Consumer confidence remains stagnant and in negative territory, despite a further easing in inflation, according to the latest Consumer Confidence Barometer from Ipsos B&A.

Consumer confidence remains stagnant and in negative territory, despite a further easing in inflation, according to the latest Consumer Confidence Barometer from Ipsos B&A.

This wave of the Ipsos B&A Consumer Confidence Barometer was conducted from the 15th–25th March 2024.

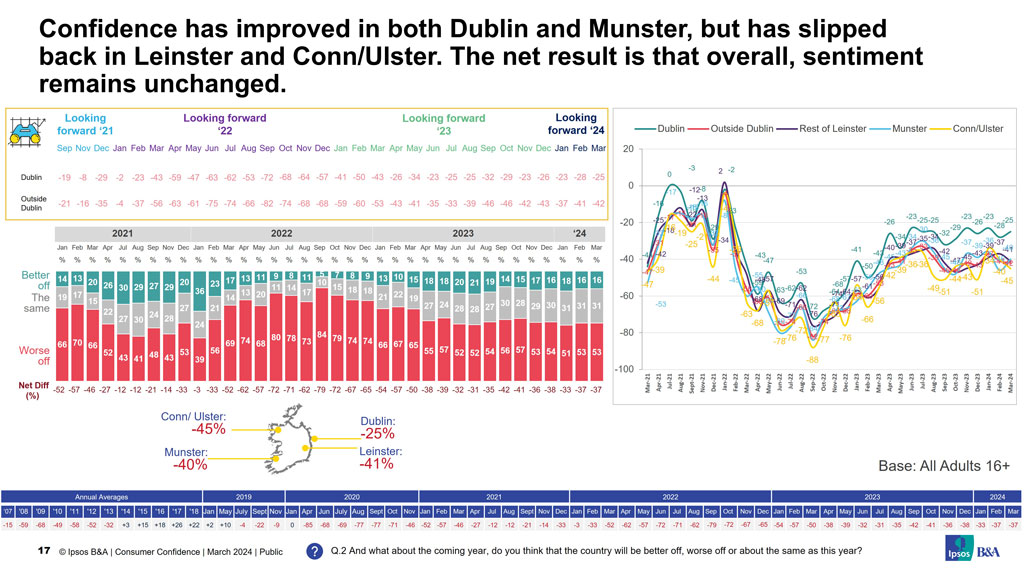

Despite easing inflation and near full employment in the economy, consumer confidence has remained stagnant in March, with a net rating of -37 (those feeling downbeat versus those feeling more upbeat). It nevertheless remains higher than the 2023 average of -41. Over half (53%) expect the country to be worse off in the year ahead, with just 16% expect the country to improve in the coming year, mirroring our February findings.

Confidence is lowest among those in the middle-aged bracket, females, and those from lower socio-economic groupings. Sentiment has improved in both Dublin and Munster but has slipped back in both Leinster and Conn/Ulster. Dubliners continue to be most upbeat.

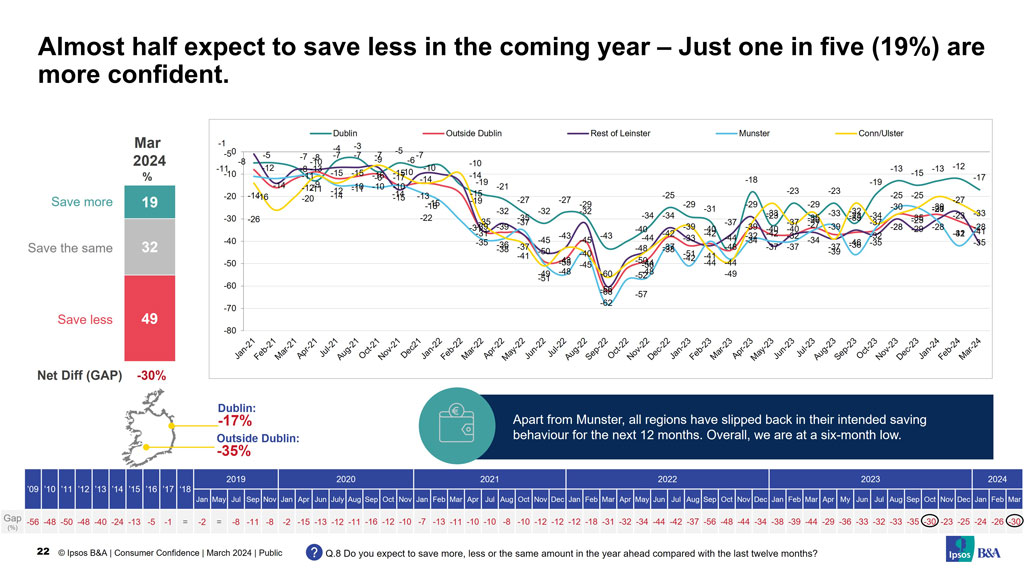

Almost half expect to save less in the coming year – Just one in five (19%) are more positive. Savings intention overall have regressed to levels last seen in October 2023.

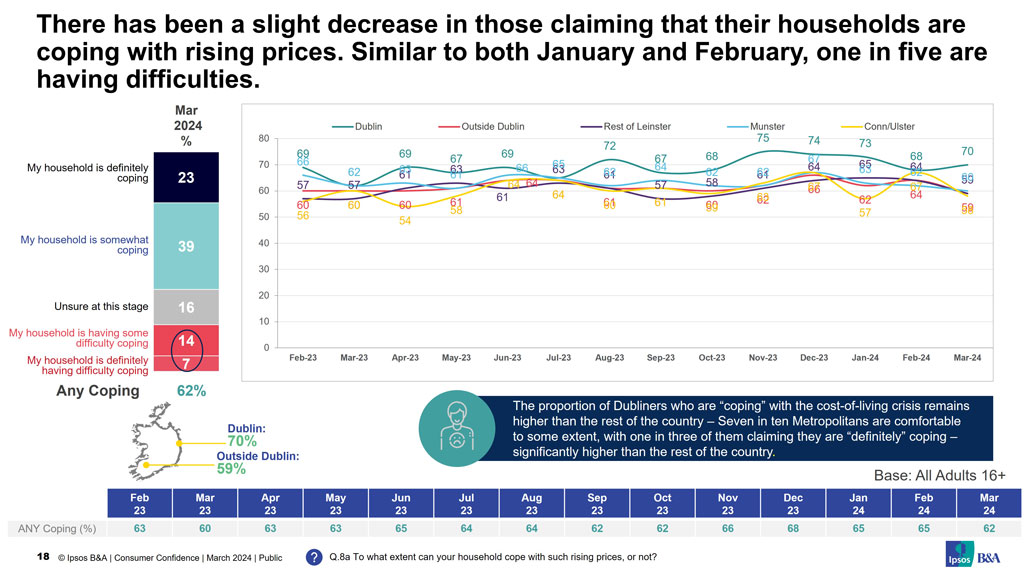

There has been a slight decrease in the proportion of households who claim to be “coping” with the cost-of-living crisis (62% are managing vs 65% in February). Over one in five (21%) state they are facing difficulties.

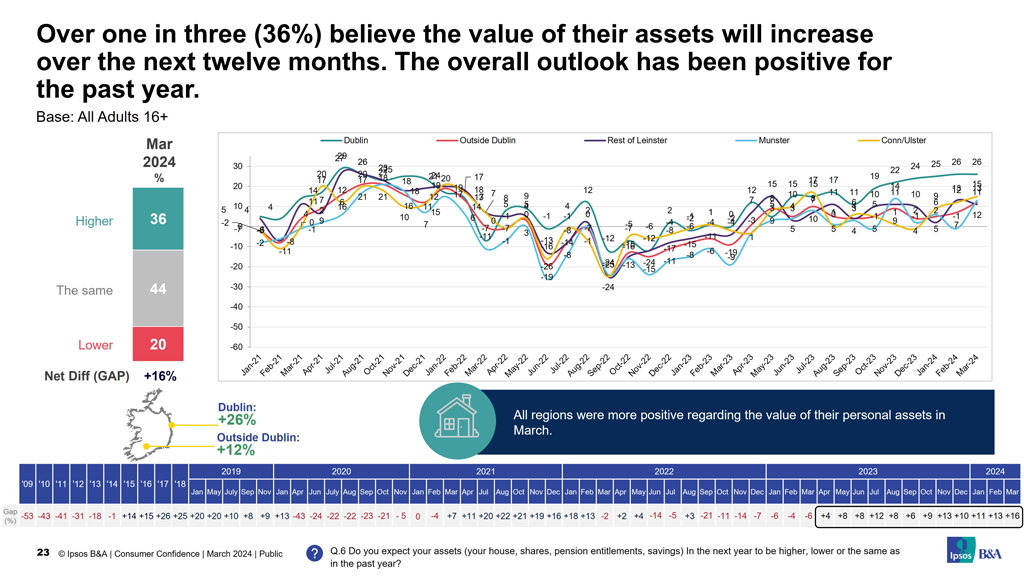

While the population are generally more circumspect this month, there is still a belief among many that their net worth (in terms of the value of their personal assets) will grow over the next 12 months – 36% believe their assets overall will increase, with just one in five adopting a more negative outlook.

Survey results are based on a sample of 1,000 adults aged 16+, quota controlled in terms of age, gender, socio-economic class, and region to reflect the profile of the adult population of the Republic of Ireland. All interviewing was conducted via Ipsos B&A’s Acumen Online Barometer.