Following a strong first half of year, Core has upwardly revised its full year advertising expenditure forecast to 6.94%.

Earlier this year Core predicted that the market would grow by around 4.1% to €1.472bn. Now it is forecasting that this will rise by 6.9% to €1,57bn.

According to Core, the key drivers of this growth include stronger than anticipated performance across digital, particularly driven by increased investment in online video and TikTok; Out-Of-Home and TV. “These channels have performed better than expected due to significant increased investment from categories such as FMCG (Fast Moving Consumer Goods), Utilities/Telcos and Retail,” Core says in its revised Outlook report for the remainder of 2024.

“This positive trend mirrors global patterns, particularly in the UK where ad spend has also experienced robust growth driven largely by digital investment and increased investment across traditional media channels such as OOH and TV,” says Christina Duff, managing director, Core Investment.

The revised forecasts from Core come on the back of strong trading performances in H1 2024 announced recently by TAM Ireland and Radiocentre Ireland which represent the TV and radio sectors respectively.

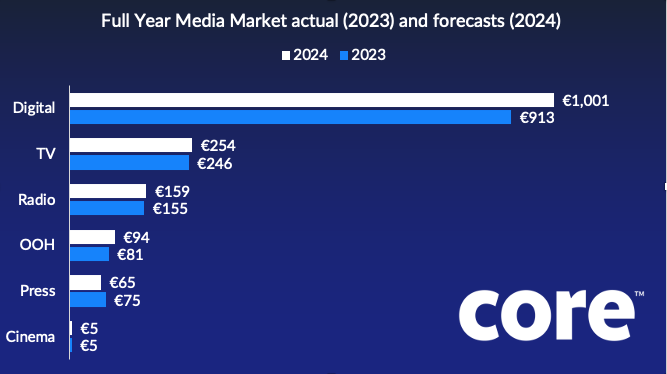

According to Core’s latest Outlook report, it is forecasting that video advertising will increase by 4.62% this year to €291.13m while out-of-home will continue its strong performances of recent years by increasing by16% to €93.9m while digital advertising spend is forecast to grow by 9.7% to €1.00bn.

Elsewhere audio advertising spend is forecast to grow by 3.39% to €176.35m while cinema advertising is expected to increase by 17.8% to €5.4m. The outlook for news media, however, remains bearish with Core forecasting a 9.44% decline advertising spend to (€94.15m.

According to Duff, audio investment across radio and partnerships is expected to increase by 2.73%, while digital audio will increase by 10% across all streaming platforms.

“Growth in revenue from government, retail and motors are driving spend across spot and content. Digital audio continues to increase; however, we have adjusted this down vs. our initial prediction of 18% growth due to competition in the digital landscape across channels such as video streaming taking share, and radio continuing to be both cost effective while delivering strong audience numbers. Streaming platforms and Podcasting will continue to witness strong growth as brands search for incremental reach within the audio landscape,” she says.

On the back of a strong first half of the year for live sports, including the Olympic Games, Duff says the “time spent” watching TV is up 1% in the year to the end of July 2024.

“Commercial impacts are up 8% which has helped ease some of the hyperinflation the market has witnessed over the last number of years. For younger audiences, viewership is up as high as 24% over the busy summer months,” she says.

“To add to this, streams across all the broadcast digital players are averaging growth of 17%. The key categories driving growth in advertising spend across Video include FMCGs, Telecommunications, Utilities and Retail. The first half of 2024 is tracking total video (TV and Broadcast Video on Demand) spend at 11%, but Core expects this to slow down slightly from September due to less live sport content compared to 2023, when the Rugby World Cup was held,” Duff adds.

With growth in OOH advertising continuing to increase, Duff says “the OOH sector can finally confirm that it has recovered post pandemic and is seeing significant growth across all formats and sectors including Retail, Media, and Food.

“The OOH sector has significantly invested in upgrading sites country wide, securing transport contracts, continued investment into digital, while focusing on sustainability and with new research on the way, there are plenty of positives for the medium.,” she says.

“The growth in Retail Media opportunities from the likes of Elevate Media, and increased DOOH formats has helped the OOH grow faster than initially predicted.

With digital advertising spend now running at in excess of €1bn a year, Duff says that AI has played a role in growing revenues beyond previous expectations.

“The key watch out for advertisers will be growing inflation in some of these platforms to counteract changing consumer behaviours as the lines blur between search and social specifically. TikTok’s potential move into long-form video will also be a watch out as it could disrupt video investment,” she says.

When it comes to news media,,print will be hit the hardest, according to Core.

However, it notes that “small growth in ad revenue across display/ video across news media channels, along with potential increased government spending towards the end of year will offset some of the double-digit decline expected in print.”

Cinema: +17.8% (€5.4 million)

Elsewhere a forecast hike of 17.8% in cinema advertising this year to €5.4m masks a tricky first few months of the year for the industry when overall admissions year to date are down 8%.

However, Core notes that “the final quarter of the year will reverse this trend with Joker 2, Gladiator 2 and many new family movies set to be released. Cinema’s unique attention-grabbing formats pre-movie will be a must have in a busy end to the year.”