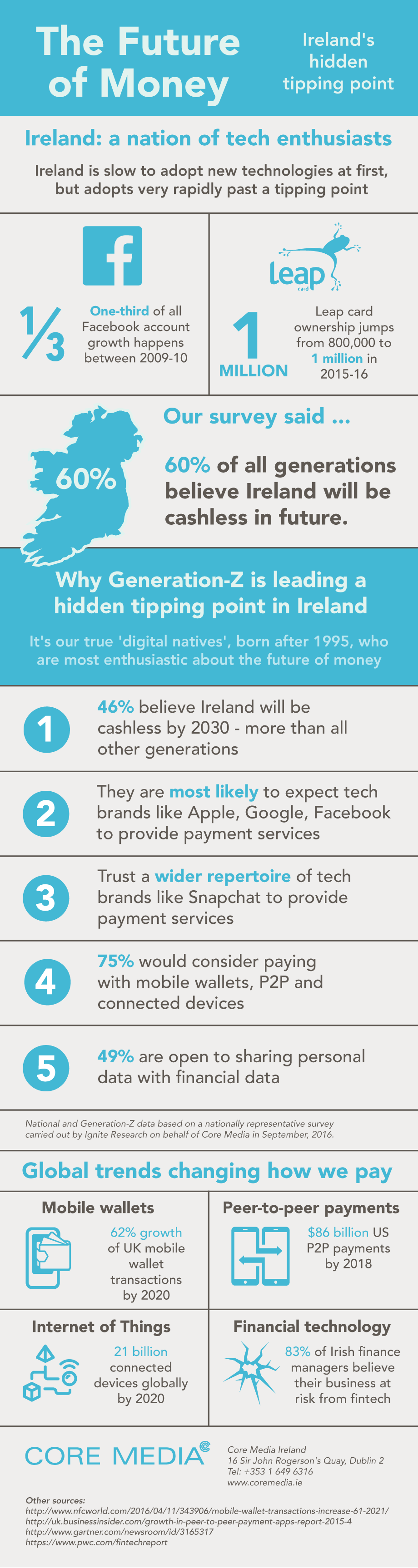

Some 60% of all Irish people believe that Ireland will become cashless in the future with a quarter of ‘Generation Z’ believing this will happen in the next fifteen years, according to new research from Core Media.

The nationwide study, entitled The Future of Money, found high levels of expectation of a cashless future as well as an awareness of and a willingness to use new payment technologies, even before they are available here in Ireland.

It is thought the ‘digital natives’ of Generation Z, those currently aged between 16 and 21, will help push these new payment options and a tipping point will be reached when they come of age, start jobs, and see their need for banking and finance coincide with their fluency in emerging technologies. This will take place in the coming years, driving new consumer behaviour, and means that within the next 15 years Ireland could be well on the way to becoming a totally cashless society.

It is thought the ‘digital natives’ of Generation Z, those currently aged between 16 and 21, will help push these new payment options and a tipping point will be reached when they come of age, start jobs, and see their need for banking and finance coincide with their fluency in emerging technologies. This will take place in the coming years, driving new consumer behaviour, and means that within the next 15 years Ireland could be well on the way to becoming a totally cashless society.

According to Core Media, this tipping point will have profound implications for brands and their future marketing strategies. New payments technologies will affect every market, category and brand at some level and businesses need to start preparing now so that they are best placed to take advantage of the changes to come and gain an edge over their competitors.

To assess Irish attitudes towards money and new transaction technologies, Core Media partnered with Ignite Research to carry out The Future of Money research across four generations: Generation Z (born between 1995 and 2000); Millennials (Born between 1985 and 1994); Generation X (Born between 1962 and 1984) and Baby Boomers (Born before 1961).

The survey found that while all generations still feel attached to cash for the time being, with most expecting the future to be ‘less-cash’ than ‘cashless’, 40% still think Ireland will never be entirely cashless.

68% of all generations are aware of new payment technologies such as mobile wallets, peer-to-peer and connected devices, but there are strong generational differences. While three-quarters of Millennials and Generation-Z claim to be aware of the new technologies, Baby Boomers lag behind significantly at 58%. Generation-Z is the most likely of all generations to consider using new payment technologies – 75% compared to 66% of Millennials and 53% of Baby Boomers.

Of the technologies which people believe they are most likely to use, mobile wallets are most popular at 49%, followed by peer-to-peer payments at 40% and connected devices at 34%. While actual use is very low, with only 15% claiming to have used mobile wallets, this is where Millennials are to the fore, with 42% saying they have used some form of new payment technology.

As more transactions are becoming digital through e-commerce, online banking and apps, such as taxi, take-away and shopping apps, there is a gradual blurring of the concepts of ‘money’ and ‘data’ in people’s minds. Most of those surveyed say they would trust major tech brands to manage transactions in the future – with over three quarters (77%) saying they would trust brands such as Facebook, Google and Apple to provide payment and financial services.

However, Irish consumers are still protective of private data, with the survey showing high levels of concern over protection of personal financial data. Almost 60% of the three older generations are reluctant to sharing personal data with their bank account data, compared to just 38% of Generation-Z.

Such findings suggest Ireland is a country highly exposed to new payments technologies, with Millennials the most capable of adopting mobile wallets first. However, a lack of widespread availability and concerns over privacy and security are barriers to adoption.

Shane Doyle, Group Strategy Director, Core Media, says these new payments technologies will affect every market, category and brand and we need to start preparing now:

“Our research shows it will become increasingly important for brands to consider opening transaction channels through relevant platforms. As new payment technologies increase, consumers will no longer have the simple choice between cash or card – they will have many other options at their disposal. Businesses will have to follow suit and engage with platforms such as Apple Pay, a branded mobile wallet, loyalty points or personal data to pay for something.

“The critical focus, however, will be on brands to prove they will take customer privacy and security very seriously or else they risk losing their trust and business overnight.

“While Millennials may be the first to adopt mobile wallets, but Generation-Z is the Irish generation who will lead the real change as they embrace the wider array of technologies more deeply as they come of age and start engaging with the world of work. As a result, it is vital that brands begin to evolve now to ensure they are ready for these changes as they happen. Generation Z expect high end technology and now is the time for brands to begin developing these platforms so they can access these markets in the future.”