The tenth annual Irish Customer Experience Report shows that 42% of companies and organisations have seen their overall customer experience (CX) scores fall over the last 12 months, declining by 1.9%.

The CX report ranks the leading 150 brands in the country based on the experiences of Irish consumers and research for the report is carried out by Amárach Research on behalf of CXi.

Over 29,500 experiences were evaluated while the 150 organisations’ performance was measured using six key emotional drivers. In addition, companies were evaluated on the basis of value, affordability, preferred channels of interaction, how important employees are to the customer experience and how their experience has changed in the last year. In addition, they were also asked whether they would pay more for a better experience and how good organisations are at making improvements to meet customer needs. In this year’s survey, participants were also asked whether customers felt their loyalty was recognised and valued by each organisation they dealt with as a customer.

The authors of this year’s report say the decline in Ireland’s overall CX score is concerning, as is the widening gap between the best and worst performers.

Gerard O’Neill of Amarách who has been compiling the survey results on behalf of the CX Company over the past ten years says a post covid bounce in CX scores appears to have fizzled out in the face of new challenges such as the cost-of-living crisis and increased digitalisation.

“While scores are now generally higher than pre covid, they are still not back at the levels we recorded in 2017 and we are also seeing a greater degree of ‘CX polarisation’ between the best and worst providers, suggesting some brands are falling seriously behind in their CX ambitions,” he says.

“Sometimes this happens when companies move too fast to digitalisation, often driven by the need to save costs rather than customer considerations. That is something we are seeing again in the current market, driven by the cost-of-living crisis,” O’Neill adds.

“It can also happen when companies fail to retain experienced customer facing staff – a real issue at a time of full employment – and then compound the problem by failing to put proper CX training systems in place for new staff. Or when different departments in a company are operating in silos and no one is seeing the bigger CX picture.”

“CX remains relatively simple to understand but is challenging to deliver because it requires full leadership buy in and cross department cooperation. For too many Irish companies one or both of those are missing,” O’Neill adds.

“To have remained on top over the last ten years is a remarkable CX story,” says Michael Killeen, author of the report and founder of the CX company.

“Because they listen carefully to their members, they understand them, and this enables them to customise solutions for their different ‘life stages’. That strong customer affinity is key. While digital options are available, if a member wants to ring or drop into them, they’ll find a person there to talk to at over 400 locations.”

“It is also worth noting that The Credit Union’s recent advertising campaign has focused on the message ‘For You. Not Profit’. Brands and organisations that have helped customers through the cost-of-living crisis, who operate with compassion, have thrived while those which failed to read the room and focused on the needs of shareholders over and above customers moved in the opposite direction and saw their scores decline,” Killeen says.

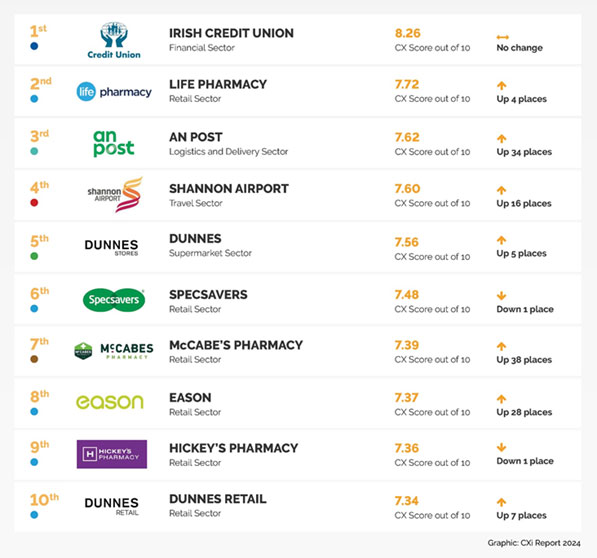

Elsewhere, pharmacies continue to lead from the front when it comes to CX in the retail sector making up 3 of the Top 10 companies with Life Pharmacy coming in second place, McCabes seventh and Hickey’s ninth. Life, Hickeys and Allcare (12th) are all part of the Uniphar Group.

This year’s report also makes very positive reading for An Post with three related companies in the Top 30. The mail and parcels company came third overall – up from 37th last year, while An Post Money came 16th and An Post Insurance was 22nd.

Shannon Airport landed in the Top 10 for the first time in 4th position while it was also a very positive year for Dunnes Stores with the supermarket claiming 5th position and Dunnes Retail coming 10th. Specsavers in 6th and Eason in 8th rounded out the Top Ten.

While Dunnes claimed pole position in the highly competitive supermarket sector, Aldi was second place in 17th followed by M&S Simply Food and Supervalu in joint 18th with Lidl and Tesco joint 29th.

Elsewhere, KFC, which recorded the biggest jump in this year’s survey, moving up 67 places from 82nd to 15th, and Burger King which was the second biggest jumper, moving up 50 places to 53rd, were the star performers in a resurgent restaurant sector. Other strong performers here included Supermacs (23rd), Butlers chocolates (26th) and Subway (29th).

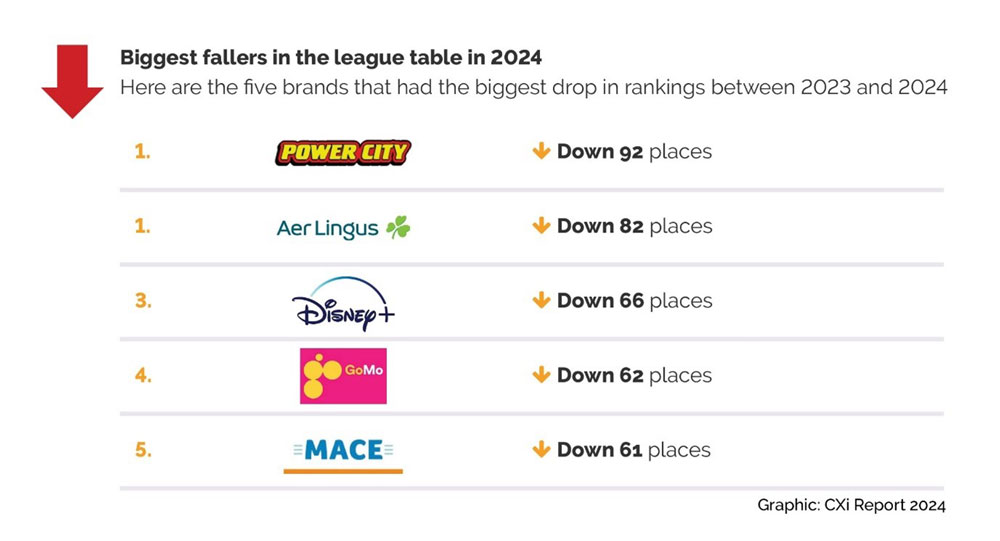

According to the report, two of the best performers from last year, Power City and Aer Lingus, which recorded the biggest falls this year, the former falling from 3rd place to 95th and the latter from 41st to 123rd. While Aer Lingus’s fall is clearly linked to this summer’s industrial action, notes the report, Power City’s fall appears to be linked to a massive fall in their value and staff scores by consumers.

In terms of Aer Lingus, Killeen says : “After an excellent CX performance last year, the airline now finds itself in a CX hole. While many of the customer’s comments referred to the dispute, cancellations and disruption, there were also lots of references to rude staff and poor customer service. One customer said ‘Their staff always act like they have had a bad day’ while another said, ‘the ferry is more reliable.’