Colum Harmon, marketing director, with this week’s view from OOH.

TII Daily Car Traffic Levels

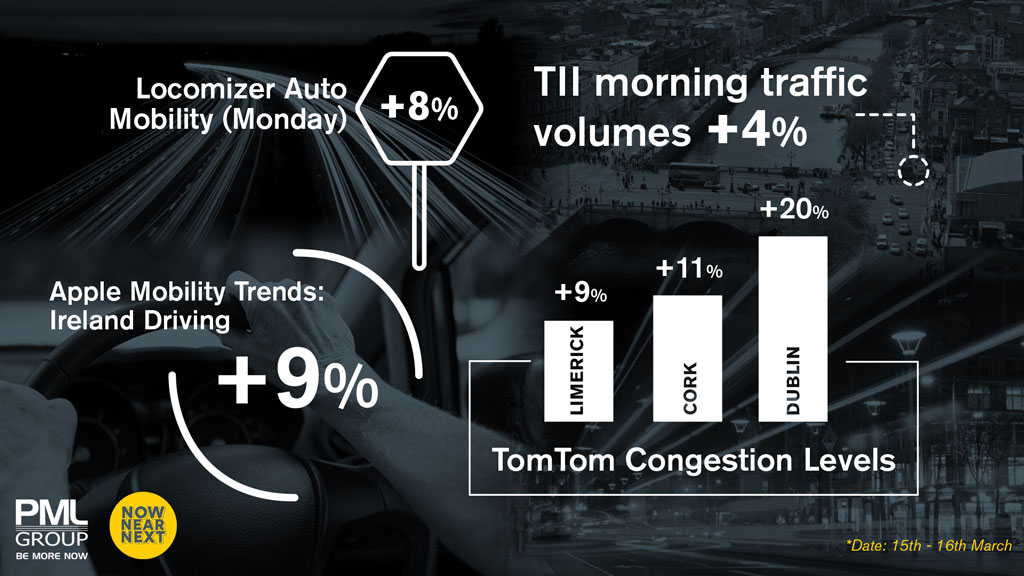

TII’s latest traffic trend information, generated from a sample of ten traffic counters located on the national road network, reports a +4% weekly increase overall in volumes for Mon-Tue this week.

Weekly trends for Tuesday 16th March are as follows: +1% on the N7 at Citywest, +3% on the M1 at M50 to Airport, +8% on the M11 at Bray and +3% on the M4 at Newcastle-Lucan. Comparisons with the same day prior to the start of the October Level 3 restrictions are as follows: -25% on the M1 at M50 to Airport, -18% on the M11 at Bray, -12% on the M4 at Newcastle-Lucan and -9% on the N7 at Citywest.

The M50 (N3 Navan Road to N4 Galway Road) shows a +2% increase compared with Tuesday 9th March and a -13% decrease as compared with pre-Level 3 traffic.

In the case of the regional cities the changes in car traffic volumes this morning as compared with Tuesday 9th March are as follows: N6 Bóthar na dTreabh Galway +7%, N40 Cork +8%, M9 Waterford +3%, and M7 Limerick +2%. Comparisons with the same day prior to the start of the October Level 3 restrictions are as follows: N6 Bóthar na dTreabh Galway -10%, N40 Cork -15%, M9 Waterford -24% and M7 Limerick -17%.

Locomizer Auto Mobility

Locomizer mobility data is based on analysis of mobile phone location data via anonymised app reporting. Latest figures for Monday 15th March show that the auto mobility level in ROI, which is calculated though a combination of mobile users, time, and signals, rose +8% week on week.

TomTom Traffic Index

The TomTom Traffic Index provides detailed insights on live and historic road congestion levels in cities around the world. Congestion levels in the three main cities have risen in the past week with Dublin +20%, Cork +11% and Limerick +9% for Mon-Tue.

Apple Mobility Trends

Apple’s routing requests mobility data for Monday of Tuesday shows a +9% increase in driving in Ireland versus the same period week previous. Transit and walking are also up 15% and 18% respectively. Counties showing particularly strong recovery include Driving: Dublin and Limerick both +12%; Walking: Dublin +19%, Cork +25% and Galway +26%.

OOH: A Path to Purchase

Back in 2011, the UK’s Out of Home (OOH) representative body, Outsmart, published a highly significant piece of research called ‘The Last Window of Influence’. The study of more than 600 respondents established OOH as the key medium to reach shoppers in the crucial thirty minutes prior to purchase. The study spoke to the idea of recency in advertising, the theory is that if an ad is relevant to a consumer, and the consumer is ready to make a purchase, the most recent advertisement seen will be the most impactful upon that consumer’s memory. ‘The Last Window of Influence’ was good news for brands and media owners operating in the retail space in particular, with so many OOH opportunities in retail car parks, at store entrances and within the store itself.

This all makes sense and remains true a decade later. However, it would be a mistake for planners and brands to limit OOH’s role in purchase decisions just to its influence at the point of sale. In the coming week, Byron Sharp will address the Marketing Institute’s DMX conference, so it’s perhaps an opportune time to focus on the powerful job OOH can do in building mental availability i.e. the propensity for a particular brand to be noticed or thought about in buying situations, as described in Sharp’s seminal bestseller, How Brands Grow. A brand achieves greater mental availability than its competitors when more consumers are more inclined to access from their memory in more buying situations. How Brands Grow outlined five actionable measures your brand can take to increase its mental availability, all of which are relevant to OOH.

A mixture of the changing nature of audience behaviour, clearly manifested through the pandemic over the last twelve months, and the evolution of the infrastructure of Outdoor advertising means the traditional lines of differentiation between brand and activation on OOH are blurring. The Path to Purchase is as much mental as it is physical and location marketing must reflect this shifting audience behaviour. The pandemic has led to new audience behaviours relating to work, shopping and leisure. How people live and how they interact with their local community has implications for location marketing. Positive implications. Opportunity.

Independent research studies carried out by Ipsos MRBI for PML Group over recent months speak to OOH’s power to build mental availability and influence consumer behaviour.

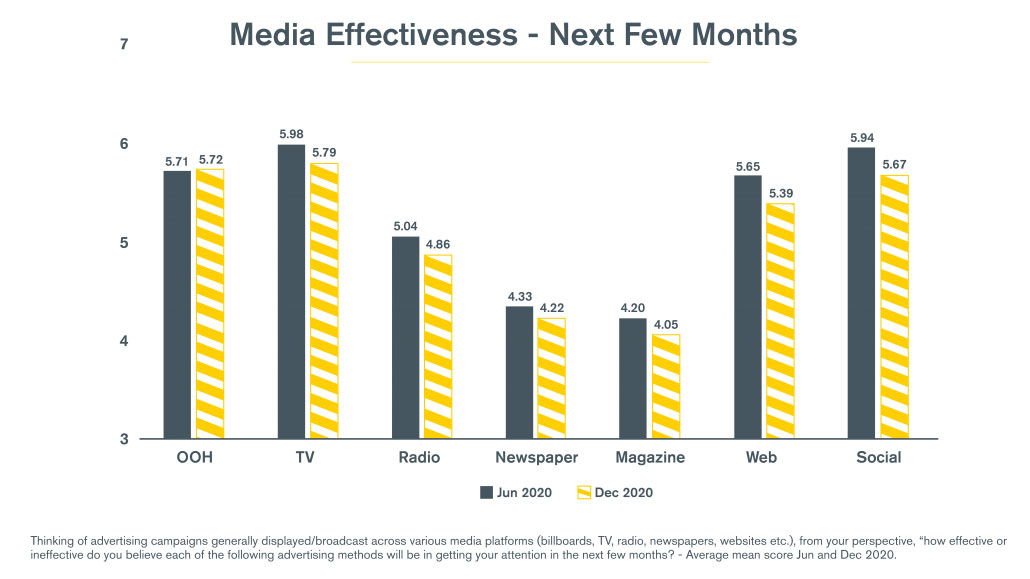

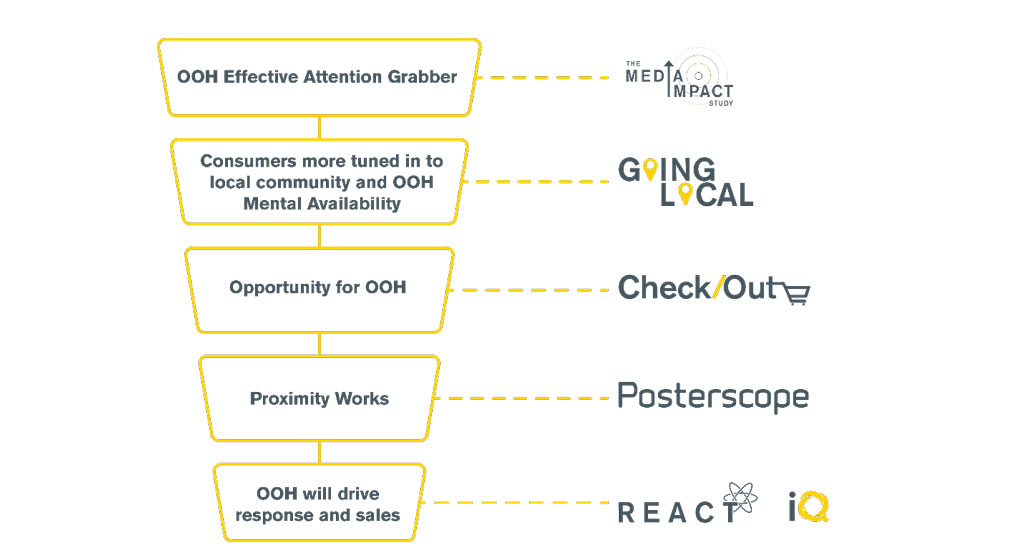

Through research and data, we can build a case, step by step, for OOH as an integral channel to do that. Firstly, and importantly, trust in OOH advertising is high – 70% agree that they trust what they see advertised on OOH. Our Media Impact Study, carried out in both June and December 2020 places OOH as one of the top media for effectiveness in terms of getting the attention of consumers in the coming months. So, the important basics of trust and attention are again re-enforced for OOH.

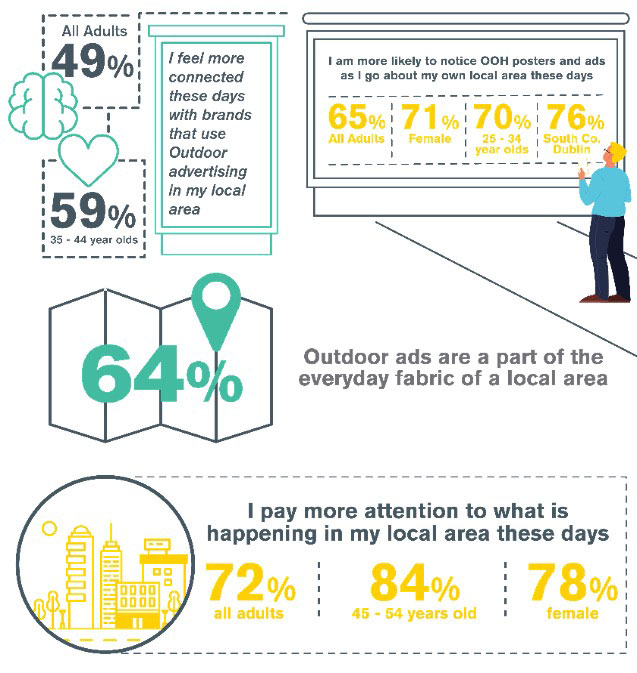

Our Going Local research study is evidence of how increased awareness of local marketing and people paying more attention to what is happening in their locality are opportunities for brands to increase mental availability at a time now when people are spending so much more time in their areas.

According to our Check/Out study, around half of respondents are more likely to plan what they want to buy before they go to the supermarket. Similarly, 54% of main shoppers are more likely to make a shopping list in the next six months than they are now. So, as consumers exercise, do the school run, and move about locally etc,.there are opportunities for brands, through location marketing, to make an impact on the shopping list, be it a mental or a physical list.

Check/Out also contains persuasive figures in terms of creating actions at point of sale, reflecting those findings from The Last Window of Influence ten years ago. Other research, in the form of our REACT study also points to consumer action as a result of OOH advertising. Additionally, industry research from Posterscope in the UK reveals that OOH advertising in close proximity to a retail outlet can deliver strong sales uplift for FMCG brands, but more significantly it has a knock-on effect on sales within other stores in the local area.

The research shows that proximity OOH advertising drives impulse purchase not just in the nearest store to where a poster is located but it also has an impact on consumers’ purchase decisions when they are in other stores further away from the poster site, across the duration of the campaign.

In summary, the evidence of multiple research studies conducted by PML Group in the era of COVID shows the viability of Out of Home to build mental availability and bring about an action in consumers. And its not just a question of doing advertising in that last window of influence. It’s about engaging classic roadside formats that consumers see as part of the fabric of their communities and that they notice more now in their communities than ever before. Digital signage also now allows advertisers to vary the creative message to deliver an added layer of relevance and create added interest and action.

(full details on all research studies referenced in this article can be obtained by contacting info@pmlgroup.ie)

And finally…

We are delighted to have made the shortlist for this year’s AIM Awards in the B2B Marketing category. It’s a tough category but we’ll give it our best shot. We hope you have found our communications over the past year useful and informative.

Congratulations to all our fellow finalists too!