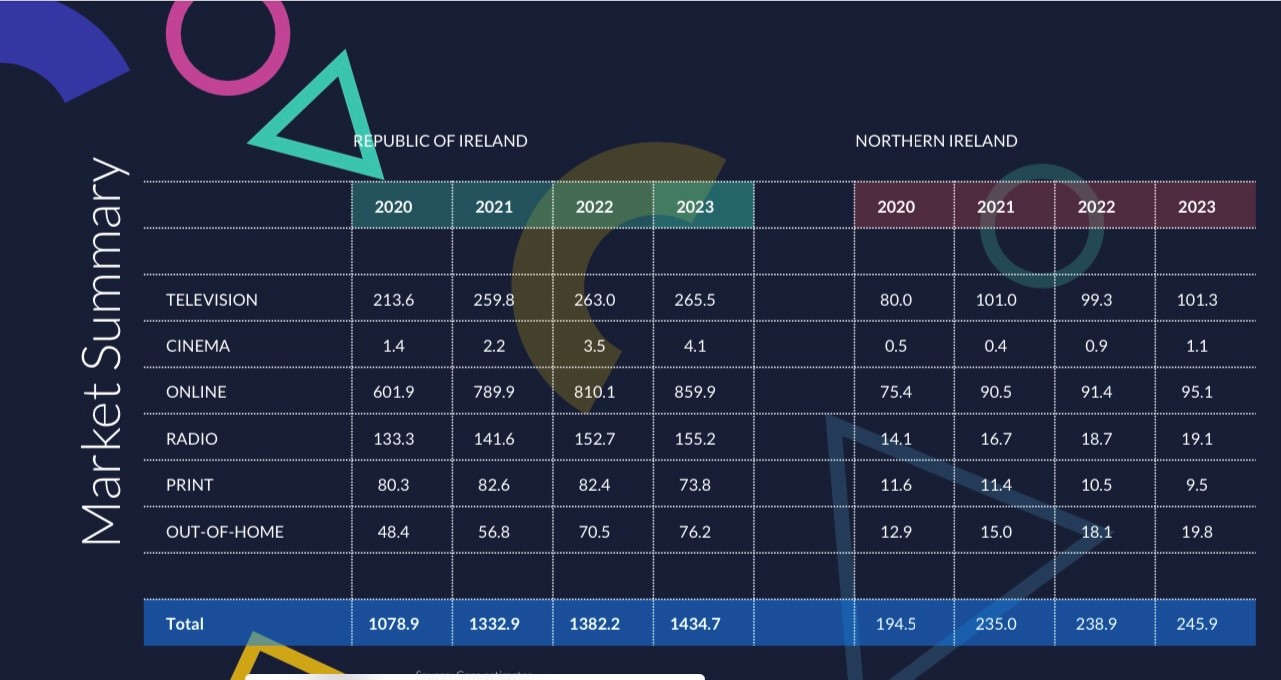

Advertising spend in the Republic of Ireland grew by 3.71% in 2022 to €1.38bn, according to the 2023 Outlook report which has been published by Core.

According to Core “the market has had a good start to 2023, but this was to be expected given the COVID-19 restrictions in early 2022. Core forecasts a 3.8% increase in media expenditure to €1.434bn. We expect to see small levels of growth across most media this year. Print once again is the exception where we are forecasting a decline of 10.4%.”

According to Core, “the key watchouts are the global economic pressures that could impact the Irish economy, and the potential downturn in the UK which could impact ad spend in Ireland. We estimate approximately 20% of marketing budgets in Ireland, are set in the UK. Northern Ireland, like in the Republic, recorded lower than originally anticipated spends in 2022. Expenditure grew just 1.6% to £203.7million (€238.9m). Core forecasts a slightly better performance in 2023 with growth of 2.9% to £209.6 million (€245.8m). The key watchout in NI is the continued political impasse and the potential impact this has on Government media spending, a key category in NI.

A breakdown by media channel shows that Core is forecasting a spend of €265.5m on TV, up from €263.0m last year. According to Core, “TV audiences continued to decline driving inflationary pressures with the medium last year. This has continued into 2023 and this will have implications on the deployment of budgets within the medium

as brands chase value and try to minimise inflation.”

Cinema advertising, which was impacted badly by the lockdowns in 2020 and 2021, is likely to see investment in the order of €4.1m, up from €3.5m last year and just €1.4m in 2020.

Elsewhere, online advertising continues to dominate although the growth rate in recent years has slowed down. For 2023, Core is forecasting an online ad spend of €859.9m, up from €810.1m in 2022 and €789.9m in 2021.

“Google and Meta will continue to dominate,” the report notes. “And some key trends to watch out for in 2023, include the rise of TikTok, the potential launch of Amazon.ie increasing opportunities in the retail media space. Also, will the industry finally have clarity on the future of the cookie in 2023?”

In the audio market, which includes both radio and digital audio, Core is forecasting that radio revenues this year are likely to be in the region of €155.2m, up from €152.7m last year while digital audio advertising continues to grow in appeal to advertisers. Last year, the digital audio market was estimated to be worth around €12.6m, according to Core which has pencilled in €14.8m this year.

“Digital audio will continue to see double digit growth in 2023 as more brands move shares to the growing sector. Expenditure is expected to increase by 16.6% to €14.8 million,” Core’s Outlook report notes.

Out of Home (OOH) meanwhile, will continue to grow its share of overall spend on the back of a strong performance of digital OOH with Core forecasting a spend in the region of €76.2m, up from €70.5m in 2022 and €56.8m in 2021.

Print advertising, however, is forecast to decline from €82.4m in 2022 to €76.2m although on the digital side Core notes that “digital spends with publishers will return to growth this year, increasing by 4% to €32.7 million.”

“The long overdue abolishment of VAT on newspapers was a welcome move by the Government last year. However, even with Government intervention, the impact on significant inflationary pressures will require the sector to look at ways to cut back on costs. This will include options like reducing the pagination of the paper, cutting back on the number of days they have a printed version or moving completely to a digital only version of their paper,” the report notes.

A full version of Core’s Outlook 2023 report can be downloaded HERE