Digital advertising spend in the Irish market for 2023 rose by 11% to reach €958m according to the latest results of the IAB PwC Online Adspend report.

Digital advertising spend in the Irish market for 2023 rose by 11% to reach €958m according to the latest results of the IAB PwC Online Adspend report.

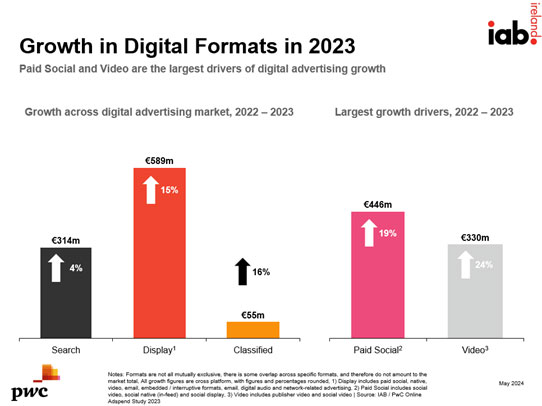

Of this, display advertising- which includes paid social- was up 15% to €589m in 2023. According to IAB Ireland, this was driven largely by growth in video, which was up 24% to €330m as well as growth in digital audio which was up by 16%. Paid social, meanwhile, grew by 19% to €446m in 2023. The IAB PwC report also notes that display advertising remains the dominant format in the Irish market, holding a share of 61% of the total digital advertising market.

Search advertising, meanwhile, grew by 4% year-on-year to €314m, giving it a 33% of the total Irish digital advertising market while classified advertising was also up by 16% to €55m.

“Following a lower growth rate of 4% in 2022 which reflected the challenging local and global economy of that year, it is very positive to see double digit growth of 11% year-on-year for the Irish digital advertising market in 2023,” says Suzanne McElligot, CEO, IAB Ireland. “The outlook for 2024 is also positive with adspend participants predicting 8% growth for this year. Participants also highlighted the challenge of increased regulation and cookie deprecation as a concern for the industry in the year ahead. IAB Ireland is focused on helping our members prepare for these challenges through our webinars, conferences and online resources.” she added.

Finn O’Loughlin, strategy consulting director, PwC, adds “Digital adspend reached a high of €958m in 2023. Display advertising represented the lion’s share of the total advertising spend at 61% and a growth rate of 15% YoY to €589m. Search advertising had more modest growth of 4% in 2023 with an adspend of €314m reflecting a more mature phase in its development, and Classified advertising enjoyed strong growth of 16% YoY with an adspend of €55m.”

Karen Preston, Chair of IAB Ireland’s Board and Chief Commercial Officer, Mediahuis also noted that “Video continues to be a dynamic driver of digital advertising in 2023 with 24% growth year-on-year. This video growth breaks down into 25% growth in adspend for social video and 20% for broadcaster/publisher video. It is not surprising that adspend participants predict that video will continue to be a top growth driver in 2024.”

Karen Preston, Chair of IAB Ireland’s Board and Chief Commercial Officer, Mediahuis also noted that “Video continues to be a dynamic driver of digital advertising in 2023 with 24% growth year-on-year. This video growth breaks down into 25% growth in adspend for social video and 20% for broadcaster/publisher video. It is not surprising that adspend participants predict that video will continue to be a top growth driver in 2024.”

For 2024, participants in the report estimate that digital adspend will rise by 8% to bring total spend to over the €1bn mark for the first time.