By Maedhbh Kelly, Senior PPC Client Lead at Wolfgang Digital

By Maedhbh Kelly, Senior PPC Client Lead at Wolfgang Digital

Meta’s bounceback, the rise of Temu and the continued strength of email marketing are just come of the main observations from Wolfgang Digital’s latest analysis of the Irish online retail market, as Maedhbh Kelly writes.

As retailers grapple with new consumer behaviours, increased competition, expanding regulatory pressures and the proliferation of AI, the fact is that one thing never changes – the mission for growth.

At Wolfgang Digital, we were keen to extract some overarching trends in relation to how online retail fared in 2023, by carrying out a deep dive of our retailers’ performance data. Our analysis leveraged over 200 million sessions and €500 million in revenue data from Google Analytics and ad platforms, to provide a comprehensive overview of last year’s performance.

By how much did retailers grow in 2023?

Let’s begin by getting down to brass tax, did retail grow in 2023, and by how much?

Looking at our dataset, we were encouraged to see that Wolfgang Digital’s clients grew at an overall level, achieving a median growth in online revenue of 7% within the Irish market. Considering the challenges mentioned above, this represents a remarkable display of resilience from this cohort of retailers, who we believe are seeing the benefit from a sustained focus on integrated, growth-focused digital marketing strategies.

Let’s dive deeper into the channel-specific performance and other key insights from the 2023 analysis.

Unpacking Channel Performance

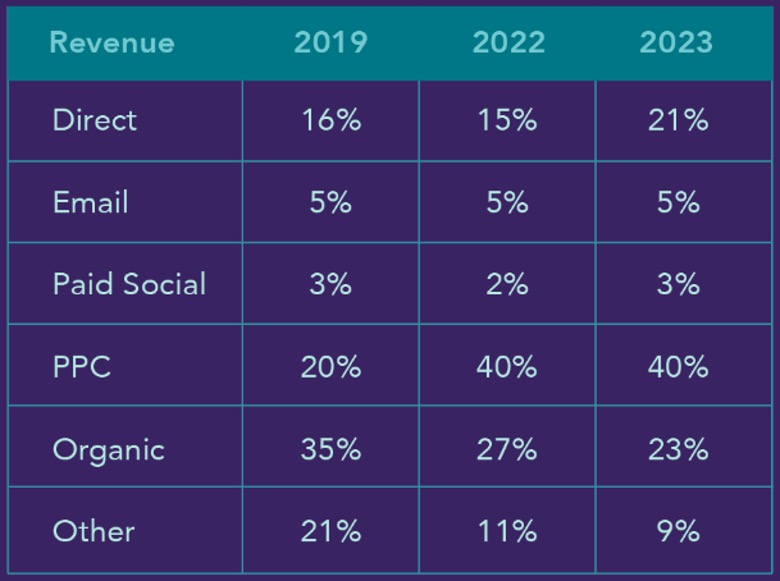

A diverse, flexible channel mix is crucial for creating strategies that drive tangible business outcomes. The below table gives a view on the overall channel mix for our retail clients’ revenue, in 2023 vs. 2022. We also compared the mix to 2019, for a comparison with pre-pandemic:

Based on this data, here are our key takeaways for retailers looking to optimise their channel mix.

Email Marketing: An Underutilised Gem

Despite its proven effectiveness, email marketing remains surprisingly underutilised in the digital marketing mix for our clients at an overall level. While many of our clients are seeing excellent revenue growth for this channel on an individual level, email marketing’s overall contribution to revenue across the mix does not align with its potential. This suggests a missed opportunity.

Email marketing stands out for its ability to drive customer retention and loyalty without the need for cookies and expensive paid media clicks. For retailers looking to deepen customer relationships and encourage repeat business, investing in a robust email marketing strategy is a no-brainer.

The Shift from Organic to Paid Search

For our clients, the revenue mix across the search channels has changed, with organic’s contribution to overall revenue declining since 2019, and paid increasing significantly. Whilst privacy-related changes such as cookie consent updates will have impacted channel attribution to some degree, the pandemic also likely played a part here. During this time, retailers raced to Google Ads, investing heavily to quickly capitalise on the uptick in search and ecommerce demand, which of course will have increased revenue attributed to paid search. This may have also potentially absorbed some revenue that may have been otherwise attributed to organic.

It is crucial that retailers don’t allow an increased focus on paid search to overshadow the critical role of organic search in driving sustainable, long-term traffic and conversions. In light of recent and upcoming AI-driven changes to search engine results pages (SERPs), optimising for organic search is not just about maintaining visibility; it’s about ensuring your brand remains relevant and accessible in a constantly evolving digital landscape. Retailers must not lose sight of SEO’s foundational role in a comprehensive digital marketing strategy.

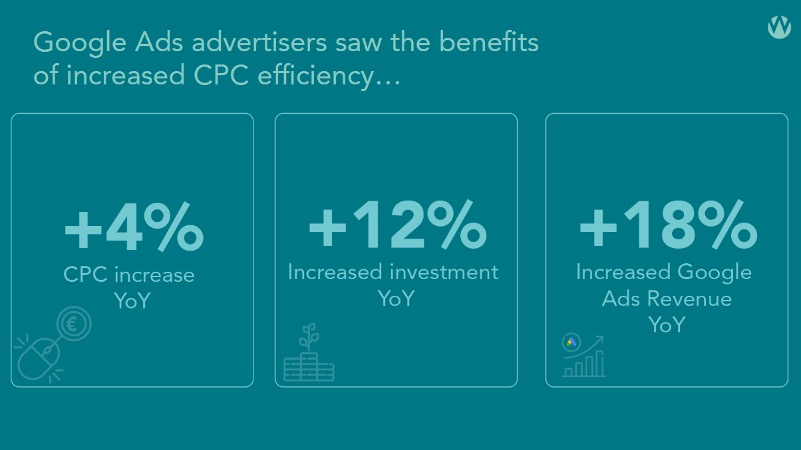

PPC’s Stellar Performance: Thanks to AI and Automation

Pay-per-click (PPC) advertising, particularly through Google Ads, has experienced remarkable growth in 2023, buoyed by the increasingly important role of highly automated campaign strategies. Our analysis showed that retailers increased their investment in PPC by a median of 12% YoY, but cost-per-click (CPC) increased only modestly from this (4%). This efficiency contributed to an impressive 18% growth in revenue from Google Ads.

One reason for this strong performance is that most retailers benefitted from a full year of Performance Max rollout through 2023 after this ad type officially replaced Smart Shopping in mid-2022. Performance Max is Google’s most automated campaign type, and these high levels of automation in campaign bidding and targeting tends to benefit click efficiency. It also shows ads across Google’s full inventory – not just Shopping and Search, but also across the Display Network and YouTube, for instance. This will have alleviated some of the pressure on typically competitive Shopping ads, further contributing to CPC efficiency. The strength of Performance Max underscores the continuous rise of automation in ad solutions – advertisers who don’t embrace the machine will be left behind.

The Rise of New Competitors: Temu’s Entry and Its Implications

One of the most significant recent developments in online retail has been the emergence of new competitors like Temu, which have reshaped the competitive landscape. As part of our analysis, we aggregated the Q4 Google Shopping auctions across our retail clients live on Google Ads, to gain an overview of the most dominant competitors. This showed that relatively new Chinese retail giants like Temu and Shein have become formidable competitors across a wide range of categories.

Temu appeared as a competitor for every single one of our retail clients – which is striking considering the breadth of categories our clients operate across. Not a single retailer, in categories from pet supplies to fashion, luxury, pharmacy and beauty, escaped the Temu effect.

This points to a broader shift in the retail ecosystem towards more diversified competition, where new entrants can quickly gain ground by leveraging aggressive paid media investment and competitive pricing. For established retailers, this means that fostering customer loyalty and communicating value beyond price-point are becoming increasingly critical.

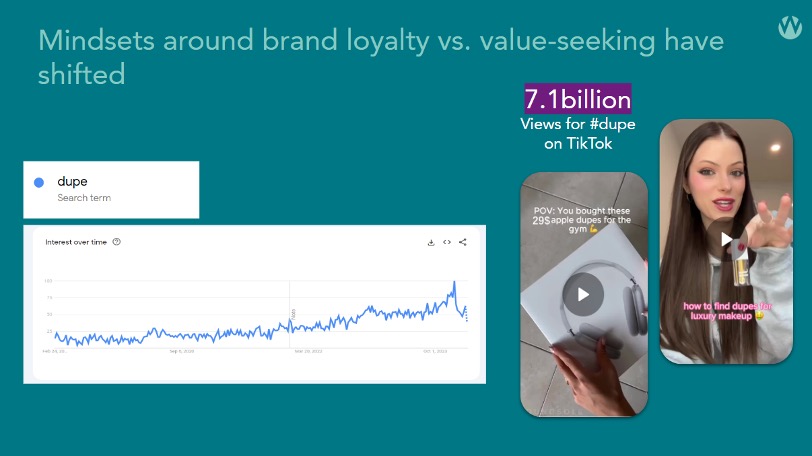

Shifting Consumer Mindsets: Value-Seeking Behaviour Among Gen Z

It’s important to consider the impact of aggressive new entrants like Temu in a landscape where brand loyalty is reported to be incredibly low, particularly for Gen Z shoppers, who are frequently reported to be more open to trying new brands than other generations. We would of course expect younger age groups to be more price-conscious and inclined to be swayed by a better offer, especially during uncertain economic times. However, there’s also been a shift in the attitude to value-seeking amongst younger generations. Older generations may view buying the cheaper version of a brand or product as a necessary action but one they might not broadcast. Conversely, younger generations are more inclined to view this kind of shopping as a savvy life hack that should be shared and celebrated on socials. Google Trends shows the steady rise of search interest in the term ‘dupe’; that is, cheaper alternatives to well-known brands or products, most frequently used in fashion, beauty, and tech. The hashtag #dupe has over 7 billion views on TikTok, where creators dedicate their content to helping users find the best dupes out there.

In this context, retailers need to rethink their strategies for winning and retaining customers. Beyond competing on price, there’s a need to build brand narratives that resonate with values, authenticity, and community. For brands, this means crafting marketing strategies that not only highlight product value but also emphasise USPs such as brand ethos, sustainability, and inclusivity.

YouTube: The Untapped Potential

Despite its power in reaching highly targeted, cost-effective audience segments at scale, YouTube campaigns remain surprisingly underutilised by our retail clients.

Whilst our analysis showed opt-in for YouTube ads is growing steadily over the years for our clients, YouTube investment still only accounts for around 3% of overall PPC budgets.

With video consumption on the rise, YouTube offers an excellent opportunity for advertisers to influence consumers early in their purchasing journey before key decisions are made. Influencing users early on YouTube, before they begin to search and compare brands on Google, alleviates some of the pressure on the lower-funnel, competitive formats such as Google Shopping. This is particularly key considering many consumers have already made up their mind about the brand they want to purchase from by the time they reach the Search.

Meta’s Remarkable Turnaround: Lessons in Resilience and Innovation

Retailers using Meta’s platforms (Facebook and Instagram) experienced a significant rebound in 2023 after a challenging few years of increasing CPCs and shrinking targeting pools, largely brought on by Apple’s App Tracking Transparency updates. This rebound was largely thanks to our clients’ widespread adoption of new ad solutions such as Advantage+ campaigns, which rely heavily on AI and automation. The dramatic decrease in CPCs and revenue growth are a testament to the effectiveness of Meta’s investment in new ad tech to overcome the challenges posed by competition from new social platforms, privacy regulations, and tracking limitations.

Retailers can draw valuable lessons from this by recognising the importance of adaptability and innovation in digital. Leaning into ad campaigns that are more AI-focused brings performance benefits. But crucially, as AI becomes increasingly more baked into ad solutions, retailers who don’t lean into these campaign types will fall behind the curve as high-automation becomes the norm.

Key Takeaways for Future-Proofing Your Retail Digital Strategy

As we reflect on the insights from 2023, it’s clear that the digital marketing landscape for retailers is both challenging and ripe with opportunity. To position themselves for success, retailers should consider the following strategic imperatives:

Embrace AI and Automation

The successes seen across the paid channels underline the critical role of AI and automation in enhancing performance. Retailers must continue to explore and adopt these technologies or risk falling behind competitors.

Prioritise Creative Excellence

However, as advertisers increasingly opt in and benefit from AI-heavy campaign types like Meta’s Advantage+, retailers need to think about what other tools they have at their disposal to gain a competitive edge. Creative strategy will become a key optimisation lever that retailers can use to differentiate, as AI continues to level the playing fields for aspects of campaign management like bidding and targeting. Investing in high-quality, platform-specific creative assets can help retailers win attention and drive meaningful engagement.

Invest in First-Party Data

Overall, retailers in our dataset had a good year in 2023 vs. 2022. But volatility in the digital marketing landscape is only going to continue through 2024 and beyond, with more significant privacy-related changes on the horizon – for instance, Chrome’s cookie deprecation is finally on course. With this in mind, building and managing robust first-party data, and ensuring this data is at the heart of your digital strategy has never been more important.

Focus on Customer Retention and Loyalty

Finally, in an ad landscape where competition is at an all time high, and brand loyalty is at an all time low, a serious amount of focus should be given to strategies that foster customer loyalty and retention. Retailers should develop programs and initiatives that reward customer loyalty, personalise the shopping experience, build strong brand relationships, and consistently communicate value.

Methodology/About the data

This analysis is grounded in data collected from a set of retailers, consisting of over 200 million sessions and €500 million in revenue. Data was aggregated from Wolfgang Digital’s client analytics accounts and ads platforms. The dataset covers January 1, 2022, to December 31, 2023, allowing for year-over-year comparisons to identify growth trends and shifts in consumer behaviour. We also compared some of the data with 2019 for a comparison with pre-pandemic.

Metrics included but were not limited to: Revenue, media spend, ROAS, clicks, cost per click, impression share

Challenges & Considerations:

The migration from Universal Analytics to GA4 posed significant challenges in ensuring data accuracy due to differences in platform data collection and attribution. Some actions were taken to mitigate these challenges as much as possible (e.g. Google Analytics accounts with significant issues due to platform migration or other reasons were removed, YoY changes were cross-referenced with some retailers’ internal business data, as well as other sources such as ad platform trends). Nonetheless, we have accepted that some degree of uncertainty around data accuracy is inevitable for this analysis, due to accounts migrating between the 2 analytics sources.

Maedhbh Kelly is , Senior PPC Client Lead at Wolfgang Digital