etc are exempt from this tightening on numbers. These measures will remain in place until September 13th.

Pent-Up Demand Fuels Card Spend Increase

New figures released by AIB this week shows that spend in in the hospitality sector is up this year.

Analysing over one million of the bank’s debit and credit card transactions up to August 3, AIB revealed card spend in pubs increased by 50% in July compared to last year. While spending in hotels and restaurants increased by 16% and 17% respectively.

Consumers spent €19m in the pub, €30m in restaurants and €28m in hotels during the month of July. Looking to individual county spending, Monaghan (€40.95) and Kilkenny (€38.28) are the biggest spenders in pubs. Kildare top the list for the highest spend in restaurants with the average card transaction at €27.17.

Staycation destinations were also measured through the spending figures. According to the data, Cork is the most popular staycation destination, followed by Kerry. Interestingly, Dubliners’ top choice of destination is Cork.

However, that data points to more localised staycations with many visiting neighbouring counties.

While spending is still down on last year, these are positive signs for the tourism and hospitality sector in their first month of reopening. The head of SME banking at AIB, Rachel Naughton, said the increase in average spend amounts can be linked to “pent-up demand and increased preference for card usage”.

Sentiment / Insights

The Great Acceleration

The latest briefing in Amárach Research’s COVID-19 series reports on a wide range of topics surrounding the outbreak which highlights new opportunities for brands and businesses.

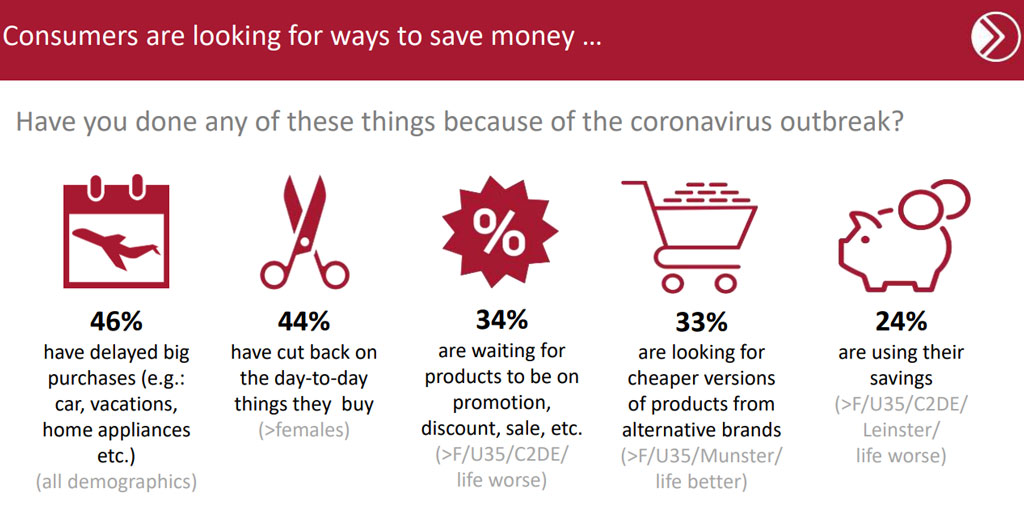

After living with the COVID-19 outbreak for a few months now, it seems new habits have formed as we adjusted to the new normal. And it seems these new habits have formed around our spending patterns which had been disrupted during lockdown.

Of the those surveyed, 46% have delayed making any big purchases while 44% have cut back on the day-to-day things they buy.

Price sensitivity is more acute in the current climate with the results revealing over a third (34%) are waiting for products to be on sale or on promotion before committing to buy. Similar figures (33%) are seeking cheaper versions of products as an alternative to branded goods. Females and those under the age of 35 are most likely to be sensitive to price currently.

It seems we are more cautious around our spending patterns as some ambiguous uncertainty lingers around employment and long-term public health measures and solutions. 22% have reduced some of their financial commitments and outgoings with memberships and subscriptions cancelled. 13% are looking for more flexible payment terms and 15% are using their credit card more. 6% have taken out a loan because of the coronavirus outbreak, this is more prevalent among under 35’s.

It is evident from the data above, price sensitivity and seeking cheaper alternatives is of high importance currently, particularly among females. Businesses could capitalise on these consumer objectives and gain competitive advantage by including price pointing within creative messages. Selecting OOH formats in relevant settings provides an opportunity for brands communicate to these price points to a large audience in a relatively short period of time.

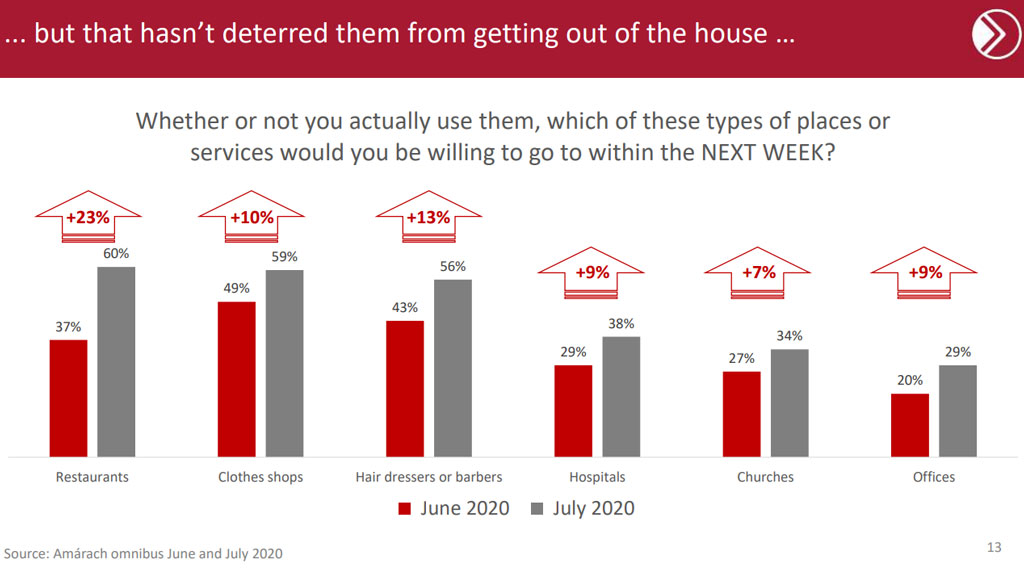

The Amárach research also delves into people’s willingness to engage with services and visit certain venues that have been reopening in the past few months as lockdown eased. All services mentioned has seen an increase in willingness to return when compared to June’s results.

60% are willing to visit a restaurant up 23% on June’s figures. There was a 10% increase in willingness to visit clothes shops up from 49% in June.

Lower levels of willingness were found around travelling by taxi, visiting an airport or visiting a gym.

As people become more familiar and comfortable with the health measures and government advice, confidence in visiting and engaging in certain services and activities is growing exponentially.

The research uncovers an opportunity for advertisers and businesses alike to communicate their health and safety measures to a large crowd to provide reassurance and stoke confidence in consumers.

Online Drivers in OOH

In our increasingly digital world, we’ve got used to getting what we need easily, and fast. From next day delivery to superfast broadband connections bringing the internet to our fingertips, we’ve grown to expect a seamless and easy customer experience. The current pandemic has accelerated the trend towards contactless communications and payments and a reawakening of interest in mechanisms such as QR Codes and NFC to accentuate advertising.

Previously users needed a dedicated app to read the code, however more recent smartphones can now scan codes directly from your camera app, so the link is just a swipe away, simplifying the path to purchase, browse or download for customers. In reality, while the codes fell away from mainstream use as an advertising tool, they are increasingly used on flight boarding passes, concert and cinema tickets, and even Snapcodes within the Snapchat app. Enter Covid-19 and many restaurants are removing menus from their diners, assigning each table a bespoke QR code for people to scan, taking them directly to an online ordering system. Removing the human interaction removes some of the risk of transmission of disease, and it also streamlines the ordering process. No more flagging down staff to order another pint, just pop online, order and pay.

Evidence suggest that NFC technology has also come of age with many of us now confident in using NFC without even realising – it’s the tech behind some contactless payments, including Apple Pay and Google Pay. As audiences become more familiar with the process of scanning a code, advertisers can amplify the customer experience in a straightforward way, gathering audience insights at the same time. 6 Sheets and Digital screens, in particular, are suitable to display a QR code to encourage brand interaction. Marketers and advertisers have an opportunity to incorporate the codes into campaigns, delivering another layer of accountability and audience tracking. Driving traffic to websites, social media sites or app downloads are just the start of what is capable for these little black boxes.

Innovation During a Crisis

The last few months have been challenging to say the least. However, as time marches on, we are starting to see some interesting innovative thinking and innovative solutions coming to the fore.

ParkOffice is a new entrant into the Irish market, by Longford entrepreneur Garret Flower. Essentially it is an online parking smartphone application. It allows companies to maximise the usage of their current car spaces. It ensures that if an employee is not going to be using their space on a given day it will be offered to another employee, thus maximising efficiency. It also allows private residents and landlords with unused, idle car spaces, to rent them out daily at a reasonable rate, thus maximising revenue. On the flip side it eliminates the stress and hassle of scouring the city looking for parking by reluctant motorists. Essentially ParkOffice is like Airbnb for car spaces.

This innovation is particularly welcome as more and more people are relying on their cars rather than public transport to get around the city. It is a simple solution that will encourage the public back into the city, which is always good news for business and OOH advertising of course!

The public advice remains the same, frequent hand washing is essential. The Poole based cosmetics brand Lush has been badly hit by the pandemic as they rely heavily on the Asian market for sales.

Cleverly they have turned a negative into a positive. They are encouraging the public to come into their stores and wash their hands, using Lush soap of course! There is no obligation to buy and lack of handwashing facilities has been well documented in city centre locations.

It is a small idea yet one that has allowed Lush to stand out on the high street and encourage the public into their stores to learn about and safely sample their range.

They have used their shop windows as giant billboards to promote the initiative.

At PML Group, our mantra has been to help our clients solve the problems that they currently face. This next example is a great case study of how technology, when used creatively can really help produce workable solutions to what might be seen as, insurmountable problems.

Italy was one of the worst effected countries by Covid-19. Tourism is a vital component of their economy and Florence’s Duomo Santa Maria del Fiore or the Cathedral (Duomo) is one of the most visited sites in Italy with over four million visitors annually.

Ensuring that visitors maintained adequate social distancing initially proved impossible. However, they have turned to technology to help overcome the problem. Visitors are now given a small lightweight device that they wear throughout their visit. If the visitor gets too close to another person, the unit beeps and vibrates, reminding them to take a step back. The device has been a huge success and has allows the cathedral welcome back visitors in a safe manner.

As we look ahead to the next few months, many challenges still exist for individual businesses. Innovative thinking and non-conventional ideas should not be dismissed or put off as they will be key to successfully meeting these challenges.

And Finally…

Guinness PRO14 rugby returns with a bang this weekend following a wait of over five months and Bank of Ireland is running 48 Sheets across the four proud provinces to celebrate.

An abbreviated schedule will see the 2019/20 Guinness PRO14 regular season run to 15 rounds followed by Semi-Finals and a Final across four consecutive weeks. Leinster host Munster in Aviva Stadium on Saturday, with Connacht facing Ulster the next day at the home of Irish Rugby.