Colum Harmon, marketing director, PML Group with this week’s Out \ Look on Out of Home

Colum Harmon, marketing director, PML Group with this week’s Out \ Look on Out of Home

Vodafone is biggest brand on OOH in 2024

Vodafone ended 2024 as the biggest spending brand on OOH media, according to WATCH, PML Group’s market intelligence resource. During the past twelve months the Telecoms brand has more than doubled its investment in the channel and accounted for almost 3% of all OOH display value. Its campaign activity included promoting the launch of Vodafone TV Play, leveraging its Irish rugby sponsorship around the Six Nations and localised messaging that communicated its broadband offering by county.

McDonalds and Cadbury completed the top three brands for the year.

At an advertiser level, Diageo’s investment on OOH through brands including Guinness, Carlsberg and Baileys maintained its position as the country’s top advertiser on the medium. Guinness and Guinness 0.0’s new association with the Premier League was vividly brought to life via classic and digital OOH, while Baileys’ scented special and Smirnoff’s UV mural were other highlights from the drinks company.

Unilever upped their OOH display by more than 50% to take second spot, ahead of Mondeléz. who, in addition to Cadbury, advertised brands including Oreo, Toblerone and Philadelphia. Vodafone, McDonald’s and Sky each also accounted for more than 2% of market display value last year. The top ten advertisers accounted for 26% of the market in 2024, up from 25% in 2023.

Retail was by far the largest spending category on OOH in 2024. All of Ireland’s major supermarket brands were among the top 30 advertisers for the year with Tesco and Lidl among the top 10 and Musgrave Group joining them in the top 20. More than one in every seven euro of display value on the medium in 2024 was placed by a retailer. Apart from the supermarkets, the biggest retail brands on OOH last year were IKEA and JD Sports. As a whole, Retail increased its display value by 27%. Other notable category increases were Media (+27%), Tourism/Travel (+37%), Personal Care/Wellness (+39%) and Finance (+31%).

Almost 60% of display was on roadside panels, with 21% in retail environments and 19% in transport hubs and vehicles.

PML Group’s full 2024 Market Report will be published next week. To receive your copy, please join on our mailing list at info@pmlgroup.ie.

Motor Mindset – Environmentally Conscious Drivers on the Rise

Motor Mindset – Environmentally Conscious Drivers on the Rise

As 2025 began, the Society of the Irish Motor Industry (SIMI) reported that over 121,000 new cars were purchased in 2024. While this figure is 1% lower than 2023 it remains the second-highest total in the past six years, surpassing 2019’s 117,100 registrations. Among these 17,459 were electric vehicles (EVs). Although EV registrations declined year-on-year, they have grown significantly over the past five years—an increase of 11% compared with 2022 and over 400% compared to 2019, when just 3,444 EVs were registered.

As the motor market continues to evolve, new insights from our ongoing research with Ipsos B&A highlight the state of consumer attitudes and priorities around car ownership and future purchasing intentions. The 2025 edition of our Motor Mindset research provides a comprehensive view of how the Irish population views mobility, offering key insights for advertisers in the automotive sector.

Current ownership trends

The study’s findings reveal that 37% of respondents currently own a car, with ownership levels peaking among the 25-34 age group at 50%. This demographic reflects particularly high levels of car ownership with 55% of men in this age group identifying as car owners. Conversely younger audiences (16-24 years) exhibit the lowest ownership rates at 26%, likely driven by lifestyle preferences, access to alternative transport options, and a growing interest in sustainable mobility solutions which is supported by the study.

Interestingly 24% of respondents do not currently own a car. This trend is most pronounced again among younger audiences at 28% of 16-24-year-olds.This suggests a growing reliance on alternative mobility solutions, such as car-sharing and public transport, indicating broader shifts toward sustainable and flexible transport options.

Despite this there is clear demand for car ownership within the younger demographic, with 23% of 16-24-year-olds planning to purchase a car within the next year. This suggests a growing cohort of first-time buyers who prioritise environmental consciousness and affordability. Overall, 18% of respondents across all demographics plan to purchase a car in the next calendar year.

Socio-economic disparities persist, with respondents in lower-income groups (DE) reporting a stronger intent to purchase (25%) compared to higher-income groups (14% in AB). These findings reveal opportunities for car brands to engage first-time buyers and those with constrained budgets.

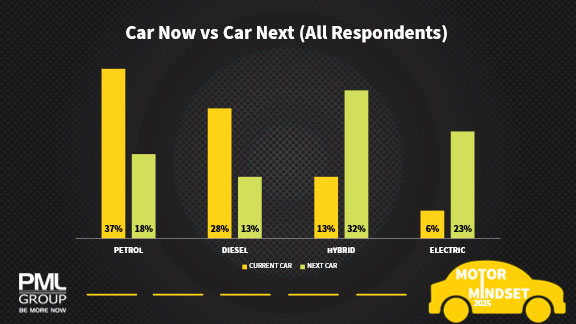

Petrol cars remain the most commonly owned vehicle type but their dominance has waned significantly, with current ownership dropping from 46% in 2023 to 37%. Similarly, next car preferences for petrol vehicles have fallen from 23% in 2023 to just 18%. Diesel vehicles have remained relatively stable in current ownership, rising slightly from 26% in 2023 to 28%. Next car preferences for diesel cars have remained relatively unchanged, dropping by just one point from 14% in 2023 to 13%.

Hybrid vehicles in contrast have shown consistent growth. Current ownership has risen from 9% in 2023 to 13% in 2025, while next car preferences climbed slightly 31% to 32%.

Key decision factors

When asked about the top considerations influencing their next car purchase, respondents highlighted a mix of factors.

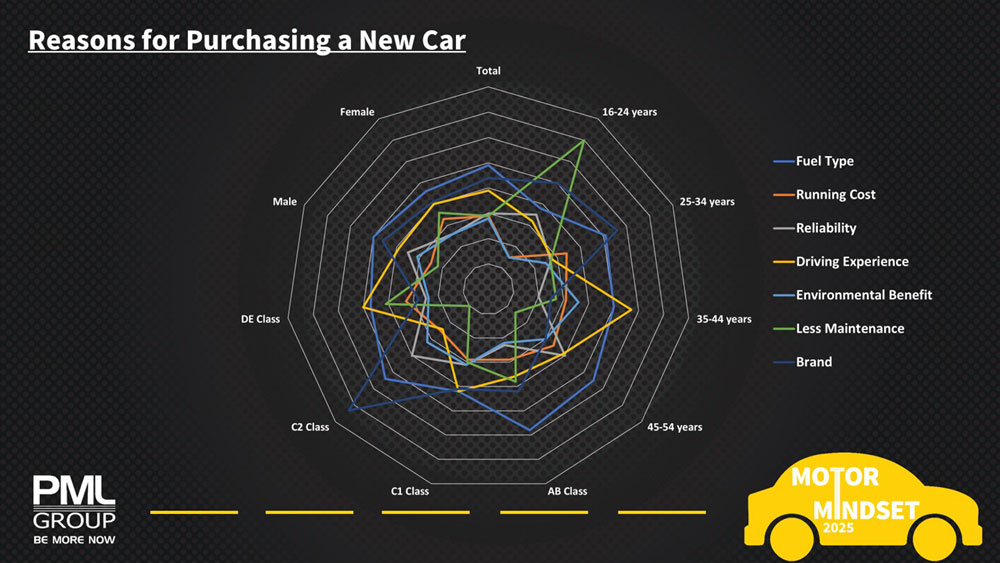

Unsurprisingly, fuel type and efficiency emerged as the top overall factor influencing 49% of respondents. Its importance grows as the cost-conscious consumer looks to bag the best deal, with age peaking at 55% among 45-54-year-olds compared to 38% among 16-24-year-olds. Brand reputation is the second highest factor for 44% of respondents peaking with 25-34-year-olds where 50% rank it as their number one consideration.

Driving experience rounds out the top three factors at 39% of respondents overall and peaking at 46% among 25-34-year-olds. This suggests that younger adults value the enjoyment and comfort of driving more than other groups.

Interestingly low maintenance emerges as a significant factor for the youngest cohort with 70% of 16-24-year-olds ranking it among their top three reasons. In contrast, older buyers aged 45-54 are more likely to prioritise reliability for a more long-term solution.

Cohort-specific motivations also highlight varied priorities. AB groups lead hybrid and EV adoption due to greater affordability and environmental awareness, while C2/DE groups continue to favour diesel vehicles for their practicality and cost efficiency.

Environmental benefits, though not the top factor for all demographics, appear most frequently among the 45-54 age group where 43% rank it among their top three reasons suggesting that sustainability is gaining traction with older, environmentally conscious buyers.

EV, but not every vehicle

The research is indicative of continued momentum toward electric and hybrid vehicles. In 2023 50% of respondents indicated an intention to purchase an EV or hybrid as their next vehicle, reflecting a sustained focus on sustainability. By 2025 this trend has become even more pronounced. EV ownership doubled from 3% in 2023 to 6% in 2025, while next car preferences for EVs surged from 19% to 23%. Similarly hybrid vehicle preferences grew significantly, with 32% of respondents planning to purchase one as their next car compared to 31% in 2023.

Despite a 24% decline in EV registrations in 2024, SIMI reports “tentative signs of a turnaround” toward the end of the yeardriven by retailer incentives and growing consumer interest. EVs, hybrids, and plug-in hybrids collectively accounted for over 45% of the market in 2024, highlighting their ever-growing importance in the automotive landscape. Petrol remains the most popular engine type representing 30% of new registrations, while diesel follows at 23%.

The younger demographic remains at the forefront of this shift with 29% of 16-24-year-olds citing sustainability as a key driver for their next car purchase. Reflecting this 37% of this group intend to purchase an EV for their next vehicle. Meanwhile older buyers prioritise safety, highlighting the need for car brands to address diverse motivations across age groups. For some consumers practical barriers like range anxiety and limited charging infrastructure may hinder EV adoption.

The Road Ahead

As consumer priorities evolve, car ownership reflects a balance between practicality and aspiration. The automotive market in Ireland continues to undergo a metamorphosis with affordability, sustainability, and safety all connected to the consumer buying process. Micro and macro effects will continue to compound consumer attitudes, which make these insights a valuable snapshot for brands to enable brand connections with consumers through meaningful campaigns that address their changing needs.

It’s not just about promoting a product but about engaging audiences with stories that resonate. Whether highlighting value for money, innovative features, or the broader benefits of sustainability, understanding these motivations will be key to standing out in a competitive market. With its unique ability to capture attention in public spaces, Outdoor advertising remains a versatile and impactful platform to bring these messages to life.