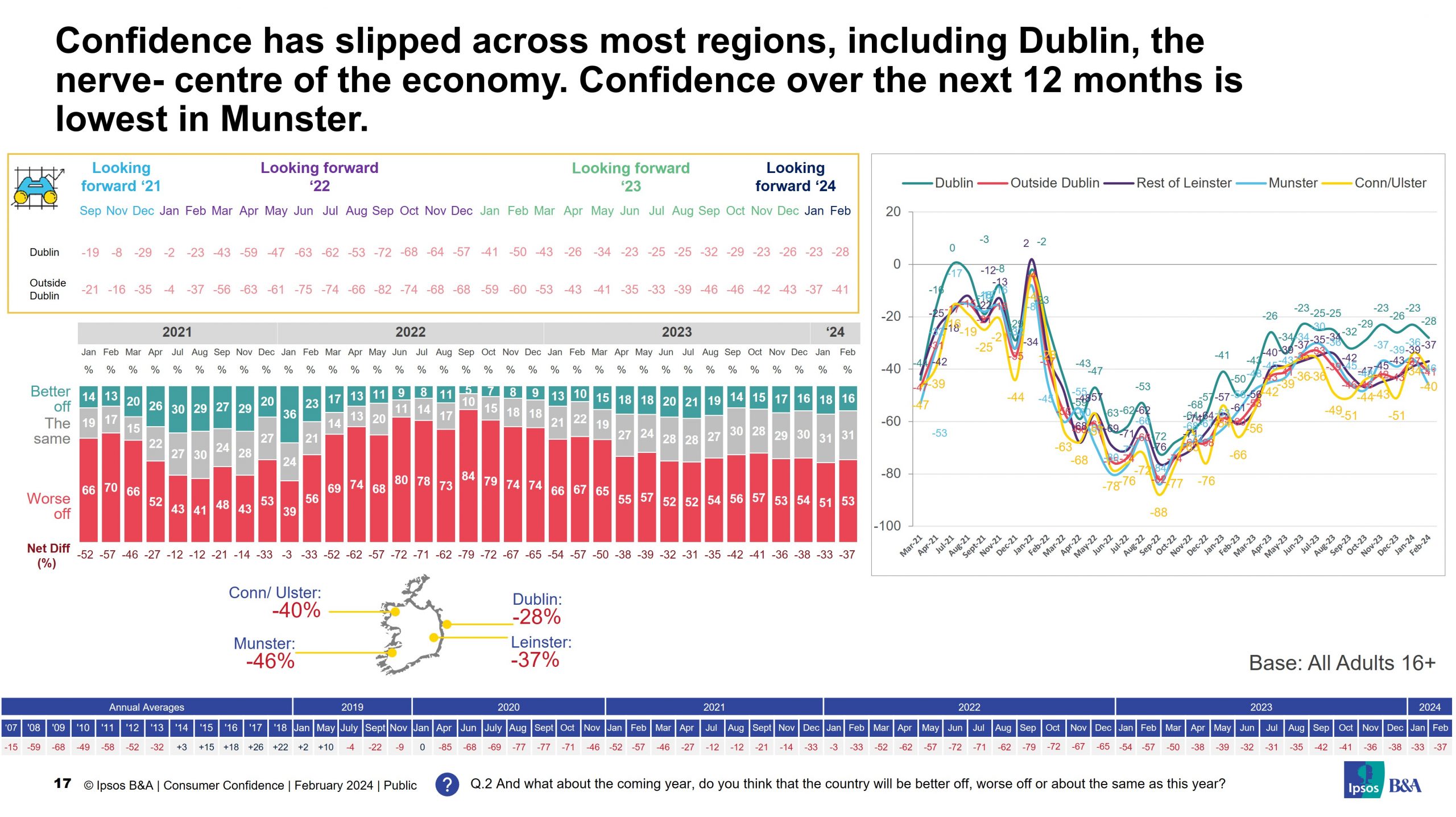

Despite a further softening of inflation consumer confidence has slipped from -33 (those feeling downbeat versus those feeling more upbeat) in January to -37 in February. It nevertheless remains higher than the 2023 average of -41. More than half (53%) expect the country to be worse off in the year ahead, with just 16% expect the country to improve in the coming year.

Confidence is lowest among those in the middle-aged bracket, females, and those from lower socio-economic groupings.

Sentiment has also slipped across all regions, although Dubliners remain more positive than those living in other regions.

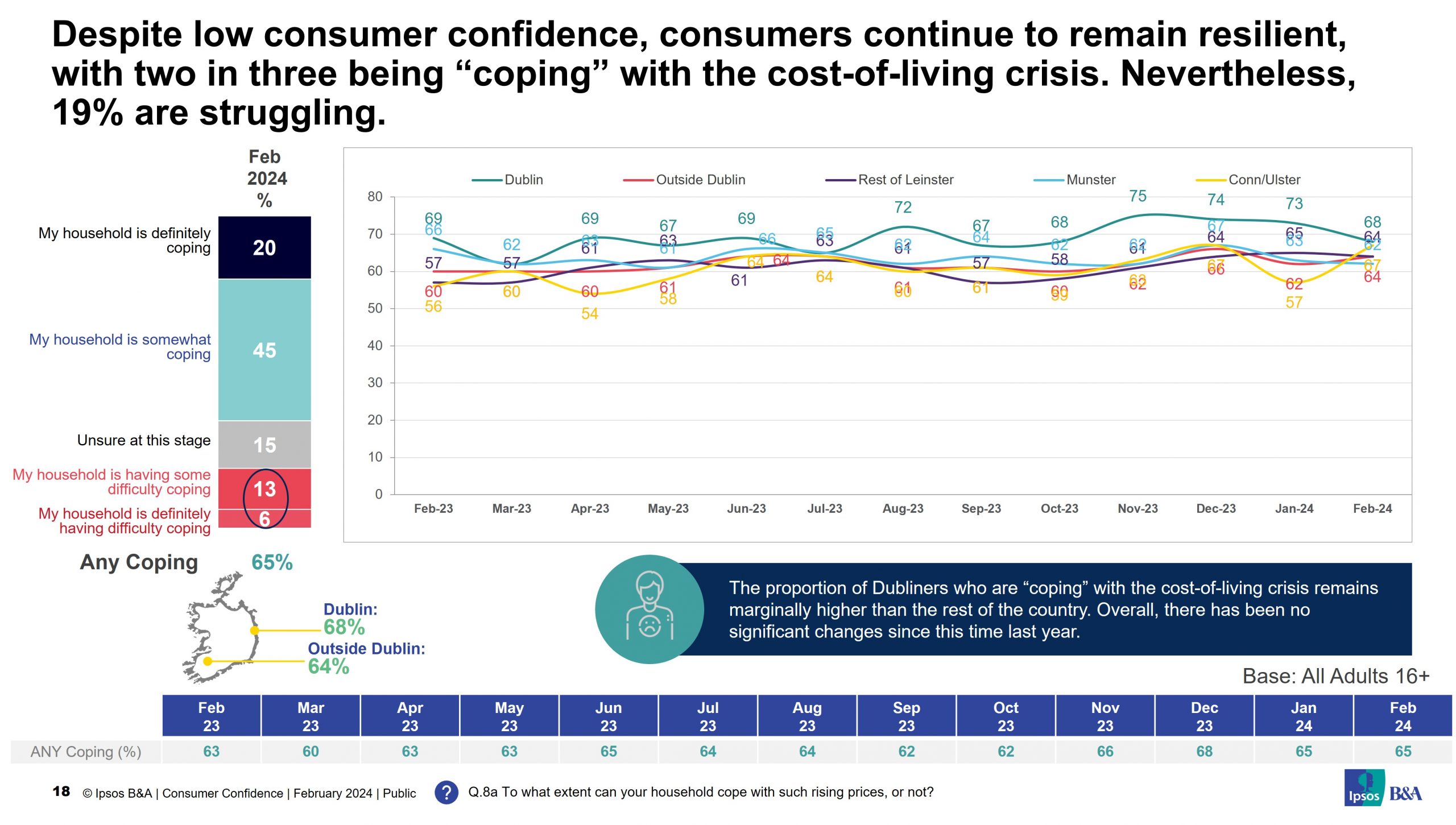

Consumers remain resilient, with two in three (65%) stating that they are “coping” with the cost-of-living crisis. However, nearly one in five (19%) are still facing difficulties.

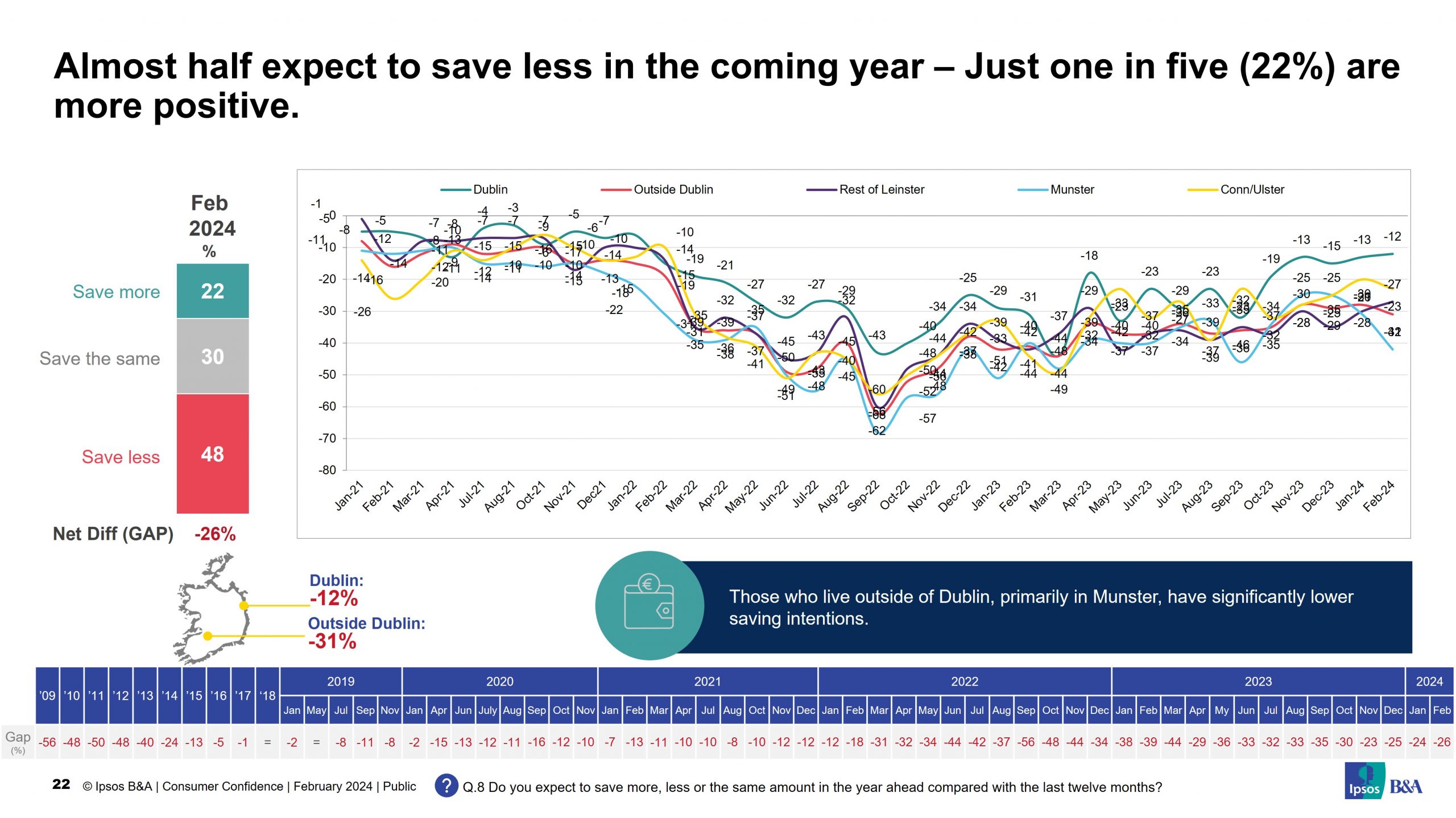

Almost half expect to save less in the coming year – Just one in five (22%) are more positive.

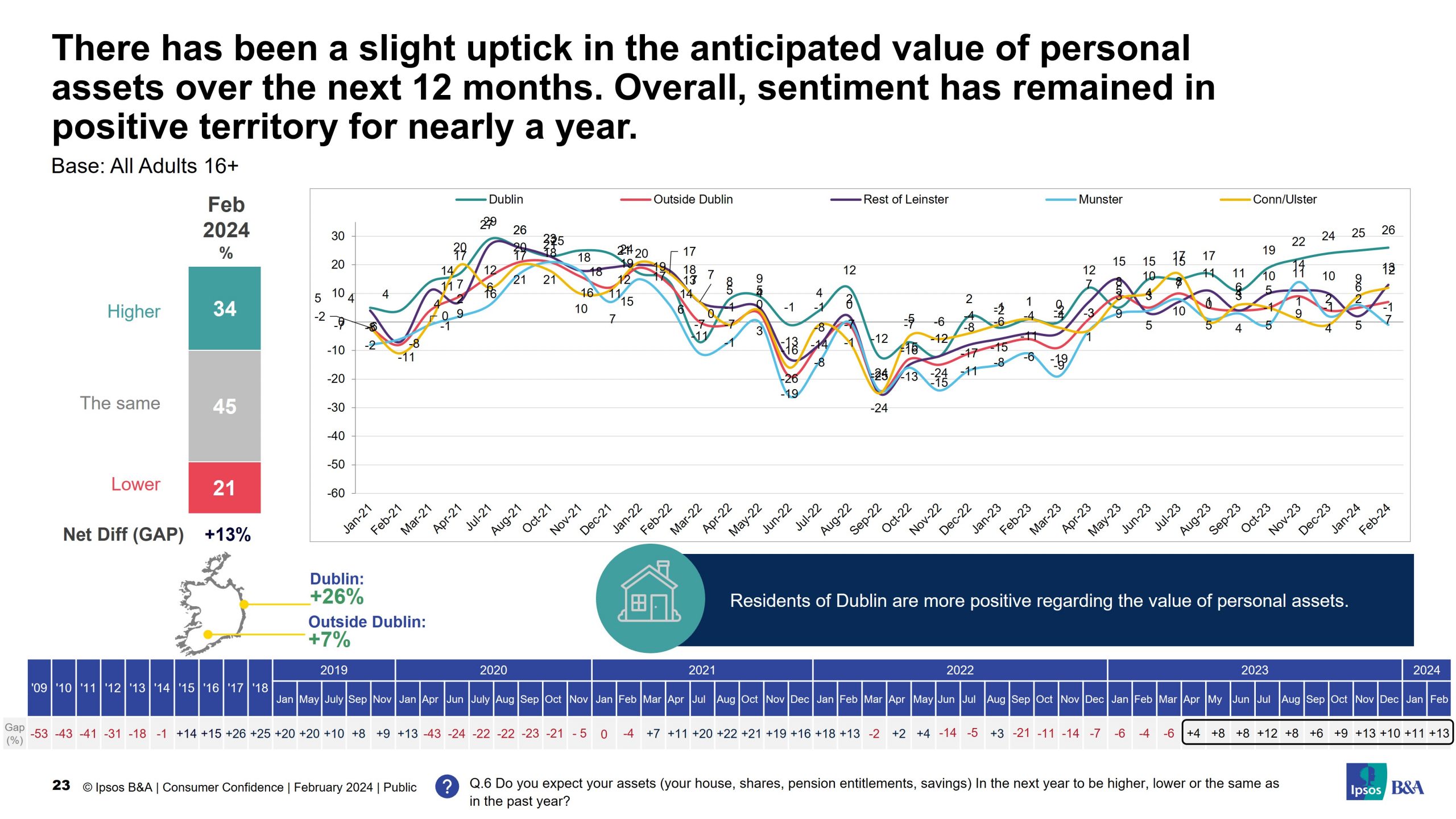

Notwithstanding the apparent levels of cautiousness, there has been a slight increase in the anticipated value of personal assets over the next 12 months. One in three (34%) believe their net worth will grow, with just 21% fearing a devaluation of their assets in the year ahead.

Survey results are based on a sample of 1,002 adults aged 16+, quota controlled in terms of age, gender, socio-economic class, and region to reflect the profile of the adult population of the Republic of Ireland. All interviewing was conducted via Ipsos B&A’s Acumen Online Barometer.

For more details and the full report or more information, please contact Jimmy Larsen, Paul Moran, and Pooja Sankhe: Jimmy.Larsen@ipsos.com, Paul.Moran@ipsos.com, and Pooja.Sankhe@ipsos.com